Enlarge image

Clear Form

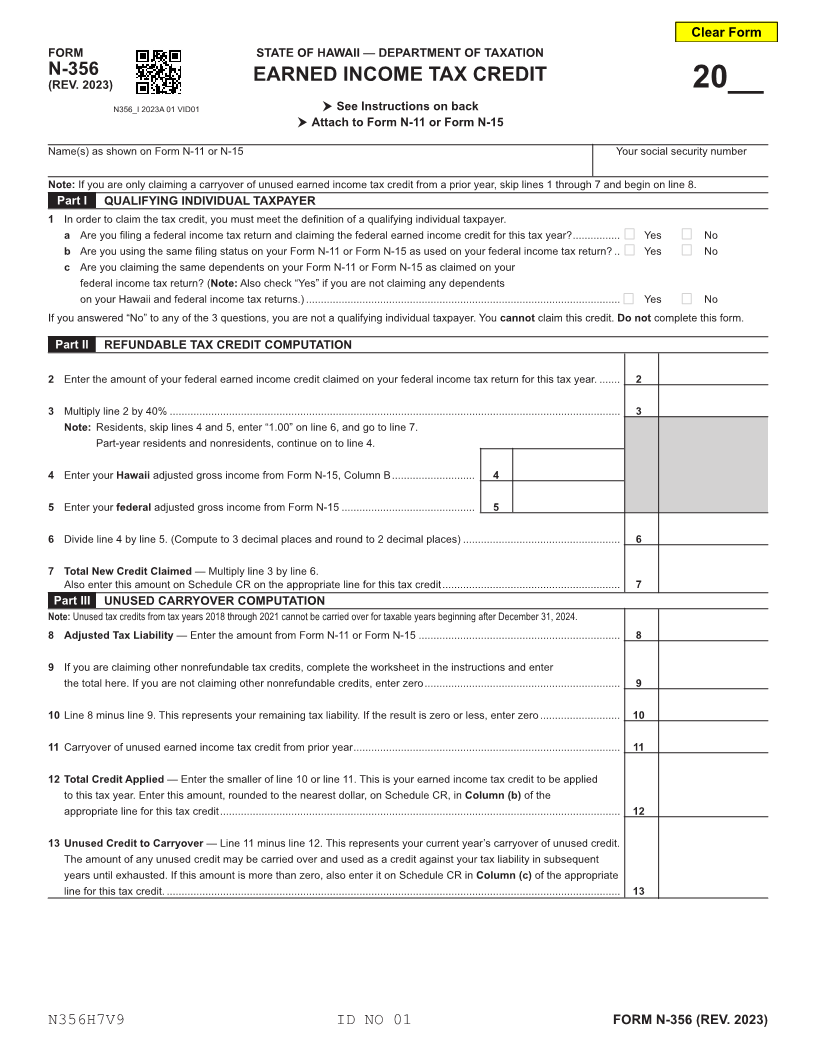

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION

N-356 EARNED INCOME TAX CREDIT

(REV. 2023) 20__

N356_I 2023A 01 VID01 See Instructions on back

Attach to Form N-11 or Form N-15

Name(s) as shown on Form N-11 or N-15 Your social security number

Note: If you are only claiming a carryover of unused earned income tax credit from a prior year, skip lines 1 through 7 and begin on line 8.

Part I QUALIFYING INDIVIDUAL TAXPAYER

1 In order to claim the tax credit, you must meet the definition of a qualifying individual taxpayer.

a Are you filing a federal income tax return and claiming the federal earned income credit for this tax year? ................ Yes No

b Are you using the same filing status on your Form N-11 or Form N-15 as used on your federal income tax return? .. Yes No

c Are you claiming the same dependents on your Form N-11 or Form N-15 as claimed on your

federal income tax return? (Note: Also check “Yes” if you are not claiming any dependents

on your Hawaii and federal income tax returns.) .......................................................................................................... Yes No

If you answered “No” to any of the 3 questions, you are not a qualifying individual taxpayer. You cannot claim this credit. Do not complete this form.

Part II REFUNDABLE TAX CREDIT COMPUTATION

2 Enter the amount of your federal earned income credit claimed on your federal income tax return for this tax year. ....... 2

3 Multiply line 2 by 40% ........................................................................................................................................................ 3

Note: Residents, skip lines 4 and 5, enter “1.00” on line 6, and go to line 7.

Part-year residents and nonresidents, continue on to line 4.

4 Enter your Hawaii adjusted gross income from Form N-15, Column B ............................ 4

5 Enter your federal adjusted gross income from Form N-15 ............................................. 5

6 Divide line 4 by line 5. (Compute to 3 decimal places and round to 2 decimal places) ..................................................... 6

7 Total New Credit Claimed — Multiply line 3 by line 6.

Also enter this amount on Schedule CR on the appropriate line for this tax credit ............................................................ 7

Part III UNUSED CARRYOVER COMPUTATION

Note: Unused tax credits from tax years 2018 through 2021 cannot be carried over for taxable years beginning after December 31, 2024.

8 Adjusted Tax Liability — Enter the amount from Form N-11 or Form N-15 .................................................................... 8

9 If you are claiming other nonrefundable tax credits, complete the worksheet in the instructions and enter

the total here. If you are not claiming other nonrefundable credits, enter zero .................................................................. 9

10 Line 8 minus line 9. This represents your remaining tax liability. If the result is zero or less, enter zero ........................... 10

11 Carryover of unused earned income tax credit from prior year .......................................................................................... 11

12 Total Credit Applied — Enter the smaller of line 10 or line 11. This is your earned income tax credit to be applied

to this tax year. Enter this amount, rounded to the nearest dollar, on Schedule CR, in Column (b) of the

appropriate line for this tax credit ....................................................................................................................................... 12

13 Unused Credit to Carryover — Line 11 minus line 12. This represents your current year’s carryover of unused credit.

The amount of any unused credit may be carried over and used as a credit against your tax liability in subsequent

years until exhausted. If this amount is more than zero, also enter it on Schedule CR in Column (c) of the appropriate

line for this tax credit. ......................................................................................................................................................... 13

N356H7V9 ID NO 01 FORM N-356 (REV. 2023)