Enlarge image

Clear Form

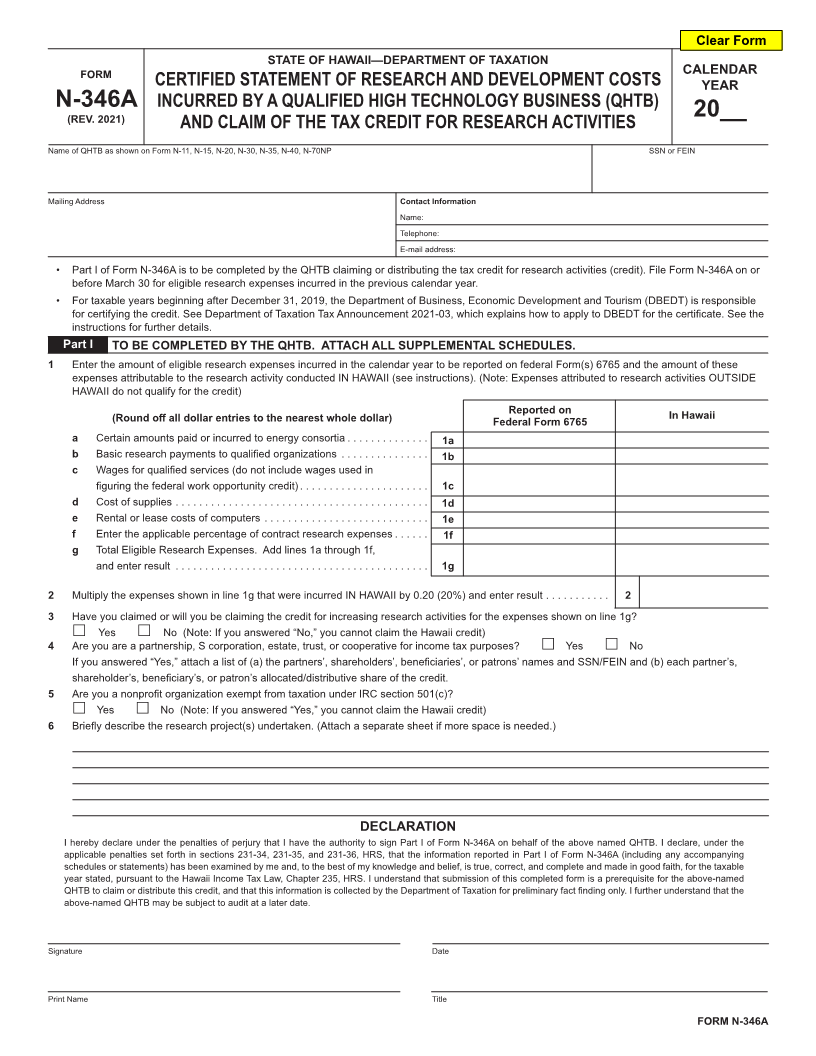

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM CALENDAR

CERTIFIED STATEMENT OF RESEARCH AND DEVELOPMENT COSTS YEAR

N-346A INCURRED BY A QUALIFIED HIGH TECHNOLOGY BUSINESS (QHTB)

(REV. 2021) 20__

AND CLAIM OF THE TAX CREDIT FOR RESEARCH ACTIVITIES

Name of QHTB as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, N-70NP SSN or FEIN

Mailing Address Contact Information

Name:

Telephone:

E-mail address:

• Part I of Form N-346A is to be completed by the QHTB claiming or distributing the tax credit for research activities (credit). File Form N-346A on or

before March 30 for eligible research expenses incurred in the previous calendar year.

• For taxable years beginning after December 31, 2019, the Department of Business, Economic Development and Tourism (DBEDT) is responsible

for certifying the credit. See Department of Taxation Tax Announcement 2021-03, which explains how to apply to DBEDT for the certificate. See the

instructions for further details.

Part I TO BE COMPLETED BY THE QHTB. ATTACH ALL SUPPLEMENTAL SCHEDULES.

1 Enter the amount of eligible research expenses incurred in the calendar year to be reported on federal Form(s) 6765 and the amount of these

expenses attributable to the research activity conducted IN HAWAII (see instructions). (Note: Expenses attributed to research activities OUTSIDE

HAWAII do not qualify for the credit)

Reported on In Hawaii

(Round off all dollar entries to the nearest whole dollar) Federal Form 6765

a Certain amounts paid or incurred to energy consortia .............. 1a

b Basic research payments to qualified organizations ............... 1b

c Wages for qualified services (do not include wages used in

figuring the federal work opportunity credit) ...................... 1c

d Cost of supplies ........................................... 1d

e Rental or lease costs of computers ............................ 1e

f Enter the applicable percentage of contract research expenses ...... 1f

g Total Eligible Research Expenses. Add lines 1a through 1f,

and enter result ........................................... 1g

2 Multiply the expenses shown in line 1g that were incurred IN HAWAII by 0.20 (20%) and enter result ........... 2

3 Have you claimed or will you be claiming the credit for increasing research activities for the expenses shown on line 1g?

Yes No (Note: If you answered “No,” you cannot claim the Hawaii credit)

4 Are you are a partnership, S corporation, estate, trust, or cooperative for income tax purposes? Yes No

If you answered “Yes,” attach a list of (a) the partners’, shareholders’, beneficiaries’, or patrons’ names and SSN/FEIN and (b) each partner’s,

shareholder’s, beneficiary’s, or patron’s allocated/distributive share of the credit.

5 Are you a nonprofit organization exempt from taxation under IRC section 501(c)?

Yes No (Note: If you answered “Yes,” you cannot claim the Hawaii credit)

6 Briefly describe the research project(s) undertaken. (Attach a separate sheet if more space is needed.)

DECLARATION

I hereby declare under the penalties of perjury that I have the authority to sign Part I of Form N-346A on behalf of the above named QHTB. I declare, under the

applicable penalties set forth in sections 231-34, 231-35, and 231-36, HRS, that the information reported in Part I of Form N-346A (including any accompanying

schedules or statements) has been examined by me and, to the best of my knowledge and belief, is true, correct, and complete and made in good faith, for the taxable

year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS. I understand that submission of this completed form is a prerequisite for the above-named

QHTB to claim or distribute this credit, and that this information is collected by the Department of Taxation for preliminary fact finding only. I further understand that the

above-named QHTB may be subject to audit at a later date.

Signature Date

Print Name Title

FORM N-346A