Enlarge image

Clear Form

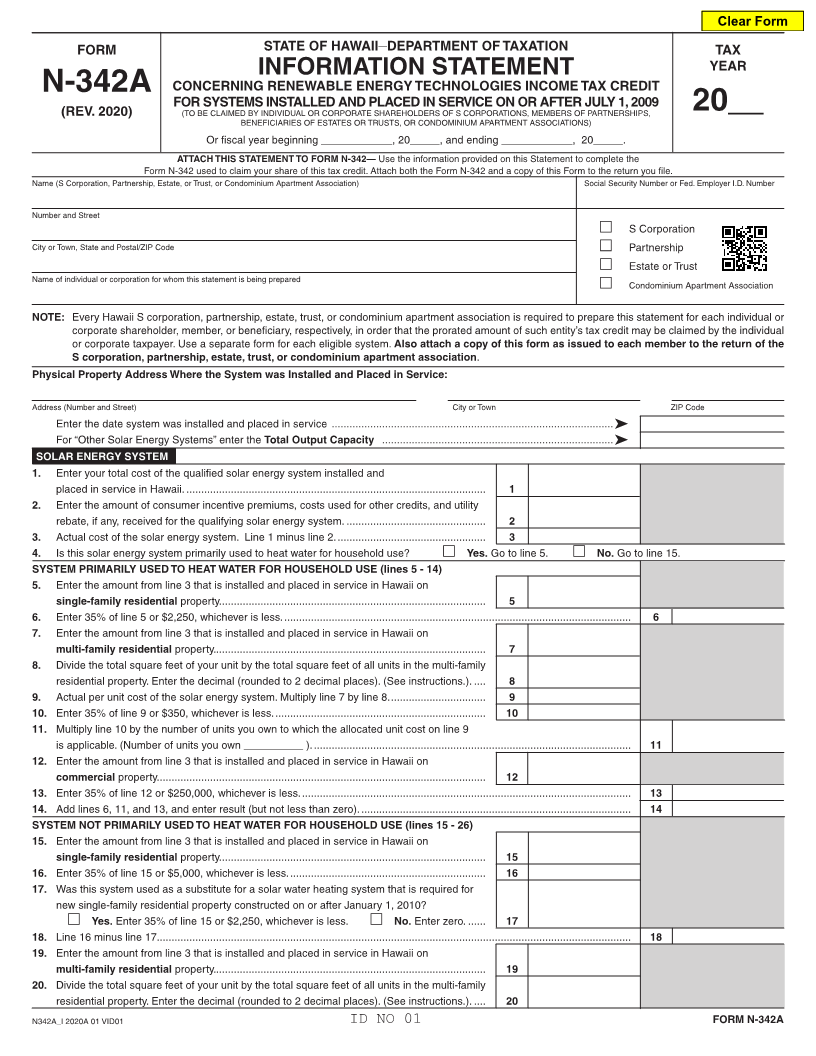

FORM STATE OF HAWAII DEPARTMENT__ OF TAXATION

TAX

INFORMATION STATEMENT YEAR

N-342A CONCERNING RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT

FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1, 2009

(REV. 2020) (TO BE CLAIMED BY INDIVIDUAL OR CORPORATE SHAREHOLDERS OF S CORPORATIONS, MEMBERS OF PARTNERSHIPS, 20__

BENEFICIARIES OF ESTATES OR TRUSTS, OR CONDOMINIUM APARTMENT ASSOCIATIONS)

Or fiscal year beginning ____________, 20_____, and ending ____________, 20_____.

ATTACH THIS STATEMENT TO FORM N-342— Use the information provided on this Statement to complete the

Form N-342 used to claim your share of this tax credit. Attach both the Form N-342 and a copy of this Form to the return you file.

Name (S Corporation, Partnership, Estate, or Trust, or Condominium Apartment Association) Social Security Number or Fed. Employer I.D. Number

Number and Street

S Corporation

City or Town, State and Postal/ZIP Code Partnership

Estate or Trust

Name of individual or corporation for whom this statement is being prepared

Condominium Apartment Association

NOTE: Every Hawaii S corporation, partnership, estate, trust, or condominium apartment association is required to prepare this statement for each individual or

corporate shareholder, member, or beneficiary, respectively, in order that the prorated amount of such entity’s tax credit may be claimed by the individual

or corporate taxpayer. Use a separate form for each eligible system. Also attach a copy of this form as issued to each member to the return of the

S corporation, partnership, estate, trust, or condominium apartment association.

Physical Property Address Where the System was Installed and Placed in Service:

Address (Number and Street) City or Town ZIP Code

Enter the date system was installed and placed in service ...............................................................................................

For “Other Solar Energy Systems” enter the Total Output Capacity ..............................................................................

SOLAR ENERGY SYSTEM

1. Enter your total cost of the qualified solar energy system installed and

placed in service in Hawaii. ..................................................................................................... 1

2. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying solar energy system. ............................................... 2

3. Actual cost of the solar energy system. Line 1 minus line 2. .................................................. 3

4. Is this solar energy system primarily used to heat water for household use? Yes. Go to line 5. No. Go to line 15.

SYSTEM PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 5 - 14)

5. Enter the amount from line 3 that is installed and placed in service in Hawaii on

single-family residential property. ......................................................................................... 5

6. Enter 35% of line 5 or $2,250, whichever is less. ..................................................................................................................... 6

7. Enter the amount from line 3 that is installed and placed in service in Hawaii on

multi-family residential property. ........................................................................................... 7

8. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). .... 8

9. Actual per unit cost of the solar energy system. Multiply line 7 by line 8. ................................ 9

10. Enter 35% of line 9 or $350, whichever is less. ....................................................................... 10

11. Multiply line 10 by the number of units you own to which the allocated unit cost on line 9

is applicable. (Number of units you own __________ ). ........................................................................................................... 11

12. Enter the amount from line 3 that is installed and placed in service in Hawaii on

commercial property. .............................................................................................................. 12

13. Enter 35% of line 12 or $250,000, whichever is less. ............................................................................................................... 13

14. Add lines 6, 11, and 13, and enter result (but not less than zero). ........................................................................................... 14

SYSTEM NOT PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 15 - 26)

15. Enter the amount from line 3 that is installed and placed in service in Hawaii on

single-family residential property. ......................................................................................... 15

16. Enter 35% of line 15 or $5,000, whichever is less. .................................................................. 16

17. Was this system used as a substitute for a solar water heating system that is required for

new single-family residential property constructed on or after January 1, 2010?

Yes. Enter 35% of line 15 or $2,250, whichever is less. No. Enter zero. ...... 17

18. Line 16 minus line 17. ............................................................................................................................................................... 18

19. Enter the amount from line 3 that is installed and placed in service in Hawaii on

multi-family residential property. ........................................................................................... 19

20. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). .... 20

N342A_I 2020A 01 VID01 ID NO 01 FORM N-342A