Enlarge image

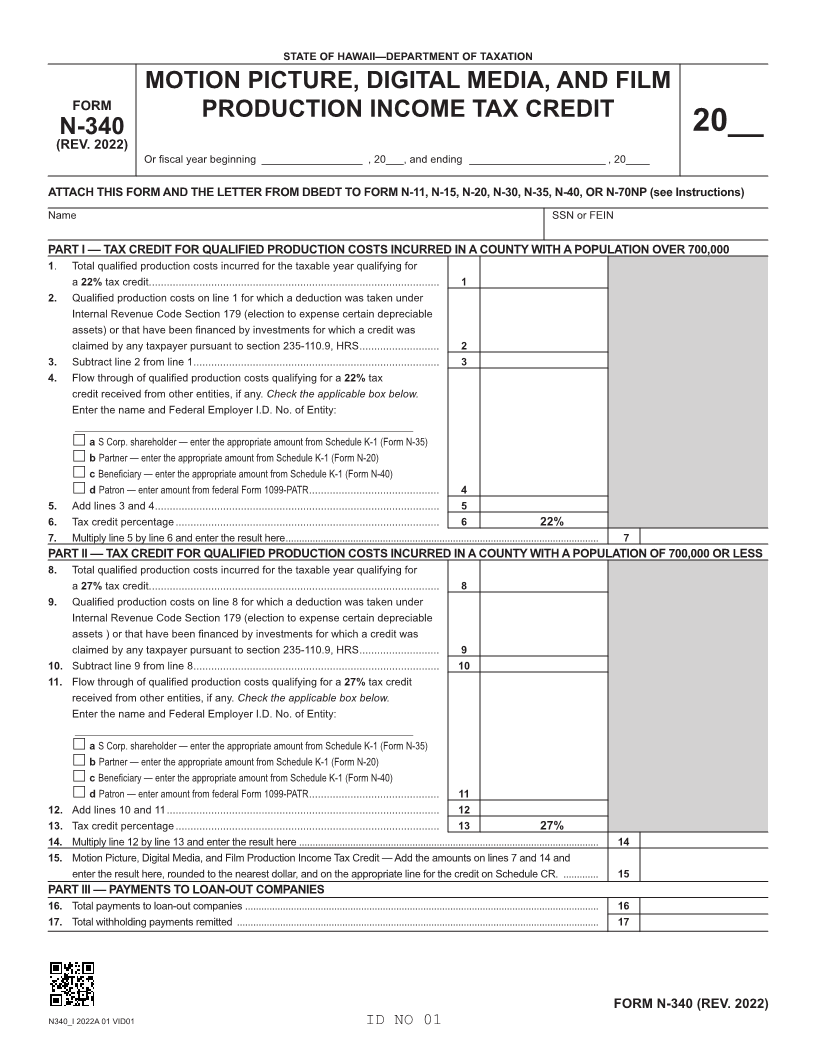

STATE OF HAWAII—DEPARTMENT OF TAXATION

MOTION PICTURE, DIGITAL MEDIA, AND FILM

FORM

PRODUCTION INCOME TAX CREDIT

N-340 20__

(REV. 2022)

Or fiscal year beginning _________________ , 20___, and ending _______________________ , 20____

ATTACH THIS FORM AND THE LETTER FROM DBEDT TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP (see Instructions)

Name SSN or FEIN

PART I –– TAX CREDIT FOR QUALIFIED PRODUCTION COSTS INCURRED IN A COUNTY WITH A POPULATION OVER 700,000

1. Total qualified production costs incurred for the taxable year qualifying for

a 22% tax credit. ................................................................................................. 1

2. Qualified production costs on line 1 for which a deduction was taken under

Internal Revenue Code Section 179 (election to expense certain depreciable

assets) or that have been financed by investments for which a credit was

claimed by any taxpayer pursuant to section 235-110.9, HRS ........................... 2

3. Subtract line 2 from line 1 ................................................................................... 3

4. Flow through of qualified production costs qualifying for a 22% tax

credit received from other entities, if any. Check the applicable box below.

Enter the name and Federal Employer I.D. No. of Entity:

_________________________________________________________

a S Corp. shareholder — enter the appropriate amount from Schedule K-1 (Form N-35)

b Partner — enter the appropriate amount from Schedule K-1 (Form N-20)

c Beneficiary — enter the appropriate amount from Schedule K-1 (Form N-40)

d Patron — enter amount from federal Form 1099-PATR ............................................ 4

5. Add lines 3 and 4 ................................................................................................ 5

6. Tax credit percentage ......................................................................................... 6 22%

7. Multiply line 5 by line 6 and enter the result here .................................................................................................................... 7

PART II –– TAX CREDIT FOR QUALIFIED PRODUCTION COSTS INCURRED IN A COUNTY WITH A POPULATION OF 700,000 OR LESS

8. Total qualified production costs incurred for the taxable year qualifying for

a 27% tax credit. ................................................................................................. 8

9. Qualified production costs on line 8 for which a deduction was taken under

Internal Revenue Code Section 179 (election to expense certain depreciable

assets ) or that have been financed by investments for which a credit was

claimed by any taxpayer pursuant to section 235-110.9, HRS ........................... 9

10. Subtract line 9 from line 8 ................................................................................... 10

11. Flow through of qualified production costs qualifying for a 27% tax credit

received from other entities, if any. Check the applicable box below.

Enter the name and Federal Employer I.D. No. of Entity:

_________________________________________________________

a S Corp. shareholder — enter the appropriate amount from Schedule K-1 (Form N-35)

b Partner — enter the appropriate amount from Schedule K-1 (Form N-20)

c Beneficiary — enter the appropriate amount from Schedule K-1 (Form N-40)

d Patron — enter amount from federal Form 1099-PATR ............................................ 11

12. Add lines 10 and 11 ............................................................................................ 12

13. Tax credit percentage ......................................................................................... 13 27%

14. Multiply line 12 by line 13 and enter the result here ............................................................................................................... 14

15. Motion Picture, Digital Media, and Film Production Income Tax Credit — Add the amounts on lines 7 and 14 and

enter the result here, rounded to the nearest dollar, and on the appropriate line for the credit on Schedule CR. ............. 15

PART III –– PAYMENTS TO LOAN-OUT COMPANIES

16. Total payments to loan-out companies ................................................................................................................................... 16

17. Total withholding payments remitted ...................................................................................................................................... 17

FORM N-340 (REV. 2022)

N340_I 2022A 01 VID01 ID NO 01