Enlarge image

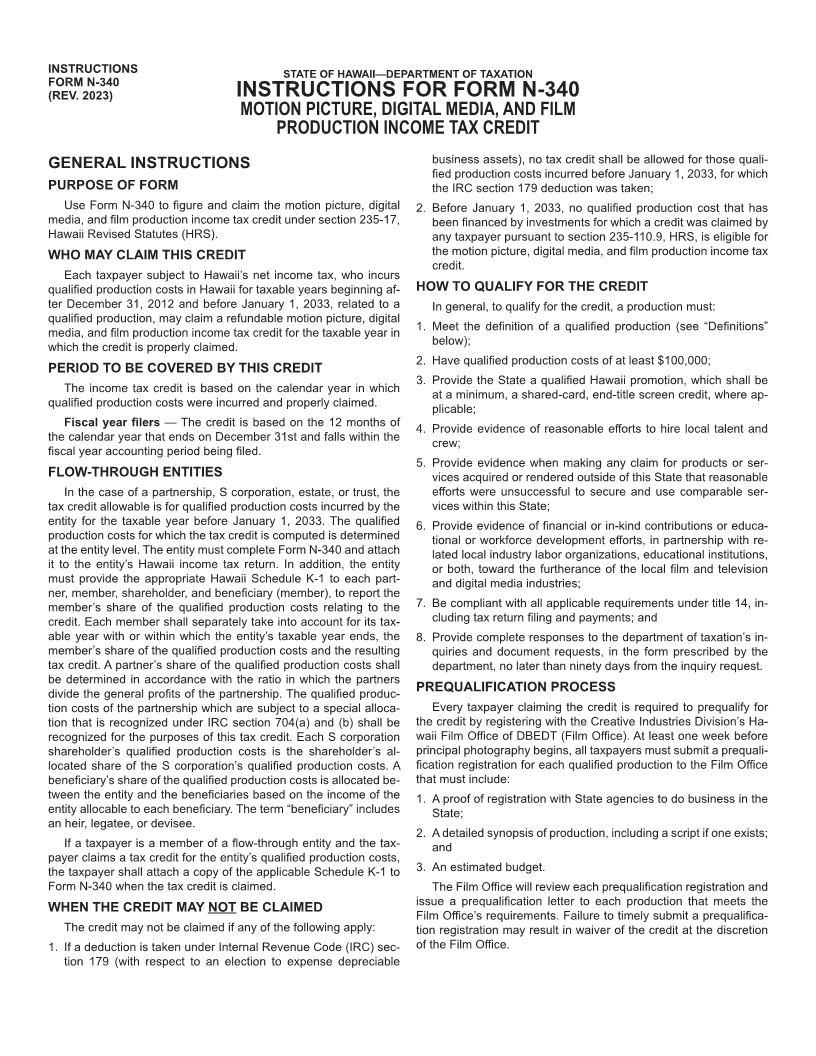

INSTRUCTIONS

FORM N-340 STATE OF HAWAII—DEPARTMENT OF TAXATION

(REV. 2023) INSTRUCTIONS FOR FORM N-340

MOTION PICTURE, DIGITAL MEDIA, AND FILM

PRODUCTION INCOME TAX CREDIT

business assets), no tax credit shall be allowed for those quali -

GENERAL INSTRUCTIONS

fied production costs incurred before January 1, 2033, for which

PURPOSE OF FORM the IRC section 179 deduction was taken;

Use Form N-340 to figure and claim the motion picture, digital 2. Before January 1, 2033, no qualified production cost that has

media, and film production income tax credit under section 235-17, been financed by investments for which a credit was claimed by

Hawaii Revised Statutes (HRS). any taxpayer pursuant to section 235-110.9, HRS, is eligible for

WHO MAY CLAIM THIS CREDIT the motion picture, digital media, and film production income tax

credit.

Each taxpayer subject to Hawaii’s net income tax, who incurs

qualified production costs in Hawaii for taxable years beginning af - HOW TO QUALIFY FOR THE CREDIT

ter December 31, 2012 and before January 1, 2033, related to a In general, to qualify for the credit, a production must:

qualified production, may claim a refundable motion picture, digital

media, and film production income tax credit for the taxable year in 1. Meet the definition of a qualified production (see “Definitions”

which the credit is properly claimed. below);

2. Have qualified production costs of at least $100,000;

PERIOD TO BE COVERED BY THIS CREDIT

3. Provide the State a qualified Hawaii promotion, which shall be

The income tax credit is based on the calendar year in which at a minimum, a shared-card, end-title screen credit, where ap-

qualified production costs were incurred and properly claimed. plicable;

Fiscal year filers — The credit is based on the 12 months of 4. Provide evidence of reasonable efforts to hire local talent and

the calendar year that ends on December 31st and falls within the crew;

fiscal year accounting period being filed.

5. Provide evidence when making any claim for products or ser -

FLOW-THROUGH ENTITIES vices acquired or rendered outside of this State that reasonable

In the case of a partnership, S corporation, estate, or trust, the efforts were unsuccessful to secure and use comparable ser-

tax credit allowable is for qualified production costs incurred by the vices within this State;

entity for the taxable year before January 1, 2033. The qualified 6. Provide evidence of financial or in-kind contributions or educa -

production costs for which the tax credit is computed is determined tional or workforce development efforts, in partnership with re-

at the entity level. The entity must complete Form N-340 and attach lated local industry labor organizations, educational institutions,

it to the entity’s Hawaii income tax return. In addition, the entity or both, toward the furtherance of the local film and television

must provide the appropriate Hawaii Schedule K-1 to each part - and digital media industries;

ner, member, shareholder, and beneficiary (member), to report the

member’s share of the qualified production costs relating to the 7. Be compliant with all applicable requirements under title 14, in-

credit. Each member shall separately take into account for its tax - cluding tax return filing and payments; and

able year with or within which the entity’s taxable year ends, the 8. Provide complete responses to the department of taxation’s in -

member’s share of the qualified production costs and the resulting quiries and document requests, in the form prescribed by the

tax credit. A partner’s share of the qualified production costs shall department, no later than ninety days from the inquiry request.

be determined in accordance with the ratio in which the partners

divide the general profits of the partnership. The qualified produc - PREQUALIFICATION PROCESS

tion costs of the partnership which are subject to a special alloca - Every taxpayer claiming the credit is required to prequalify for

tion that is recognized under IRC section 704(a) and (b) shall be the credit by registering with the Creative Industries Division’s Ha-

recognized for the purposes of this tax credit. Each S corporation waii Film Office of DBEDT (Film Office). At least one week before

shareholder’s qualified production costs is the shareholder’s al- principal photography begins, all taxpayers must submit a prequali -

located share of the S corporation’s qualified production costs. A fication registration for each qualified production to the Film Office

beneficiary’s share of the qualified production costs is allocated be - that must include:

tween the entity and the beneficiaries based on the income of the 1. A proof of registration with State agencies to do business in the

entity allocable to each beneficiary. The term “beneficiary” includes State;

an heir, legatee, or devisee.

2. A detailed synopsis of production, including a script if one exists;

If a taxpayer is a member of a flow-through entity and the tax- and

payer claims a tax credit for the entity’s qualified production costs,

the taxpayer shall attach a copy of the applicable Schedule K-1 to 3. An estimated budget.

Form N-340 when the tax credit is claimed. The Film Office will review each prequalification registration and

issue a prequalification letter to each production that meets the

WHEN THE CREDIT MAY NOT BE CLAIMED

Film Office’s requirements. Failure to timely submit a prequalifica -

The credit may not be claimed if any of the following apply: tion registration may result in waiver of the credit at the discretion

1. If a deduction is taken under Internal Revenue Code (IRC) sec - of the Film Office.

tion 179 (with respect to an election to expense depreciable