Enlarge image

Clear Form

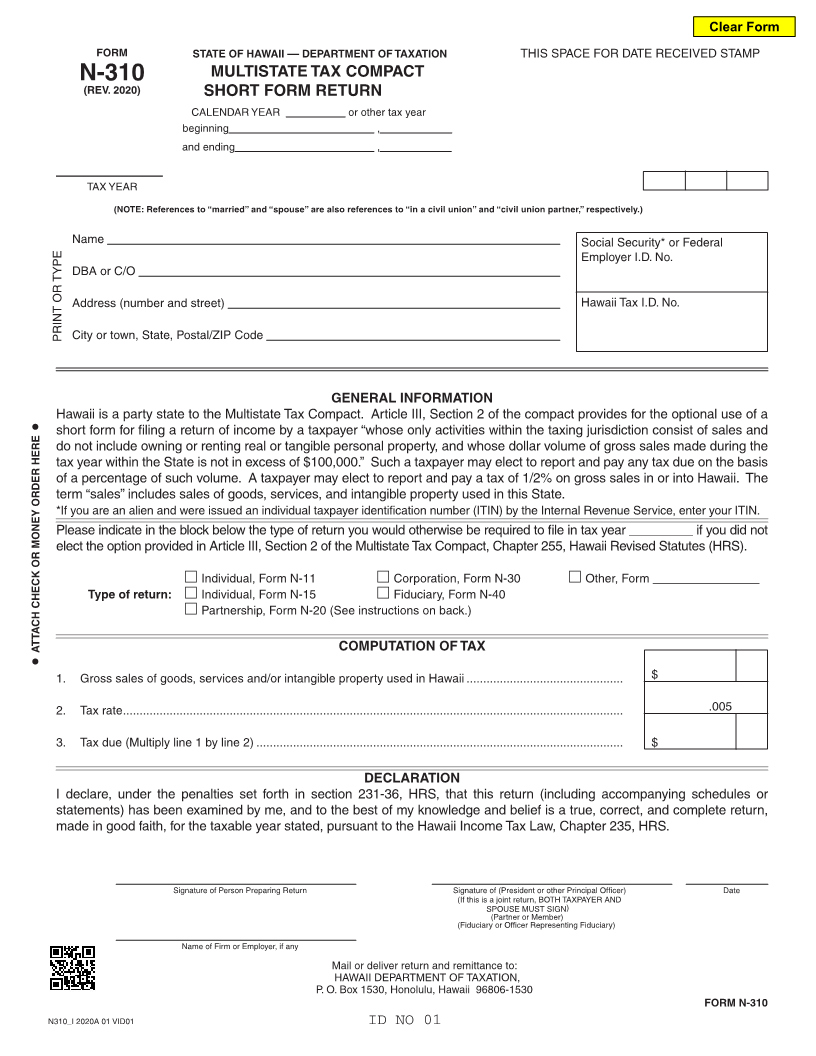

FORM STATE OF HAWAII –– DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMP

N-310 MULTISTATE TAX COMPACT

(REV. 2020) SHORT FORM RETURN

CALENDAR YEAR or other tax year

beginning ,

and ending ,

________

TAX YEAR

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

Name Social Security* or Federal

Employer I.D. No.

DBA or C/O

Address (number and street) Hawaii Tax I.D. No.

PRINT OR TYPE City or town, State, Postal/ZIP Code

GENERAL INFORMATION

Hawaii is a party state to the Multistate Tax Compact. Article III, Section 2 of the compact provides for the optional use of a

•

short form for filing a return of income by a taxpayer “whose only activities within the taxing jurisdiction consist of sales and

do not include owning or renting real or tangible personal property, and whose dollar volume of gross sales made during the

tax year within the State is not in excess of $100,000.” Such a taxpayer may elect to report and pay any tax due on the basis

of a percentage of such volume. A taxpayer may elect to report and pay a tax of 1/2% on gross sales in or into Hawaii. The

term “sales” includes sales of goods, services, and intangible property used in this State.

*If you are an alien and were issued an individual taxpayer identification number (ITIN) by the Internal Revenue Service, enter your ITIN.

Please indicate in the block below the type of return you would otherwise be required to file in tax year _________ if you did not

elect the option provided in Article III, Section 2 of the Multistate Tax Compact, Chapter 255, Hawaii Revised Statutes (HRS).

Individual, Form N-11 Corporation, Form N-30 Other, Form ________________

Type of return: Individual, Form N-15 Fiduciary, Form N-40

Partnership, Form N-20 (See instructions on back.)

ATTACH CHECK OR MONEY ORDER HERE COMPUTATION OF TAX

•

1. Gross sales of goods, services and/or intangible property used in Hawaii ............................................... $

2. Tax rate ...................................................................................................................................................... .005

3. Tax due (Multiply line 1 by line 2) .............................................................................................................. $

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including accompanying schedules or

statements) has been examined by me, and to the best of my knowledge and belief is a true, correct, and complete return,

made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS.

Signature of Person Preparing Return Signature of (President or other Principal Officer) Date

(If this is SPOUSEa joint return,MUSTBOTHSIGNTAXPAYER )AND

(Partner or Member)

(Fiduciary or Officer Representing Fiduciary)

Name of Firm or Employer, if any

Mail or deliver return and remittance to:

HAWAII DEPARTMENT OF TAXATION,

P. O. Box 1530, Honolulu, Hawaii 96806-1530

FORM N-310

N310_I 2020A 01 VID01 ID NO 01