Enlarge image

Clear Form

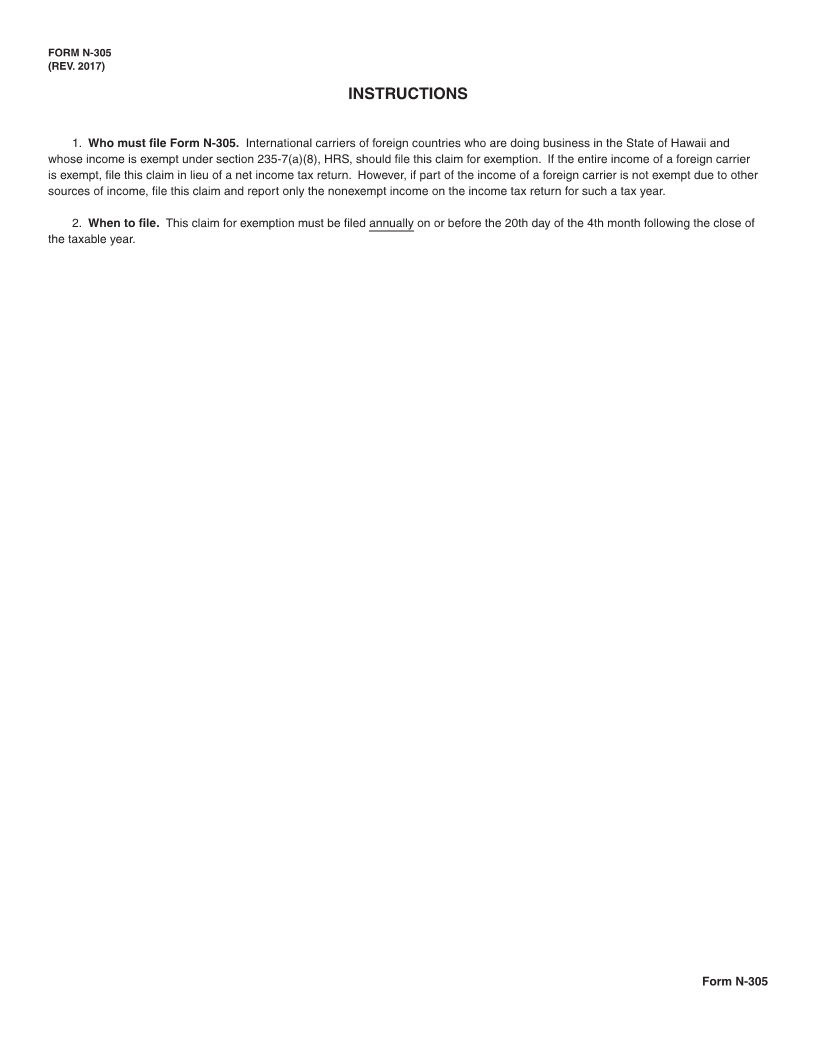

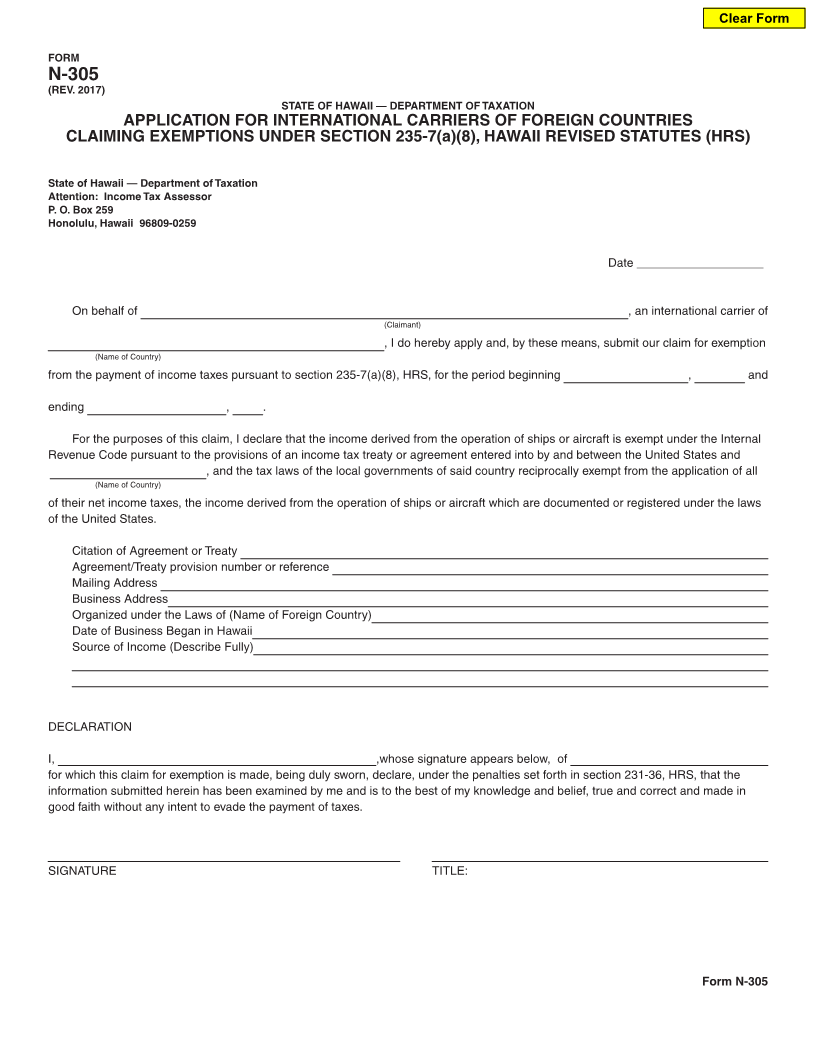

FORM

N-305

(REV. 2017)

STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR INTERNATIONAL CARRIERS OF FOREIGN COUNTRIES

CLAIMING EXEMPTIONS UNDER SECTION 235-7(a)(8), HAWAII REVISED STATUTES (HRS)

State of Hawaii — Department of Taxation

Attention: Income Tax Assessor

P. O. Box 259

Honolulu, Hawaii 96809-0259

Date ___________________

On behalf of , an international carrier of

(Claimant)

, I do hereby apply and, by these means, submit our claim for exemption

(Name of Country)

from the payment of income taxes pursuant to section 235-7(a)(8), HRS, for the period beginning , and

ending , .

For the purposes of this claim, I declare that the income derived from the operation of ships or aircraft is exempt under the Internal

Revenue Code pursuant to the provisions of an income tax treaty or agreement entered into by and between the United States and

, and the tax laws of the local governments of said country reciprocally exempt from the application of all

(Name of Country)

of their net income taxes, the income derived from the operation of ships or aircraft which are documented or registered under the laws

of the United States.

Citation of Agreement or Treaty

Agreement/Treaty provision number or reference

Mailing Address

Business Address

Organized under the Laws of (Name of Foreign Country)

Date of Business Began in Hawaii

Source of Income (Describe Fully)

DECLARATION

I, ,whose signature appears below, of

for which this claim for exemption is made, being duly sworn, declare, under the penalties set forth in section 231-36, HRS, that the

information submitted herein has been examined by me and is to the best of my knowledge and belief, true and correct and made in

good faith without any intent to evade the payment of taxes.

SIGNATURE TITLE:

Form N-305