Enlarge image

Clear Form

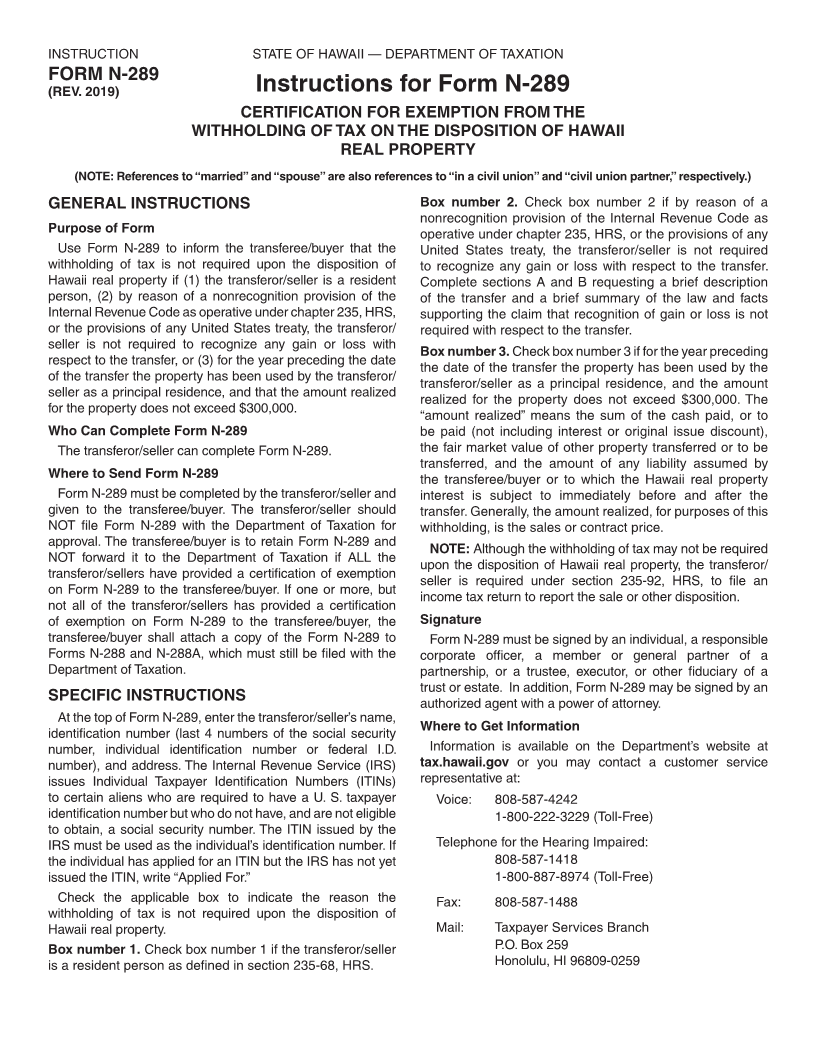

FORM N-289 STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2019)

CERTIFICATION FOR EXEMPTION FROM THE

WITHHOLDING OF TAX ON THE DISPOSITION OF HAWAII

REAL PROPERTY

(To be completed by transferor/seller and given to transferee/buyer. The transferor/seller

should NOT file Form N-289 with the Department of Taxation for approval.)

Section 235-68, Hawaii Revised Statutes (HRS), provides that a transferee/buyer of Hawaii real property must withhold tax if the transferor/seller is a

nonresident person. To inform the transferee/buyer that withholding of tax is not required upon the disposition of Hawaii real property by _____________

_______________________________________ (name of transferor/seller), the undersigned hereby certifies the following:

Transferor/seller’s identification number (Last 4 numbers of the SSN or FEIN) _______________________________

Transferor/seller’s address (home address for individuals, office address for corporations, partnerships, trusts, or estates)

The withholding of tax is not required upon the disposition of Hawaii real property because (check whichever box is applicable):

1 The transferor/seller is a resident person as defined in section 235-68, HRS. Resident person means any: (1) Individual included in the

definition of “resident” in section 235-1, HRS; (2) Corporation incorporated or granted a certificate of authority under Chapter 414, 414D, or

415A, HRS; (3) Partnership formed or registered under Chapter 425 or 425E*, HRS; (4) Foreign partnership qualified to transact business

pursuant to Chapter 425 or 425E*, HRS; (5) Limited liability company formed under Chapter 428, HRS, or any foreign limited liability company

registered under Chapter 428, HRS; provided that if a single member limited liability company has not elected to be taxed as a corporation, the

single member limited liability company shall be disregarded for purposes of section 235-68, HRS, and section 235-68, HRS, shall be applied

as if the sole member is the transferor; (6) Limited liability partnership formed under Chapter 425, HRS; (7) Foreign limited liability partnership

qualified to transact business under Chapter 425, HRS; (8) Trust included in the definition of “resident trust” in section 235-1, HRS; or (9) Estate

included in the definition of “resident estate” in section 235-1, HRS.

*Note: Chapter 425E, HRS, replaced chapter 425D, HRS, effective July 1, 2004.

2 That by reason of a nonrecognition provision of the Internal Revenue Code as operative under chapter 235, HRS, or the provisions of any

United States treaty, the transferor/seller is not required to recognize any gain or loss with respect to the transfer. (See Instructions)

(Complete A and B below.)

A. Brief description of the transfer:

B. Brief summary of the law and facts supporting the claim that recognition of gain or loss is not required with respect to the transfer:

3For the year preceding the date of the transfer the property has been used by the transferor/seller as a principal residence, and that the amount

realized for the property does not exceed $300,000. (See Instructions)

____________________________________________________ (name of transferor/seller) understands that this certification may be disclosed to the

State of Hawaii, Department of Taxation by the transferee/buyer and that any false statement contained herein could be punished by fine, imprisonment,

or both.

I declare, under the penalties set forth in section 231-36, HRS, that this certification has been examined by me, and to the best of my knowledge and

belief, it is true, correct, and complete. In the case of corporations, partnerships, trusts, or estates, I further declare that I have authority to sign this

document on behalf of ____________________________________________________ (name of transferor/seller).

Signed: _______________________________________________ Print Name: ________________________________________________

Title: _______________________________________________ Date: ________________________________________________

FORM N-289