Enlarge image

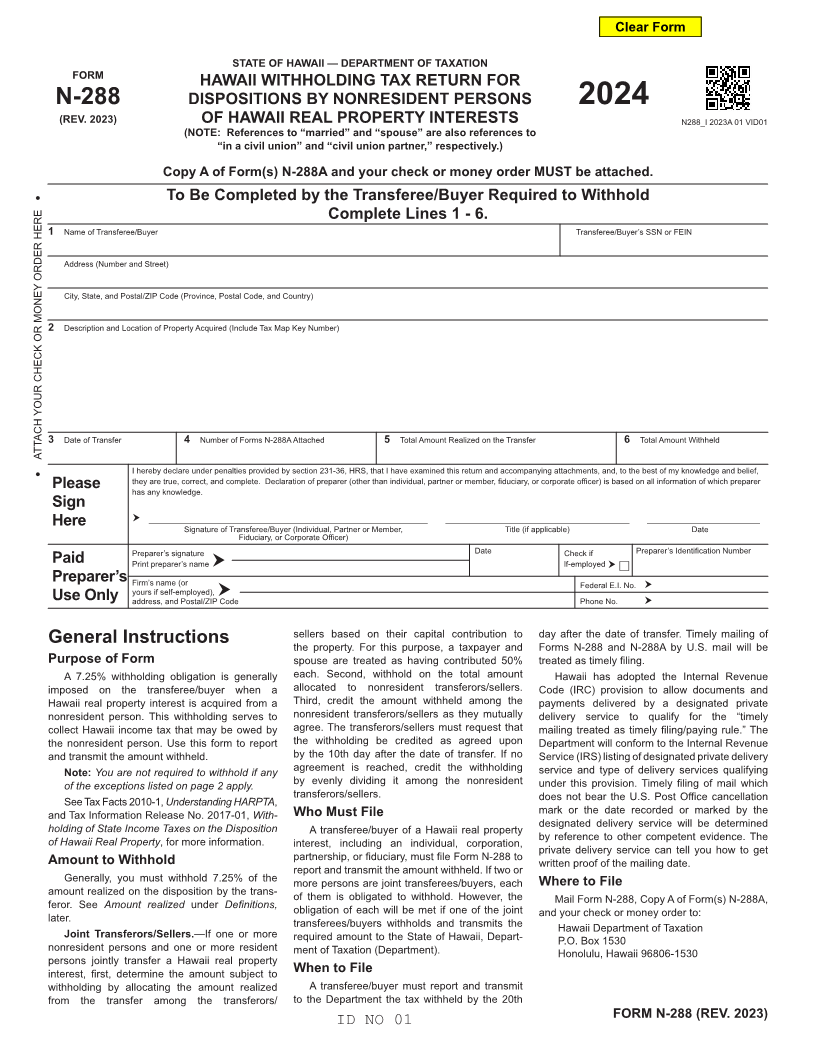

Clear Form STATE OF HAWAII — DEPARTMENT OF TAXATION FORM HAWAII WITHHOLDING TAX RETURN FOR N-288 DISPOSITIONS BY NONRESIDENT PERSONS 2024 (REV. 2023) OF HAWAII REAL PROPERTY INTERESTS N288_I 2023A 01 VID01 (NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.) Copy A of Form(s) N-288A and your check or money order MUST be attached. • To Be Completed by the Transferee/Buyer Required to Withhold Complete Lines 1 - 6. 1 Name of Transferee/Buyer Transferee/Buyer’s SSN or FEIN Address (Number and Street) City, State, and Postal/ZIP Code (Province, Postal Code, and Country) 2 Description and Location of Property Acquired (Include Tax Map Key Number) 3 Date of Transfer 4 Number of Forms N-288A Attached 5 Total Amount Realized on the Transfer 6 Total Amount Withheld ATTACH YOUR CHECK OR MONEY ORDER HERE • I hereby declare under penalties provided by section 231-36, HRS, that I have examined this return and accompanying attachments, and, to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than individual, partner or member, fiduciary, or corporate officer) is based on all information of which preparer Please has any knowledge. Sign h _______________________________________________ _______________________________ ___________________ Here Signature of Transferee/Buyer (Individual, Partner or Member, Title (if applicable) Date Fiduciary, or Corporate Officer) Preparer’s signature Date Check ifPreparer’s Identification Number Paid Print preparer’s name h lf-employed h Preparer’s Firm’s name (or Federal E.I. No. h Use Only address,yours if self-employed), and Postal/ZIPh Code Phone No. h sellers based on their capital contribution to day after the date of transfer. Timely mailing of General Instructions the property. For this purpose, a taxpayer and Forms N-288 and N-288A by U.S. mail will be Purpose of Form spouse are treated as having contributed 50% treated as timely filing. A 7.25% withholding obligation is generally each. Second, withhold on the total amount Hawaii has adopted the Internal Revenue imposed on the transferee/buyer when a allocated to nonresident transferors/sellers. Code (IRC) provision to allow documents and Hawaii real property interest is acquired from a Third, credit the amount withheld among the payments delivered by a designated private nonresident person. This withholding serves to nonresident transferors/sellers as they mutually delivery service to qualify for the “timely collect Hawaii income tax that may be owed by agree. The transferors/sellers must request that mailing treated as timely filing/paying rule.” The the nonresident person. Use this form to report the withholding be credited as agreed upon Department will conform to the Internal Revenue and transmit the amount withheld. by the 10th day after the date of transfer. If no Service (IRS) listing of designated private delivery Note: You are not required to withhold if any agreement is reached, credit the withholding service and type of delivery services qualifying of the exceptions listed on page 2 apply. by evenly dividing it among the nonresident under this provision. Timely filing of mail which transferors/sellers. See Tax Facts 2010-1, Understanding HARPTA, does not bear the U.S. Post Office cancellation and Tax Information Release No. 2017-01, With- Who Must File mark or the date recorded or marked by the designated delivery service will be determined holding of State Income Taxes on the Disposition A transferee/buyer of a Hawaii real property by reference to other competent evidence. The of Hawaii Real Property, for more information. interest, including an individual, corporation, private delivery service can tell you how to get Amount to Withhold partnership, or fiduciary, must file Form N-288 to written proof of the mailing date. report and transmit the amount withheld. If two or Generally, you must withhold 7.25% of the more persons are joint transferees/buyers, each Where to File amount realized on the disposition by the trans- of them is obligated to withhold. However, the Mail Form N-288, Copy A of Form(s) N-288A, feror. See Amount realized under Definitions, obligation of each will be met if one of the joint and your check or money order to: later. transferees/buyers withholds and transmits the Hawaii Department of Taxation Joint Transferors/Sellers.—If one or more required amount to the State of Hawaii, Depart- P.O. Box 1530 nonresident persons and one or more resident ment of Taxation (Department). Honolulu, Hawaii 96806-1530 persons jointly transfer a Hawaii real property interest, first, determine the amount subject to When to File withholding by allocating the amount realized A transferee/buyer must report and transmit from the transfer among the transferors/ to the Department the tax withheld by the 20th FORM N-288 (REV. 2023) ID NO 01