Enlarge image

Clear Form

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM

Underpayment of Estimated Tax by Corporations

and S Corporations

N-220 2024

(REV. 2024) Attach this form to your tax return See separate instructions

Name as shown on tax return Federal Employer I.D. Number

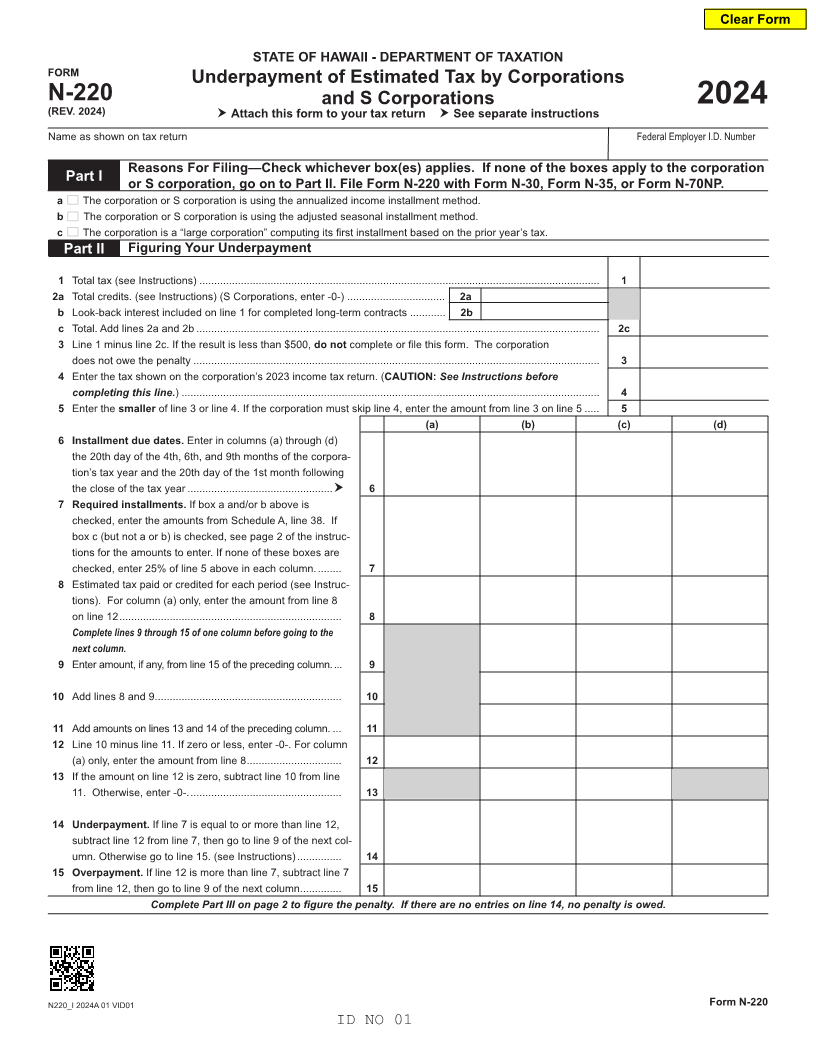

Reasons For Filing—Check whichever box(es) applies. If none of the boxes apply to the corporation

Part I

or S corporation, go on to Part II. File Form N-220 with Form N-30, Form N-35, or Form N-70NP.

a The corporation or S corporation is using the annualized income installment method.

b The corporation or S corporation is using the adjusted seasonal installment method.

c The corporation is a “large corporation” computing its first installment based on the prior year’s tax.

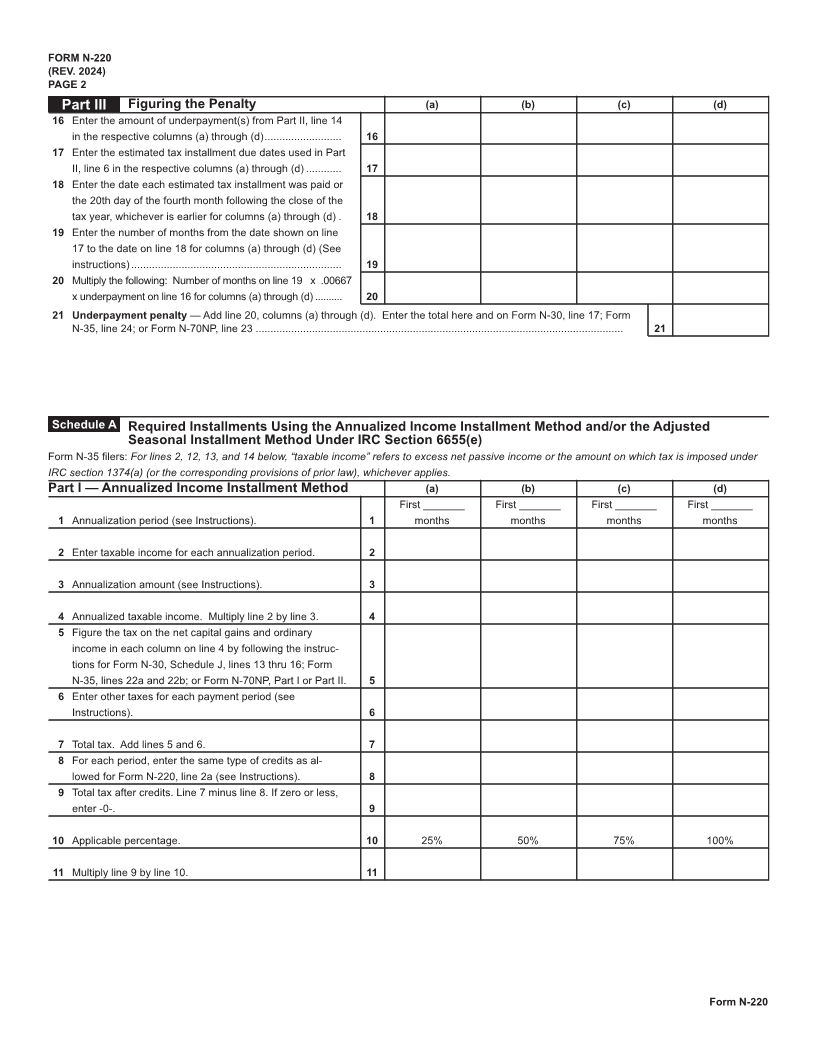

Part II Figuring Your Underpayment

1 Total tax (see Instructions) ....................................................................................................................................... 1

2a Total credits. (see Instructions) (S Corporations, enter -0-) ................................. 2a

b Look-back interest included on line 1 for completed long-term contracts ............ 2b

c Total. Add lines 2a and 2b ........................................................................................................................................ 2c

3 Line 1 minus line 2c. If the result is less than $500, do not complete or file this form. The corporation

does not owe the penalty ......................................................................................................................................... 3

4 Enter the tax shown on the corporation’s 2023 income tax return. (CAUTION: See Instructions before

completing this line.) ............................................................................................................................................. 4

5 Enter the smaller of line 3 or line 4. If the corporation must skip line 4, enter the amount from line 3 on line 5 ..... 5

(a) (b) (c) (d)

6 Installment due dates. Enter in columns (a) through (d)

the 20th day of the 4th, 6th, and 9th months of the corpora-

tion’s tax year and the 20th day of the 1st month following

the close of the tax year ................................................. 6

7 Required installments. If box a and/or b above is

checked, enter the amounts from Schedule A, line 38. If

box c (but not a or b) is checked, see page 2 of the instruc-

tions for the amounts to enter. If none of these boxes are

checked, enter 25% of line 5 above in each column. ........ 7

8 Estimated tax paid or credited for each period (see Instruc-

tions). For column (a) only, enter the amount from line 8

on line 12 ........................................................................... 8

Complete lines 9 through 15 of one column before going to the

next column.

9 Enter amount, if any, from line 15 of the preceding column. ... 9

10 Add lines 8 and 9. .............................................................. 10

11 Add amounts on lines 13 and 14 of the preceding column. ... 11

12 Line 10 minus line 11. If zero or less, enter -0-. For column

(a) only, enter the amount from line 8 ................................ 12

13 If the amount on line 12 is zero, subtract line 10 from line

11. Otherwise, enter -0-. ................................................... 13

14 Underpayment. If line 7 is equal to or more than line 12,

subtract line 12 from line 7, then go to line 9 of the next col-

umn. Otherwise go to line 15. (see Instructions) ............... 14

15 Overpayment. If line 12 is more than line 7, subtract line 7

from line 12, then go to line 9 of the next column. ............. 15

Complete Part III on page 2 to figure the penalty. If there are no entries on line 14, no penalty is owed.

N220_I 2024A 01 VID01 Form N-220

ID NO 01