Enlarge image

Clear Form

INSTRUCTIONS STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM N-220

(REV. 2023) INSTRUCTIONS FOR FORM N-220

Underpayment of Estimated Tax by Corporations

and S Corporations

Purpose of Form If the corporation is using only the annualized income installment method,

it must check box a of Part I and complete Parts I and III of Schedule A. If

Form N-220 is used by corporations, S corporations, and tax-exempt organi- the corporation is using only the adjusted seasonal installment method, it

zations subject to the unrelated business income tax, to determine whether must check box b of Part I and complete Parts II and III of Schedule A. If

they paid enough estimated income tax, whether they are subject to the pen- the corporation is using both methods, it must check boxes a and b of Part I

alty for underpayment of estimated tax, and, if so, the amount of the pen- and complete all three parts of Schedule A. Enter the amount from the cor-

alty due. The estimated tax is a corporation’s or S corporation’s expected responding column of line 38, Part III, Schedule A, in each column on line 7

income tax liability minus the allowable tax credits and look-back interest for of Form N-220.

completed long-term contracts included in the expected income tax liability.

A domestic corporation must make estimated tax payments if it can reason- Box c. If the corporation is a “large corporation,” check box c. A “large cor-

ably expect its estimated tax to be $500 or more. A foreign corporation must poration” is a corporation (other than an S corporation) that had, or its pre-

make estimated tax payments if 15% or more of the corporation’s business decessor had, taxable income of $1 million or more for any of the three tax

(entire gross income) for the taxable year will be attributable to Hawaii. The years immediately preceding the current tax year. For this purpose, taxable

Department of Taxation may excuse the filing of an estimate and payment of income is modified to exclude net operating loss or capital loss carrybacks

estimated taxes if it is satisfied that less than 15% of the foreign corporation’s or carryovers.

business for the taxable year will be attributable to the State. Part II. Figuring the Underpayment

Form N-220 includes the annualized income installment method and the Complete lines 1 through 15 of Part II.

adjusted seasonal installment method. These estimated tax computation

methods are incorporated in the Schedule A section. Under the annualized Line 1. — Enter the tax from line 11, Form N-30; sum of lines 22(a) and 22(b),

income installment method, a corporation or S corporation has three sets Form N-35; or line 16, Form N-70NP.

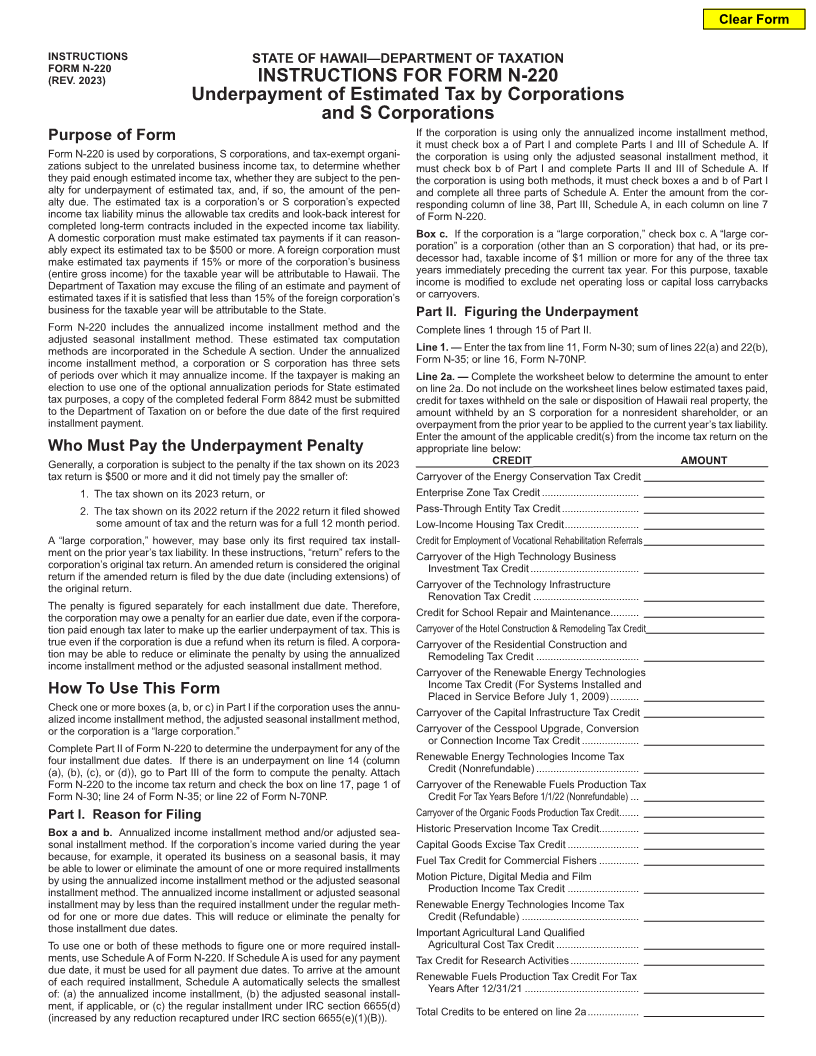

of periods over which it may annualize income. If the taxpayer is making an Line 2a. — Complete the worksheet below to determine the amount to enter

election to use one of the optional annualization periods for State estimated on line 2a. Do not include on the worksheet lines below estimated taxes paid,

tax purposes, a copy of the completed federal Form 8842 must be submitted credit for taxes withheld on the sale or disposition of Hawaii real property, the

to the Department of Taxation on or before the due date of the first required amount withheld by an S corporation for a nonresident shareholder, or an

installment payment. overpayment from the prior year to be applied to the current year’s tax liability.

Enter the amount of the applicable credit(s) from the income tax return on the

Who Must Pay the Underpayment Penalty appropriate line below:

Generally, a corporation is subject to the penalty if the tax shown on its 2023 CREDIT AMOUNT

tax return is $500 or more and it did not timely pay the smaller of: Carryover of the Energy Conservation Tax Credit

1. The tax shown on its 2023 return, or Enterprise Zone Tax Credit ..................................

2. The tax shown on its 2022 return if the 2022 return it filed showed Pass-Through Entity Tax Credit ...........................

some amount of tax and the return was for a full 12 month period. Low-Income Housing Tax Credit ..........................

A “large corporation,” however, may base only its first required tax install- Credit for Employment of Vocational Rehabilitation Referrals

ment on the prior year’s tax liability. In these instructions, “return” refers to the Carryover of the High Technology Business

corporation’s original tax return. An amended return is considered the original Investment Tax Credit ......................................

return if the amended return is filed by the due date (including extensions) of

the original return. Carryover of the Technology Infrastructure

Renovation Tax Credit .....................................

The penalty is figured separately for each installment due date. Therefore,

the corporation may owe a penalty for an earlier due date, even if the corpora- Credit for School Repair and Maintenance..........

tion paid enough tax later to make up the earlier underpayment of tax. This is Carryover of the Hotel Construction & Remodeling Tax Credit

true even if the corporation is due a refund when its return is filed. A corpora- Carryover of the Residential Construction and

tion may be able to reduce or eliminate the penalty by using the annualized Remodeling Tax Credit ....................................

income installment method or the adjusted seasonal installment method.

Carryover of the Renewable Energy Technologies

Income Tax Credit (For Systems Installed and

How To Use This Form Placed in Service Before July 1, 2009) ..........

Check one or more boxes (a, b, or c) in Part I if the corporation uses the annu- Carryover of the Capital Infrastructure Tax Credit

alized income installment method, the adjusted seasonal installment method,

or the corporation is a “large corporation.” Carryover of the Cesspool Upgrade, Conversion

or Connection Income Tax Credit ....................

Complete Part II of Form N-220 to determine the underpayment for any of the

four installment due dates. If there is an underpayment on line 14 (column Renewable Energy Technologies Income Tax

(a), (b), (c), or (d)), go to Part III of the form to compute the penalty. Attach Credit (Nonrefundable) ....................................

Form N-220 to the income tax return and check the box on line 17, page 1 of Carryover of the Renewable Fuels Production Tax

Form N-30; line 24 of Form N-35; or line 22 of Form N-70NP. Credit For Tax Years Before 1/1/22 (Nonrefundable) ...

Part I. Reason for Filing Carryover of the Organic Foods Production Tax Credit.......

Box a and b. Annualized income installment method and/or adjusted sea- Historic Preservation Income Tax Credit..............

sonal installment method. If the corporation’s income varied during the year Capital Goods Excise Tax Credit .........................

because, for example, it operated its business on a seasonal basis, it may Fuel Tax Credit for Commercial Fishers ..............

be able to lower or eliminate the amount of one or more required installments

by using the annualized income installment method or the adjusted seasonal Motion Picture, Digital Media and Film

installment method. The annualized income installment or adjusted seasonal Production Income Tax Credit .........................

installment may by less than the required installment under the regular meth- Renewable Energy Technologies Income Tax

od for one or more due dates. This will reduce or eliminate the penalty for Credit (Refundable) .........................................

those installment due dates. Important Agricultural Land Qualified

To use one or both of these methods to figure one or more required install- Agricultural Cost Tax Credit .............................

ments, use Schedule A of Form N-220. If Schedule A is used for any payment Tax Credit for Research Activities ........................

due date, it must be used for all payment due dates. To arrive at the amount

of each required installment, Schedule A automatically selects the smallest Renewable Fuels Production Tax Credit For Tax

of: (a) the annualized income installment, (b) the adjusted seasonal install- Years After 12/31/21 ........................................

ment, if applicable, or (c) the regular installment under IRC section 6655(d) Total Credits to be entered on line 2a ..................

(increased by any reduction recaptured under IRC section 6655(e)(1)(B)).