Enlarge image

Clear Form

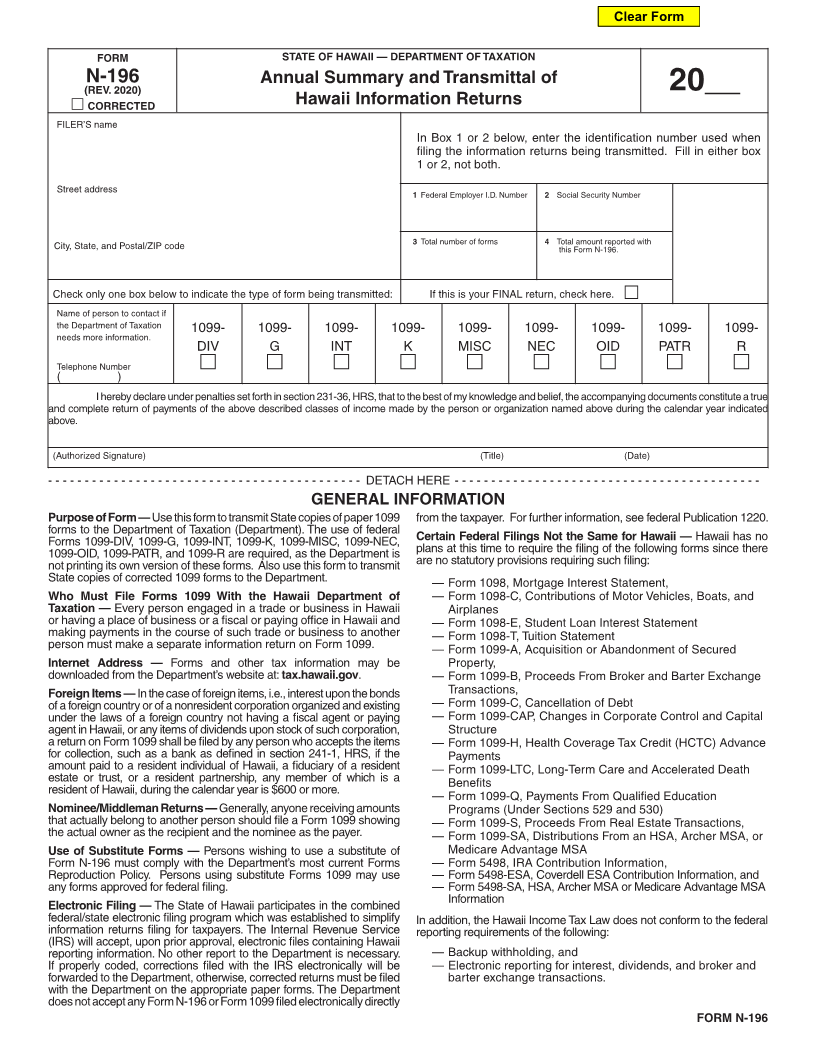

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION

N-196 Annual Summary and Transmittal of

(REV. 2020) 20__

CORRECTED Hawaii Information Returns

FILER’S name

In Box 1 or 2 below, enter the identification number used when

filing the information returns being transmitted. Fill in either box

1 or 2, not both.

Street address 1 Federal Employer I.D. Number 2 Social Security Number

City, State, and Postal/ZIP code 3 Total number of forms 4 Totalthis FormamountN-196.reported with

Check only one box below to indicate the type of form being transmitted: If this is your FINAL return, check here.

Name of person to contact if

the Department of Taxation 1099- 1099- 1099- 1099- 1099- 1099- 1099- 1099- 1099-

needs more information.

DIV G INT K MISC NEC OID PATR R

Telephone Number

( )

I hereby declare under penalties set forth in section 231-36, HRS, that to the best of my knowledge and belief, the accompanying documents constitute a true

and complete return of payments of the above described classes of income made by the person or organization named above during the calendar year indicated

above.

(Authorized Signature) (Title) (Date)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - DETACH HERE ------------------------------------------

GENERAL INFORMATION

Purpose of Form — Use this form to transmit State copies of paper 1099 from the taxpayer. For further information, see federal Publication 1220.

forms to the Department of Taxation (Department). The use of federal

Forms 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, Certain Federal Filings Not the Same for Hawaii — Hawaii has no

1099-OID, 1099-PATR, and 1099-R are required, as the Department is plans at this time to require the filing of the following forms since there

not printing its own version of these forms. Also use this form to transmit are no statutory provisions requiring such filing:

State copies of corrected 1099 forms to the Department. — Form 1098, Mortgage Interest Statement,

Who Must File Forms 1099 With the Hawaii Department of — Form 1098-C, Contributions of Motor Vehicles, Boats, and

Taxation — Every person engaged in a trade or business in Hawaii Airplanes

or having a place of business or a fiscal or paying office in Hawaii and — Form 1098-E, Student Loan Interest Statement

making payments in the course of such trade or business to another — Form 1098-T, Tuition Statement

person must make a separate information return on Form 1099. — Form 1099-A, Acquisition or Abandonment of Secured

Internet Address — Forms and other tax information may be Property,

downloaded from the Department’s website at: tax.hawaii.gov. — Form 1099-B, Proceeds From Broker and Barter Exchange

Foreign Items — In the case of foreign items, i.e., interest upon the bonds Transactions,

of a foreign country or of a nonresident corporation organized and existing — Form 1099-C, Cancellation of Debt

under the laws of a foreign country not having a fiscal agent or paying — Form 1099-CAP, Changes in Corporate Control and Capital

agent in Hawaii, or any items of dividends upon stock of such corporation, Structure

a return on Form 1099 shall be filed by any person who accepts the items — Form 1099-H, Health Coverage Tax Credit (HCTC) Advance

for collection, such as a bank as defined in section 241-1, HRS, if the Payments

amount paid to a resident individual of Hawaii, a fiduciary of a resident — Form 1099-LTC, Long-Term Care and Accelerated Death

estate or trust, or a resident partnership, any member of which is a Benefits

resident of Hawaii, during the calendar year is $600 or more. — Form 1099-Q, Payments From Qualified Education

Nominee/Middleman Returns — Generally, anyone receiving amounts Programs (Under Sections 529 and 530)

that actually belong to another person should file a Form 1099 showing — Form 1099-S, Proceeds From Real Estate Transactions,

the actual owner as the recipient and the nominee as the payer. — Form 1099-SA, Distributions From an HSA, Archer MSA, or

Use of Substitute Forms — Persons wishing to use a substitute of Medicare Advantage MSA

Form N-196 must comply with the Department’s most current Forms — Form 5498, IRA Contribution Information,

Reproduction Policy. Persons using substitute Forms 1099 may use — Form 5498-ESA, Coverdell ESA Contribution Information, and

any forms approved for federal filing. — Form 5498-SA, HSA, Archer MSA or Medicare Advantage MSA

Information

Electronic Filing — The State of Hawaii participates in the combined

federal/state electronic filing program which was established to simplify In addition, the Hawaii Income Tax Law does not conform to the federal

information returns filing for taxpayers. The Internal Revenue Service reporting requirements of the following:

(IRS) will accept, upon prior approval, electronic files containing Hawaii

reporting information. No other report to the Department is necessary. — Backup withholding, and

If properly coded, corrections filed with the IRS electronically will be — Electronic reporting for interest, dividends, and broker and

forwarded to the Department, otherwise, corrected returns must be filed barter exchange transactions.

with the Department on the appropriate paper forms. The Department

does not accept any Form N-196 or Form 1099 filed electronically directly

FORM N-196