Enlarge image

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM TAX

FUEL TAX CREDIT FOR COMMERCIAL FISHERS YEAR

N-163

(REV. 2020)

Or fiscal year beginning , 20 and ending , 20 20__

ATTACH TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP,

WHICHEVER IS APPLICABLE

NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.

Name(s) as shown on tax return SSN or FEIN

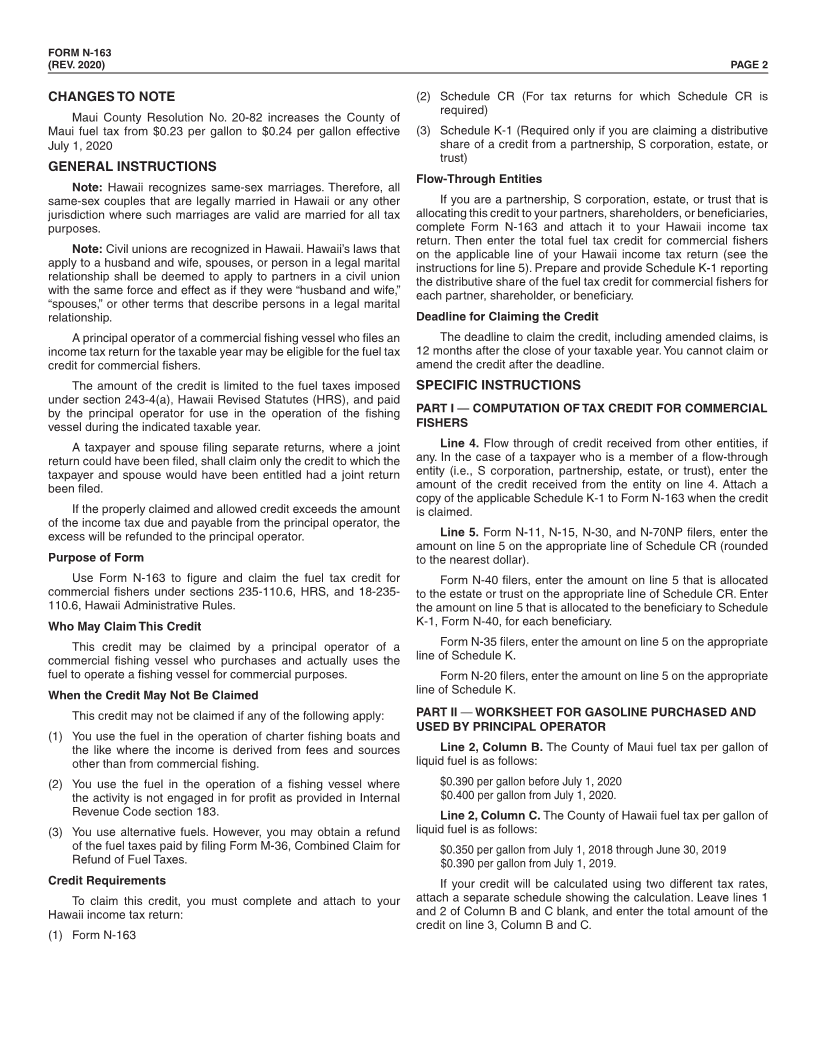

PART I — COMPUTATION OF TAX CREDIT FOR COMMERCIAL FISHERS

Note: If you are only claiming your distributive share(s) of a credit distributed from a partnership, an S Corporation, an

estate, or a trust, skip lines 1 through 3 and begin on line 4.

1. Enter the number of gallons of diesel oil purchased and used by the principal operator ............................

2. Multiply the number of gallons from line 1 by $0.01 and enter the amount here ......................................... $

3. Add the amount of credit from Part II, line 3, Columns A through D, and enter total here. .......................... $

4. Flow through of fuel tax credit for commercial fishers received from other entities, if any:

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

__________________________________________________________________________________

aS corporation shareholder — enter amount from Schedule K-1 (Form N-35),

bPartner — enter amount from Schedule K-1 (Form N-20),

cBeneficiary — enter amount from Schedule K-1 (Form N-40),

dPatron — enter amount from federal Form 1099-PATR ......................................................................$

5. Add the credit from lines 2, 3, and 4. Enter the total here and on the appropriate line of Schedule CR

(for Form N-11, N-15, N-30, N-40 and N-70NP filers) (rounded to the nearest dollar)... ............................. $

PART II — WORKSHEET FOR GASOLINE PURCHASED AND USED BY PRINCIPAL OPERATOR

Column A Column B Column C Column D

City & County of County of County of County of

Honolulu Maui Hawaii Kauai

1. Enter the number of gallons of

gasoline purchased and used by the

principal operator.

2. Rate (see Instructions) x $0.325 x x x $0.330

3. Multiply the number of gallons from

line 1 by the rate listed on line 2 $ $ $ $

N163_I 2020A 01 VID01 ID NO 01 FORM N-163