Enlarge image

Clear Form

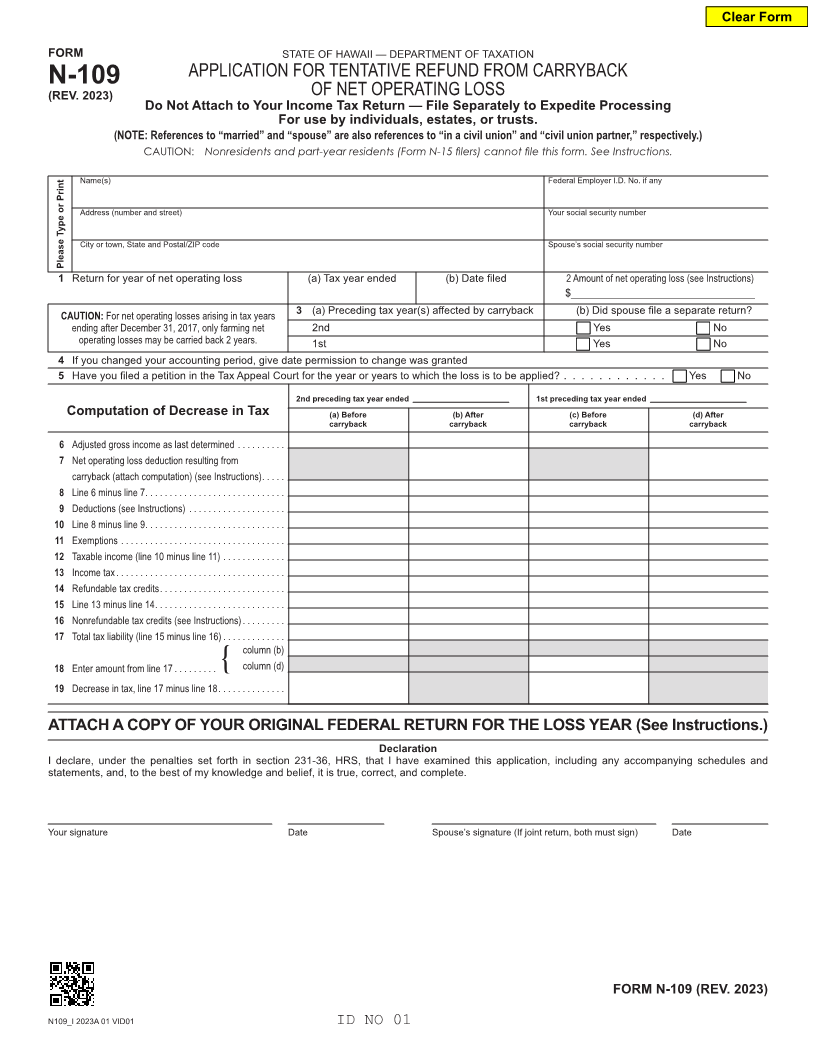

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR TENTATIVE REFUND FROM CARRYBACK

N-109

(REV. 2023) OF NET OPERATING LOSS

Do Not Attach to Your Income Tax Return — File Separately to Expedite Processing

For use by individuals, estates, or trusts.

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

CAUTION: Nonresidents and part-year residents (Form N-15 filers) cannot file this form. See Instructions.

Name(s) Federal Employer I.D. No. if any

Address (number and street) Your social security number

City or town, State and Postal/ZIP code Spouse’s social security number

Please Type or Print

1 Return for year of net operating loss (a) Tax year ended (b) Date filed 2 Amount of net operating loss (see Instructions)

$_______________________________

CAUTION: For net operating losses arising in tax years 3 (a) Preceding tax year(s) affected by carryback (b) Did spouse file a separate return?

ending after December 31, 2017, only farming net 2nd Yes No

operating losses may be carried back 2 years . 1st Yes No

4 If you changed your accounting period, give date permission to change was granted

5 Have you filed a petition in the Tax Appeal Court for the year or years to which the loss is to be applied? . . . . . . . . . . . . Yes No

2nd preceding tax year ended 1st preceding tax year ended

Computation of Decrease in Tax (a) Before (b) After (c) Before (d) After

carryback carryback carryback carryback

6 Adjusted gross income as last determined . . . . . . . . . .

7 Net operating loss deduction resulting from

carryback (attach computation) (see Instructions) . . . . .

8 Line 6 minus line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Deductions (see Instructions) . . . . . . . . . . . . . . . . . . . .

10 Line 8 minus line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Taxable income (line 10 minus line 11) . . . . . . . . . . . . .

13 Income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 Refundable tax credits . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Line 13 minus line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Nonrefundable tax credits (see Instructions) . . . . . . . . .

17 Total tax liability (line 15 minus line 16) . . . . . . . . . . . . .

column (b)

18 Enter amount from line 17 . . . . . . . . . { column (d)

19 Decrease in tax, line 17 minus line 18 . . . . . . . . . . . . . .

ATTACH A COPY OF YOUR ORIGINAL FEDERAL RETURN FOR THE LOSS YEAR (See Instructions.)

Declaration

I declare, under the penalties set forth in section 231-36, HRS, that I have examined this application, including any accompanying schedules and

statements, and, to the best of my knowledge and belief, it is true, correct, and complete.

Your signature Date Spouse’s signature (If joint return, both must sign) Date

FORM N-109 (REV. 2023)

N109_I 2023A 01 VID01 ID NO 01