Enlarge image

Clear Form

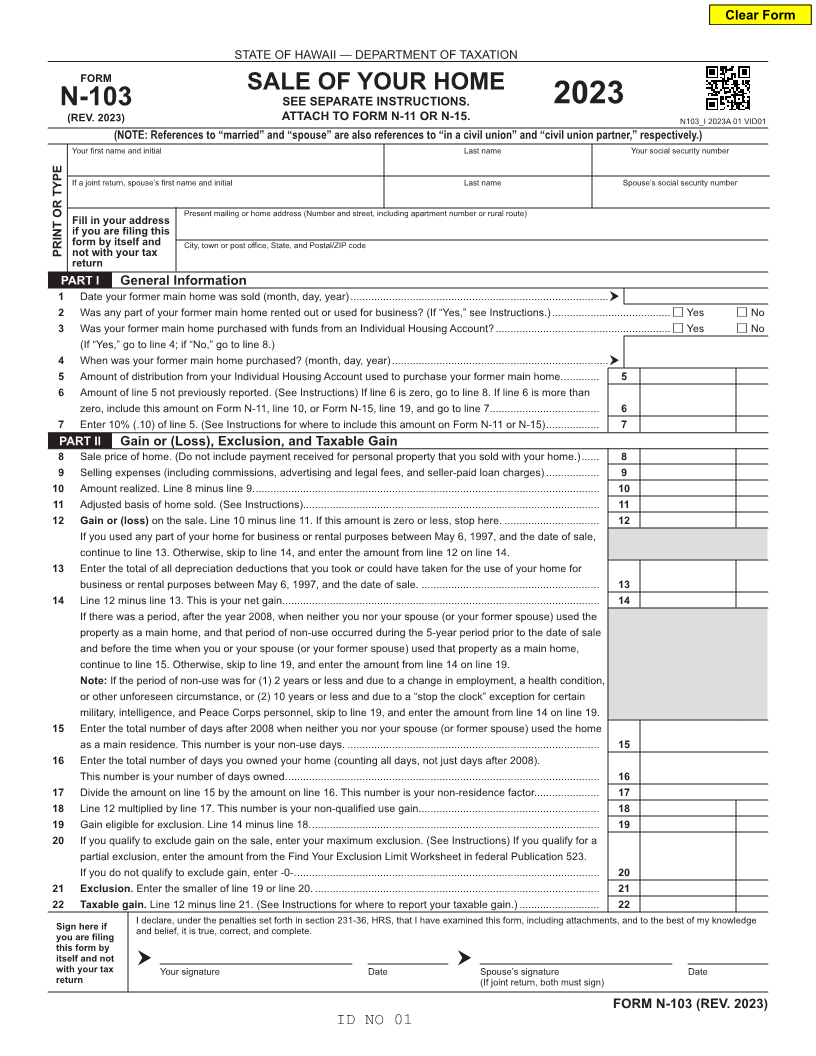

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

SALE OF YOUR HOME

N-103 SEE SEPARATE INSTRUCTIONS. 2023

(REV. 2023) ATTACH TO FORM N-11 OR N-15. N103_I 2023A 01 VID01

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Present mailing or home address (Number and street, including apartment number or rural route)

Fill in your address

if you are filing this

form by itself and

PRINT OR TYPE not with your tax City, town or post office, State, and Postal/ZIP code

return

PART I General Information

1 Date your former main home was sold (month, day, year) .......................................................................................

2 Was any part of your former main home rented out or used for business? (If “Yes,” see Instructions.) ........................................ Yes No

3 Was your former main home purchased with funds from an Individual Housing Account? ........................................................... Yes No

(If “Yes,” go to line 4; if “No,” go to line 8.)

4 When was your former main home purchased? (month, day, year) .........................................................................

5 Amount of distribution from your Individual Housing Account used to purchase your former main home. ............ 5

6 Amount of line 5 not previously reported. (See Instructions) If line 6 is zero, go to line 8. If line 6 is more than

zero, include this amount on Form N-11, line 10, or Form N-15, line 19, and go to line 7. .................................... 6

7 Enter 10% (.10) of line 5. (See Instructions for where to include this amount on Form N-11 or N-15) .................. 7

PART II Gain or (Loss), Exclusion, and Taxable Gain

8 Sale price of home. (Do not include payment received for personal property that you sold with your home.) ...... 8

9 Selling expenses (including commissions, advertising and legal fees, and seller-paid loan charges) .................. 9

10 Amount realized. Line 8 minus line 9. .................................................................................................................... 10

11 Adjusted basis of home sold. (See Instructions).................................................................................................... 11

12 Gain or (loss)on the sale Line. 10 minus line 11. If this amount is zero or less, stop here. ................................ 12

If you used any part of your home for business or rental purposes between May 6, 1997, and the date of sale,

continue to line 13. Otherwise, skip to line 14, and enter the amount from line 12 on line 14.

13 Enter the total of all depreciation deductions that you took or could have taken for the use of your home for

business or rental purposes between May 6, 1997, and the date of sale. ............................................................ 13

14 Line 12 minus line 13. This is your net gain. .......................................................................................................... 14

If there was a period, after the year 2008, when neither you nor your spouse (or your former spouse) used the

property as a main home, and that period of non-use occurred during the 5-year period prior to the date of sale

and before the time when you or your spouse (or your former spouse) used that property as a main home,

continue to line 15. Otherwise, skip to line 19, and enter the amount from line 14 on line 19.

Note: If the period of non-use was for (1) 2 years or less and due to a change in employment, a health condition,

or other unforeseen circumstance, or (2) 10 years or less and due to a “stop the clock” exception for certain

military, intelligence, and Peace Corps personnel, skip to line 19, and enter the amount from line 14 on line 19.

15 Enter the total number of days after 2008 when neither you nor your spouse (or former spouse) used the home

as a main residence. This number is your non-use days. ..................................................................................... 15

16 Enter the total number of days you owned your home (counting all days, not just days after 2008).

This number is your number of days owned. ......................................................................................................... 16

17 Divide the amount on line 15 by the amount on line 16. This number is your non-residence factor. ..................... 17

18 Line 12 multiplied by line 17. This number is your non-qualified use gain. ............................................................ 18

19 Gain eligible for exclusion. Line 14 minus line 18. ................................................................................................. 19

20 If you qualify to exclude gain on the sale, enter your maximum exclusion. (See Instructions) If you qualify for a

partial exclusion, enter the amount from the Find Your Exclusion Limit Worksheet in federal Publication 523.

If you do not qualify to exclude gain, enter -0-. ...................................................................................................... 20

21 Exclusion. Enter the smaller of line 19 or line 20. ................................................................................................ 21

22 Taxable gain. Line 12 minus line 21. (See Instructions for where to report your taxable gain.) ........................... 22

I declare, under the penalties set forth in section 231-36, HRS, that I have examined this form, including attachments, and to the best of my knowledge

Sign here if and belief, it is true, correct, and complete.

you are filing

this form by

itself and not

with your tax Your signature Date Spouse’s signature Date

return (If joint return, both must sign)

FORM N-103 (REV. 2023)

ID NO 01