Enlarge image

Clear Form

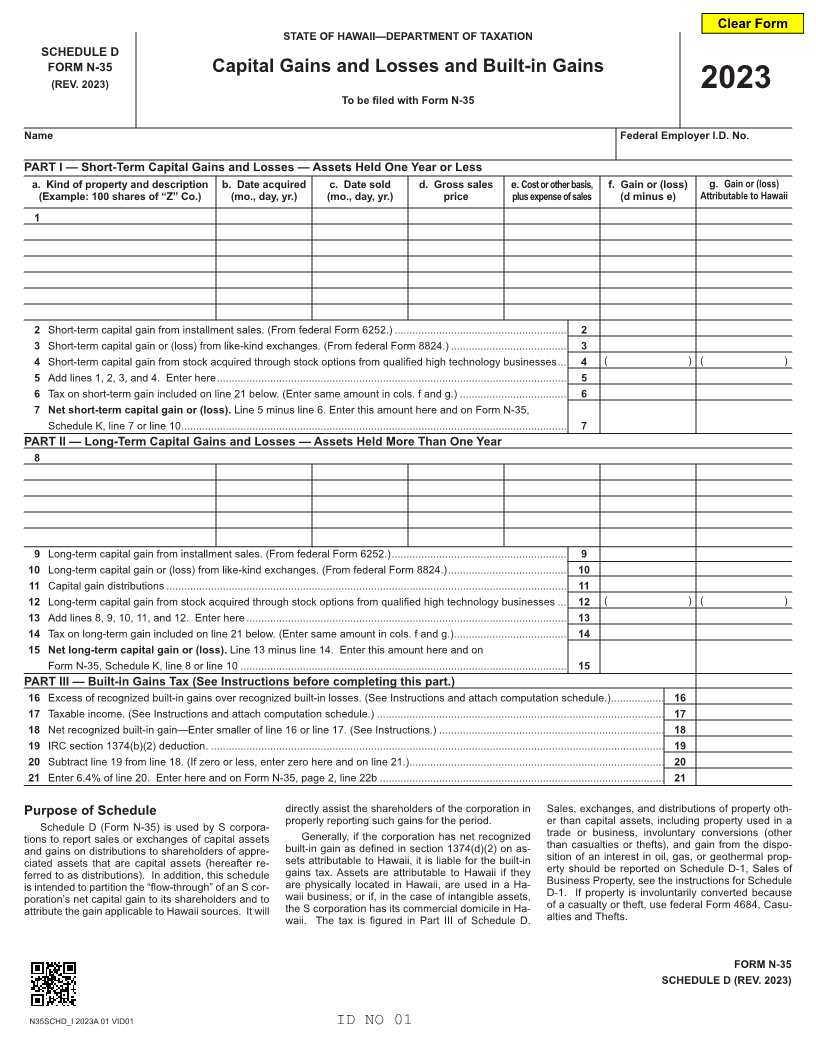

STATE OF HAWAII—DEPARTMENT OF TAXATION

SCHEDULE D

FORM N-35 Capital Gains and Losses and Built-in Gains

(REV. 2023)

2023

To be filed with Form N-35

Name Federal Employer I.D. No.

PART I — Short-Term Capital Gains and Losses — Assets Held One Year or Less

a. Kind of property and description b. Date acquired c. Date sold d. Gross sales e. Cost or other basis, f. Gain or (loss) g. Gain or (loss)

(Example: 100 shares of “Z” Co.) (mo., day, yr.) (mo., day, yr.) price plus expense of sales (d minus e) Attributable to Hawaii

1

2 Short-term capital gain from installment sales. (From federal Form 6252.) .......................................................... 2

3 Short-term capital gain or (loss) from like-kind exchanges. (From federal Form 8824.) ....................................... 3

4 Short-term capital gain from stock acquired through stock options from qualified high technology businesses ... 4 ( ) ( )

5 Add lines 1, 2, 3, and 4. Enter here ...................................................................................................................... 5

6 Tax on short-term gain included on line 21 below. (Enter same amount in cols. f and g.) .................................... 6

7 Net short-term capital gain or (loss). Line 5 minus line 6. Enter this amount here and on Form N-35,

Schedule K, line 7 or line 10 .................................................................................................................................. 7

PART II — Long-Term Capital Gains and Losses — Assets Held More Than One Year

8

9 Long-term capital gain from installment sales. (From federal Form 6252.) ........................................................... 9

10 Long-term capital gain or (loss) from like-kind exchanges. (From federal Form 8824.) ........................................ 10

11 Capital gain distributions ....................................................................................................................................... 11

12 Long-term capital gain from stock acquired through stock options from qualified high technology businesses ... 12 ( ) ( )

13 Add lines 8, 9, 10, 11, and 12. Enter here ............................................................................................................ 13

14 Tax on long-term gain included on line 21 below. (Enter same amount in cols. f and g.) ...................................... 14

15 Net long-term capital gain or (loss). Line 13 minus line 14. Enter this amount here and on

Form N-35, Schedule K, line 8 or line 10 .............................................................................................................. 15

PART III — Built-in Gains Tax (See Instructions before completing this part.)

16 Excess of recognized built-in gains over recognized built-in losses. (See Instructions and attach computation schedule.) .................. 16

17 Taxable income. (See Instructions and attach computation schedule.) ................................................................................................. 17

18 Net recognized built-in gain—Enter smaller of line 16 or line 17. (See Instructions.) ............................................................................ 18

19 IRC section 1374(b)(2) deduction. ......................................................................................................................................................... 19

20 Subtract line 19 from line 18. (If zero or less, enter zero here and on line 21.) ...................................................................................... 20

21 Enter 6.4% of line 20. Enter here and on Form N-35, page 2, line 22b ................................................................................................ 21

Purpose of Schedule directly assist the shareholders of the corporation in Sales, exchanges, and distributions of property oth-

properly reporting such gains for the period. er than capital assets, including property used in a

Schedule D (Form N-35) is used by S corpora- trade or business, involuntary conversions (other

tions to report sales or exchanges of capital assets Generally, if the corporation has net recognized

and gains on distributions to shareholders of appre- built-in gain as defined in section 1374(d)(2) on as- than casualties or thefts), and gain from the dispo-

ciated assets that are capital assets (hereafter re- sets attributable to Hawaii, it is liable for the built-in sition of an interest in oil, gas, or geothermal prop-

ferred to as distributions). In addition, this schedule gains tax. Assets are attributable to Hawaii if they erty should be reported on Schedule D-1, Sales of

is intended to partition the “flow-through” of an S cor- are physically located in Hawaii, are used in a Ha- Business Property, see the instructions for Schedule

poration’s net capital gain to its shareholders and to waii business, or if, in the case of intangible assets, D-1. If property is involuntarily converted because

attribute the gain applicable to Hawaii sources. It will the S corporation has its commercial domicile in Ha- of a casualty or theft, use federal Form 4684, Casu-

waii. The tax is figured in Part III of Schedule D. alties and Thefts.

FORM N-35

SCHEDULE D (REV. 2023)

N35SCHD_I 2023A 01 VID01 ID NO 01