Enlarge image

Clear Form

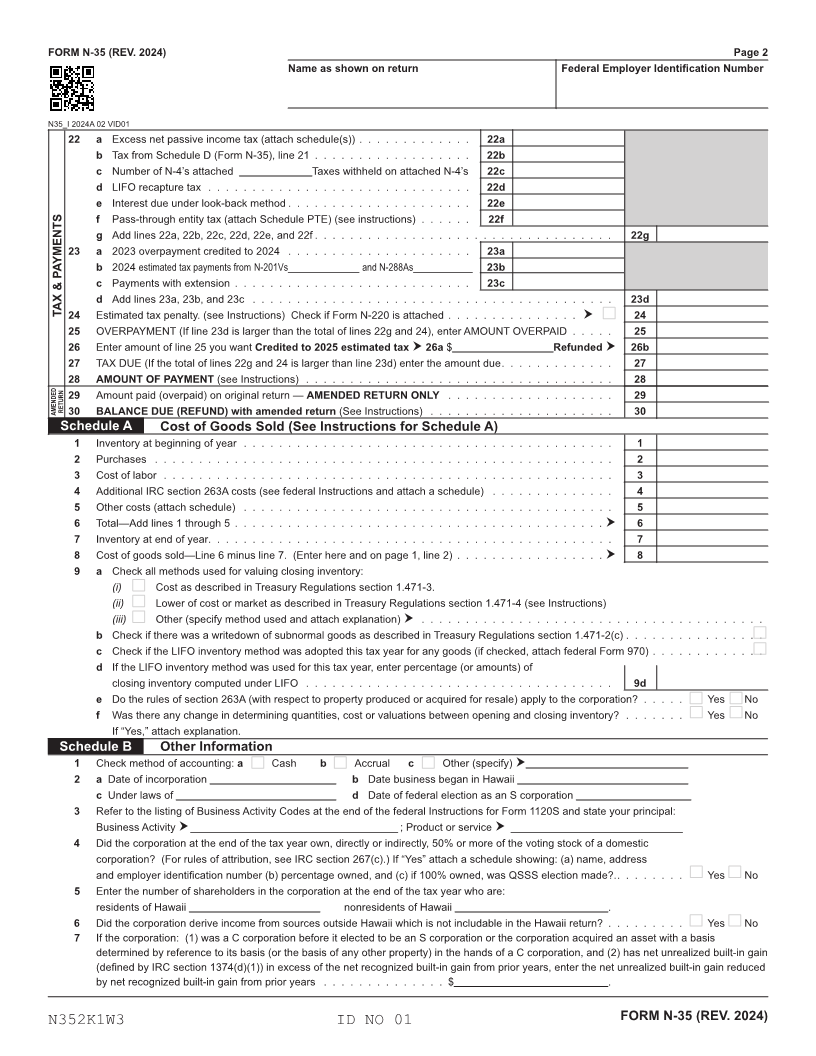

STATE OF HAWAII—DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMP

FORM

S CORPORATION INCOME TAX RETURN

N-35

(REV. 2024)

For calendar year

2024

or other tax year beginning ___________________, 2024

and ending _________________ , 20 ________

N35_I 2024A 01 VID01 AMENDED Return (Attach Sch AMD)

Name Federal Employer I.D. No.

Dba or C/O Business Activity Code (Use code shown on federal Form 1120S)

Mailing Address (number and street) Hawaii Tax I.D. No.

PRINT OR TYPE City or town, State, and Postal/ZIP Code. If foreign address, see Instructions. Enter the number of Schedules NS

attached to this return

Check applicable boxes: (1) Initial Return (2) Final Return (3) S Election Termination or Revocation

(4) Name Change (5) IRS Adjustment (6) Electing PTE (Attach Sch PTE)

Is the corporation electing to be an S corporation beginning with this tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

How many months in 2024 was this corporation in operation?_____ Was this corporation in operation at the end of 2024? . . Yes No

CAUTION: Include only trade or business income and expenses on lines 1a through 20. See Instructions for more information.

1 a Gross receipts or sales (see Instructions). . . . . . . . . . . . . . . . . . . 1a

b Returns and allowances. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

c Line 1a minus line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

2 Cost of goods sold (Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Gross profit (line 1c minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

INCOME

4 Net gain or (loss) from Schedule D-1, Part II, line 19 (attach Schedule D-1) . . . . . . . . . . . . . . . . . . . 4

5 Other income (see Instructions) (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 TOTAL income (loss) — Add lines 3 through 5 and enter here . . . . . . . . . . . . . . . . . . . . . . . 6

7 Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Salaries and wages (less employment credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Bad debts (see Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Attach Forms N-4 and Payment Here 11 Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Taxes and licenses (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Depreciation from federal Form 4562 not claimed elsewhere on return (see Instructions) . . . . . . . . . . . 14

15 Depletion (Do not deduct oil and gas depletion. See Instructions.) . . . . . . . . . . . . . . . . . . . . . . . 15

DEDUCTIONS 16 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Pension, profit-sharing, etc. plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Other deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 TOTAL deductions — Add lines 7 through 19 and enter here . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Ordinary income (loss) from trade or business activities — line 6 minus line 20 (To Sch. K, line 1) . . . . . . . 21

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined

by me and, to the best of my knowledge and belief, is true, correct, and complete, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter

235, HRS. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of officer Date Type or print name and title of officer

May the Hawaii Department of Taxation discuss this return with the preparer shown below? . . . . . . . . . . . . Yes No

Please Sign Here (See page 3 of the Instructions) This designation does not replace Form N-848, Power of Attorney.

Preparer’s Signature Date PTIN

Check if

Paid Print Preparer’s Name self-employed

Preparer’s Firm’s name (or Federal

Information E.I. No.

yours if self-employed)

Address and Postal/ZIP Code Phone no.

N351K1W3 ID NO 01 FORM N-35 (REV. 2024)