Enlarge image

Clear Form

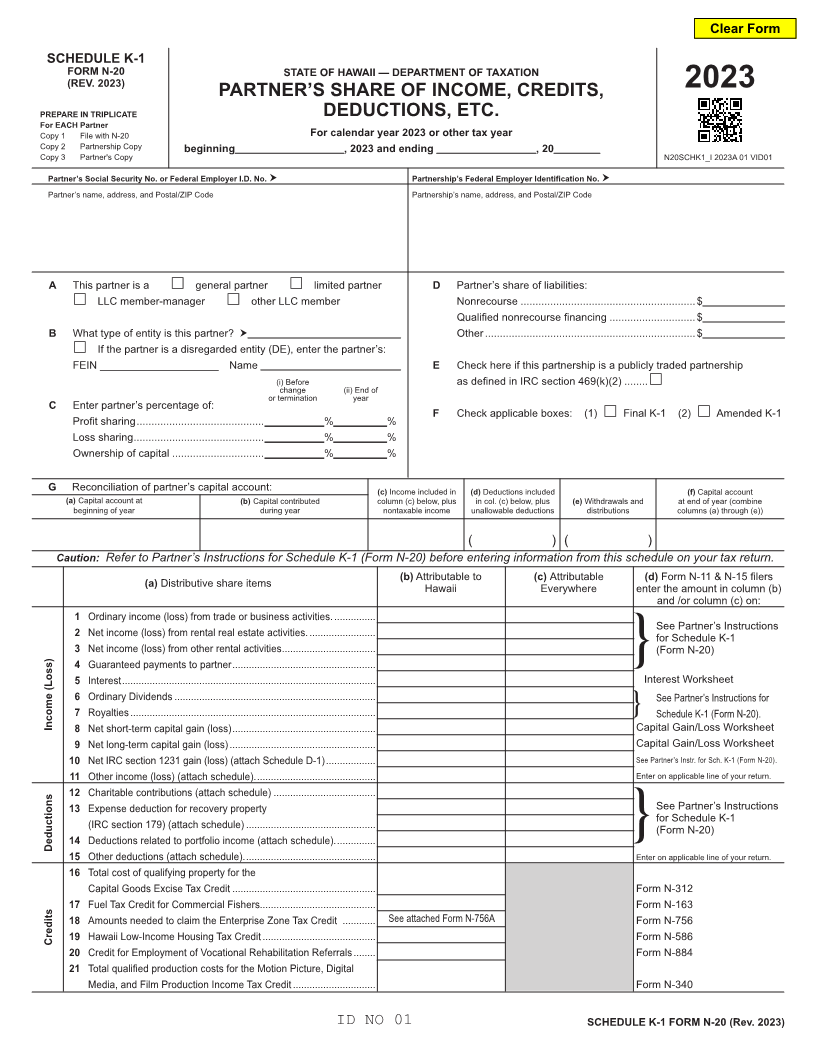

SCHEDULE K-1

FORM N-20 STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2023)

PARTNER’S SHARE OF INCOME, CREDITS, 2023

PREPARE IN TRIPLICATE DEDUCTIONS, ETC.

For EACH Partner

Copy 1 File with N-20 For calendar year 2023 or other tax year

Copy 2 Partnership Copy beginning , 2023 and ending , 20

Copy 3 Partner's Copy N20SCHK1_I 2023A 01 VID01

Partner’s Social Security No. or Federal Employer I.D. No. Partnership’s Federal Employer Identification No.

Partner’s name, address, and Postal/ZIP Code Partnership’s name, address, and Postal/ZIP Code

A This partner is a general partner limited partner D Partner’s share of liabilities:

LLC member-manager other LLC member Nonrecourse ...........................................................$

Qualified nonrecourse financing .............................$

B What type of entity is this partner? Other .......................................................................$

If the partner is a disregarded entity (DE), enter the partner’s:

FEIN ____________________ Name E Check here if this partnership is a publicly traded partnership

(i) Before as defined in IRC section 469(k)(2) ........

change (ii) End of

or termination year

C Enter partner’s percentage of:

F Check applicable boxes: (1) Final K-1 (2) Amended K-1

Profit sharing ...........................................__________%_________%

Loss sharing ............................................__________%_________%

Ownership of capital ...............................__________%_________%

G Reconciliation of partner’s capital account: (c) Income included in (d) Deductions included (f) Capital account

(a) Capital account at (b) Capital contributed column (c) below, plus in col. (c) below, plus (e) Withdrawals and at end of year (combine

beginning of year during year nontaxable income unallowable deductions distributions columns (a) through (e))

( ) ( )

Caution: Refer to Partner’s Instructions for Schedule K-1 (Form N-20) before entering information from this schedule on your tax return.

(a) Distributive share items (b) Attributable to (c) Attributable (d) Form N-11 & N-15 filers

Hawaii Everywhere enter the amount in column (b)

and /or column (c) on:

1Ordinary income (loss) from trade or business activities. ...............

See Partner’s Instructions

2Net income (loss) from rental real estate activities. ........................ for Schedule K-1

3Net income (loss) from other rental activities .................................. (Form N-20)

4Guaranteed payments to partner .................................................... }

5Interest ............................................................................................ Interest Worksheet

6Ordinary Dividends ......................................................................... See Partner’s Instructions for

7 Royalties ......................................................................................... } Schedule K-1 (Form N-20).

Income 8Net(Loss)short-term capital gain (loss) .................................................... Capital Gain/Loss Worksheet

9Net long-term capital gain (loss) ..................................................... Capital Gain/Loss Worksheet

10 Net IRC section 1231 gain (loss) (attach Schedule D-1) .................. See Partner’s Instr. for Sch. K-1 (Form N-20).

11Other income (loss) (attach schedule). ........................................... Enter on applicable line of your return.

12Charitable contributions (attach schedule) .....................................

13Expense deduction for recovery property See Partner’s Instructions

for Schedule K-1

(IRC section 179) (attach schedule) ............................................... (Form N-20)

Deductions 14Deductions related to portfolio income (attach schedule). .............. }

15 Other deductions (attach schedule). ............................................... Enter on applicable line of your return.

16Total cost of qualifying property for the

Capital Goods Excise Tax Credit .................................................... Form N-312

17Fuel Tax Credit for Commercial Fishers.......................................... Form N-163

18Amounts needed to claim the Enterprise Zone Tax Credit ............ See attached Form N-756A Form N-756

Credits 19Hawaii Low-Income Housing Tax Credit ......................................... Form N-586

20 Credit for Employment of Vocational Rehabilitation Referrals ........ Form N-884

21 Total qualified production costs for the Motion Picture, Digital

Media, and Film Production Income Tax Credit .............................. Form N-340

ID NO 01 SCHEDULE K-1 FORM N-20 (Rev. 2023)