Enlarge image

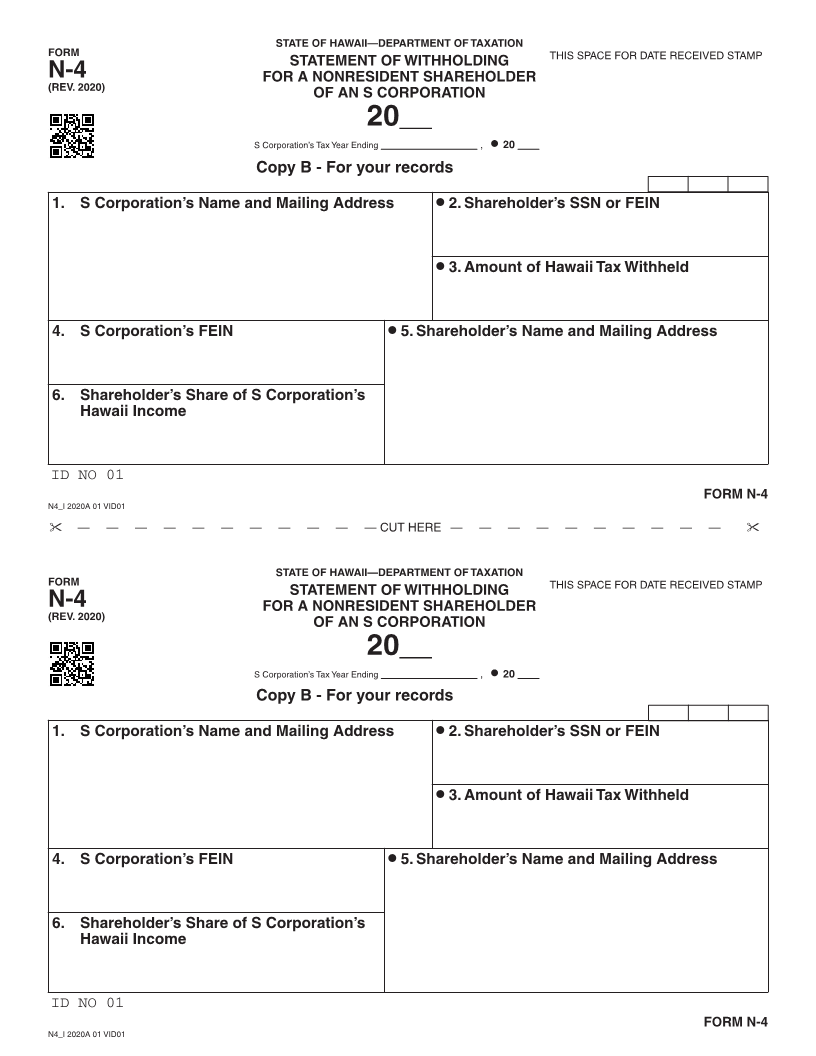

FORM STATE OF HAWAII—DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMPClear Form

STATEMENT OF WITHHOLDING

N-4 FOR A NONRESIDENT SHAREHOLDER

(REV. 2020)

OF AN S CORPORATION

20__

S Corporation’s Tax Year Ending , 20

Copy A - Attach to Form N-35

1. S Corporation’s Name and Mailing Address • 2. Shareholder’s SSN or FEIN

• 3. Amount of Hawaii Tax Withheld

4. S Corporation’s FEIN • 5. Shareholder’s Name and Mailing Address

6. Shareholder’s Share of S Corporation’s

Hawaii Income

ID NO 01 ATTACH TO THE FRONT OF FORM N-35 WHERE INDICATED

FORM N-4

N4_I 2020A 01 VID01

CUT HERE

FORM STATE OF HAWAII—DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMP

STATEMENT OF WITHHOLDING

N-4 FOR A NONRESIDENT SHAREHOLDER

(REV. 2020)

OF AN S CORPORATION

20__

S Corporation’s Tax Year Ending , 20

Copy A - Attach to Form N-35

1. S Corporation’s Name and Mailing Address • 2. Shareholder’s SSN or FEIN

• 3. Amount of Hawaii Tax Withheld

4. S Corporation’s FEIN • 5. Shareholder’s Name and Mailing Address

6. Shareholder’s Share of S Corporation’s

Hawaii Income

ID NO 01 ATTACH TO THE FRONT OF FORM N-35 WHERE INDICATED

FORM N-4

N4_I 2020A 01 VID01