Enlarge image

Clear Form

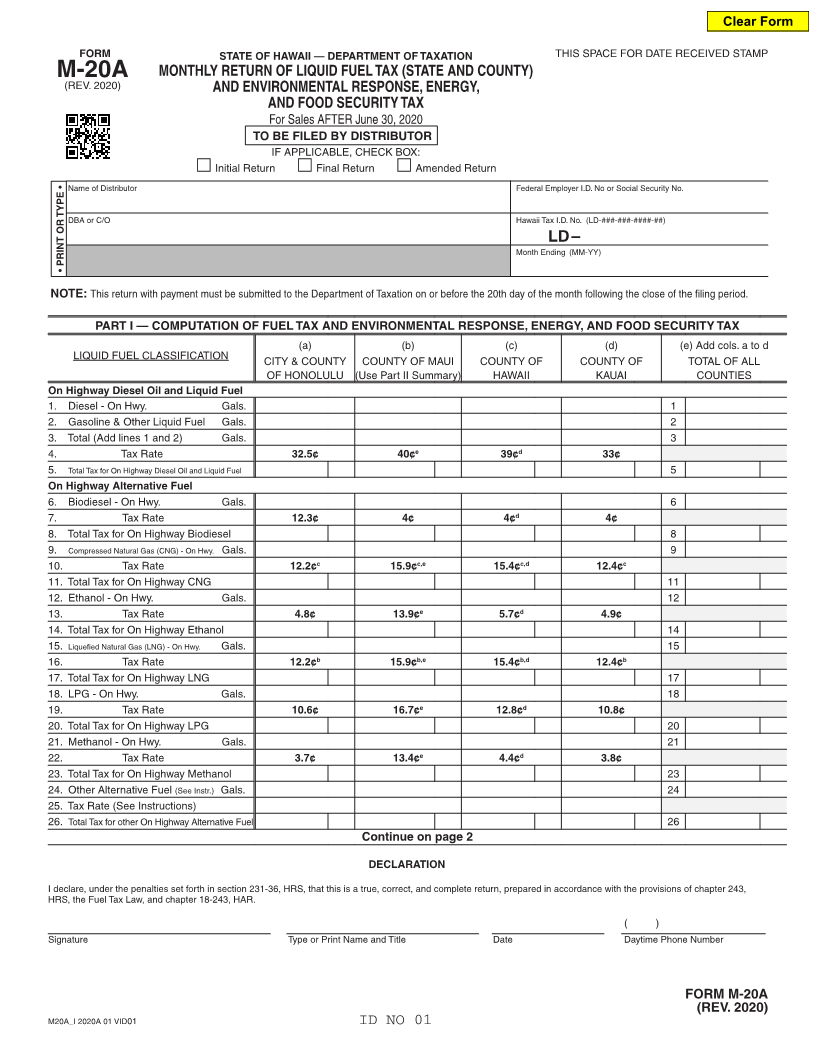

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMP

M-20A MONTHLY RETURN OF LIQUID FUEL TAX (STATE AND COUNTY)

(REV. 2020) AND ENVIRONMENTAL RESPONSE, ENERGY,

AND FOOD SECURITY TAX

For Sales AFTER June 30, 2020

TO BE FILED BY DISTRIBUTOR

IF APPLICABLE, CHECK BOX:

Initial Return Final Return Amended Return

Name of Distributor Federal Employer I.D. No or Social Security No.

DBA or C/O Hawaii Tax I.D. No. (LD-###-###-####-##)

LD –

Month Ending (MM-YY)

• PRINT OR TYPE •

NOTE: This return with payment must be submitted to the Department of Taxation on or before the 20th day of the month following the close of the filing period.

PART I — COMPUTATION OF FUEL TAX AND ENVIRONMENTAL RESPONSE, ENERGY, AND FOOD SECURITY TAX

(a) (b) (c) (d) (e) Add cols. a to d

LIQUID FUEL CLASSIFICATION CITY & COUNTY COUNTY OF MAUI COUNTY OF COUNTY OF TOTAL OF ALL

OF HONOLULU (Use Part II Summary) HAWAII KAUAI COUNTIES

On Highway Diesel Oil and Liquid Fuel

1. Diesel - On Hwy. Gals. 1

2. Gasoline & Other Liquid Fuel Gals. 2

3. Total (Add lines 1 and 2) Gals. 3

4. Tax Rate 32.5¢ 40¢e 39¢d 33¢

5. Total Tax for On Highway Diesel Oil and Liquid Fuel 5

On Highway Alternative Fuel

6. Biodiesel - On Hwy. Gals. 6

7. Tax Rate 12.3¢ 4¢ 4¢d 4¢

8. Total Tax for On Highway Biodiesel 8

9. Compressed Natural Gas (CNG) - On Hwy. Gals. 9

10. Tax Rate 12.2¢c 15.9¢c,e 15.4¢c,d 12.4¢c

11. Total Tax for On Highway CNG 11

12. Ethanol - On Hwy. Gals. 12

13. Tax Rate 4.8¢ 13.9¢e 5.7¢d 4.9¢

14. Total Tax for On Highway Ethanol 14

15. Liquefied Natural Gas (LNG) - On Hwy. Gals. 15

16. Tax Rate 12.2¢b 15.9¢b,e 15.4¢b,d 12.4¢b

17. Total Tax for On Highway LNG 17

18. LPG - On Hwy. Gals. 18

19. Tax Rate 10.6¢ 16.7¢e 12.8¢d 10.8¢

20. Total Tax for On Highway LPG 20

21. Methanol - On Hwy. Gals. 21

22. Tax Rate 3.7¢ 13.4¢e 4.4¢d 3.8¢

23. Total Tax for On Highway Methanol 23

24. Other Alternative Fuel (See Instr.) Gals. 24

25. Tax Rate (See Instructions)

26. Total Tax for other On Highway Alternative Fuel 26

Continue on page 2

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this is a true, correct, and complete return, prepared in accordance with the provisions of chapter 243,

HRS, the Fuel Tax Law, and chapter 18-243, HAR.

( )

Signature Type or Print Name and Title Date Daytime Phone Number

FORM M-20A

(REV. 2020)

M20A_I 2020A 01 VID01 ID NO 01