Enlarge image

Clear Form

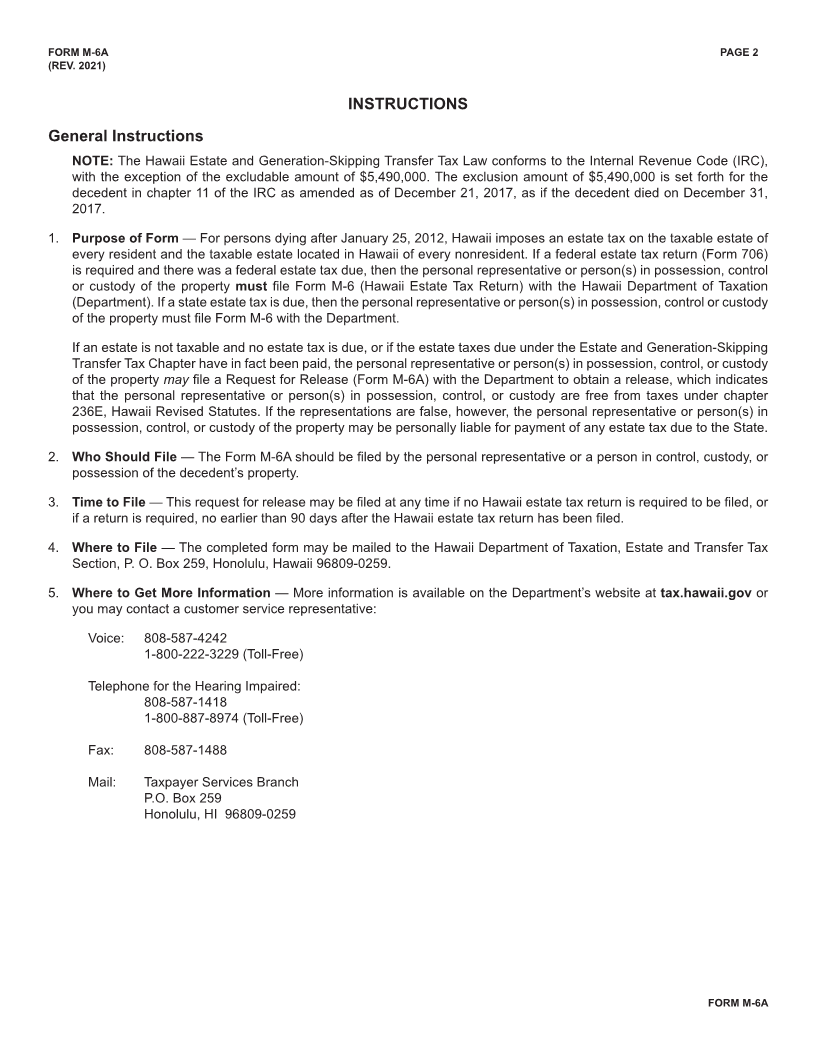

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION THIS SPACE FOR DATE RECEIVED STAMP

M-6A REQUEST FOR RELEASE

(REV. 2021) TO BE FILED FOR DECEDENTS

DYING AFTER JUNE 30, 1983

(NOTE: References to “married” and “spouse”

are also references to “in a civil union” and

“civil union partner,” respectively.)

Estate of Probate No.

Actual Place of Death Date of Death

Resident of Decedent’s Social Security Number

PRINT OR TYPE

If you were required to file a Hawaii estate tax return (Form M-6), attach a copy of the first page of the Form M-6,

as well as a copy of the first page of the federal estate tax return (Form 706) or similar statement.

Under the penalties of perjury, I, as of the above named estate, swear

(Personal Representative, surviving spouse, etc.)

that I have examined all assets and documents of this estate, and that to the best of my knowledge, information, and

belief (check one box):

No estate tax is imposed by the Estate and Generation-Skipping Transfer Tax Chapter and in fact no taxes

are due.

The estate taxes due under the Estate and Generation-Skipping Transfer Tax Chapter have been paid as

prescribed in section 236E-9, Hawaii Revised Statutes.

Signature of Personal Representative, surviving spouse, etc.

Print Name

Address:

Social Security Number

or

Identification Number

FORM M-6A (REV. 2021)

M6A_I 2021A 01 VID01 ID NO 01