Enlarge image

Clear Form

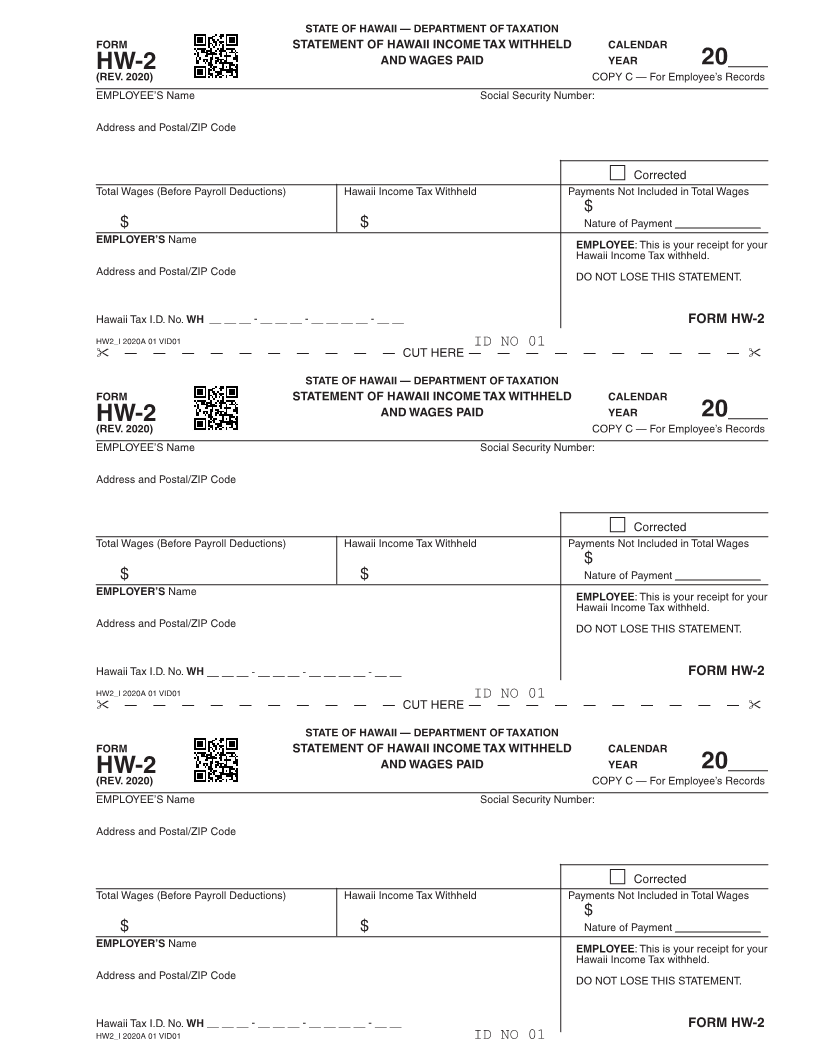

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM STATEMENT OF HAWAII INCOME TAX WITHHELD CALENDAR

AND WAGES PAID YEAR

HW-2 20___

(REV. 2020) COPY A — For Hawaii State Tax Collector

EMPLOYEE’S Name Social Security Number:

Address and Postal/ZIP Code

Corrected

Total Wages (Before Payroll Deductions) Hawaii Income Tax Withheld Payments Not Included in Total Wages

$

$ $ Nature of Payment

EMPLOYER’S Name

EMPLOYER: See Instructions

on reverse side.

Address and Postal/ZIP Code

Hawaii Tax I.D. No. WH __ __ __ - __ __ __ - __ __ __ __ - __ __ FORM HW-2

HW2_I 2020A 01 VID01

CUT HERE ID NO 01

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM STATEMENT OF HAWAII INCOME TAX WITHHELD CALENDAR

AND WAGES PAID YEAR

HW-2 20___

(REV. 2020) COPY A — For Hawaii State Tax Collector

EMPLOYEE’S Name Social Security Number:

Address and Postal/ZIP Code

Corrected

Total Wages (Before Payroll Deductions) Hawaii Income Tax Withheld Payments Not Included in Total Wages

$

$ $ Nature of Payment

EMPLOYER’S Name

EMPLOYER: See Instructions

on reverse side.

Address and Postal/ZIP Code

Hawaii Tax I.D. No. WH __ __ __ - __ __ __ - __ __ __ __ - __ __ FORM HW-2

HW2_I 2020A 01 VID01

CUT HERE ID NO 01

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM STATEMENT OF HAWAII INCOME TAX WITHHELD CALENDAR

AND WAGES PAID YEAR

HW-2 20___

(REV. 2020) COPY A — For Hawaii State Tax Collector

EMPLOYEE’S Name Social Security Number:

Address and Postal/ZIP Code

Corrected

Total Wages (Before Payroll Deductions) Hawaii Income Tax Withheld Payments Not Included in Total Wages

$

$ $ Nature of Payment

EMPLOYER’S Name

EMPLOYER: See Instructions

on reverse side.

Address and Postal/ZIP Code

Hawaii Tax I.D. No. WH __ __ __ - __ __ __ - __ __ __ __ - __ __ FORM HW-2

HW2_I 2020A 01 VID01 ID NO 01