Enlarge image

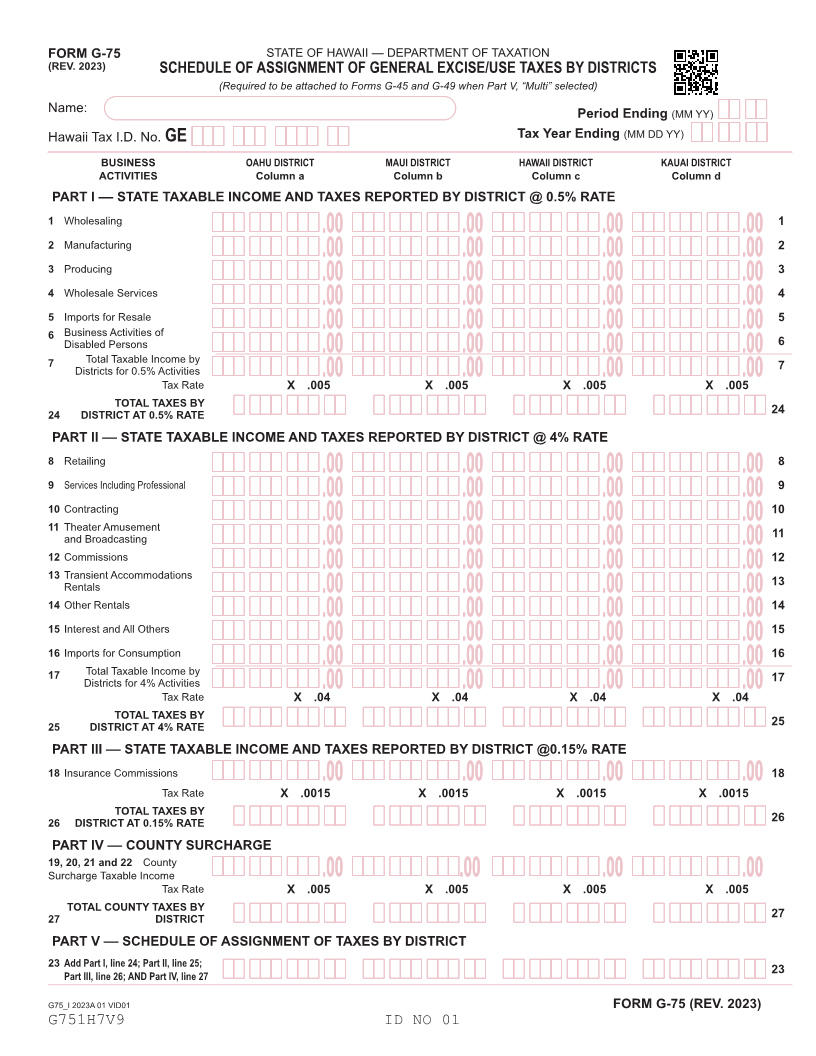

FORM G-75 STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2023) SCHEDULE OF ASSIGNMENT OF GENERAL EXCISE/USE TAXES BY DISTRICTS

(Required to be attached to Forms G-45 and G-49 when Part V, “Multi” selected)

Name: Period Ending (MM YY)

Hawaii Tax I.D. No. GE Tax Year Ending (MM DD YY)

BUSINESS OAHU DISTRICT MAUI DISTRICT HAWAII DISTRICT KAUAI DISTRICT

ACTIVITIES Column a Column b Column c Column d

PART I –– STATE TAXABLE INCOME AND TAXES REPORTED BY DISTRICT @ 0.5% RATE

1 Wholesaling 1

.00 .00 .00 .00 .00 .00 .00 .00

2 Manufacturing 2

.00 .00 .00 .00 .00 .00 .00 .00

3 Producing 3

.00 .00 .00 .00 .00 .00 .00 .00

4 Wholesale Services 4

.00 .00 .00 .00 .00 .00 .00 .00

5 Imports for Resale 5

6 Business Activities of .00 .00 .00 .00 .00 .00 .00 .00

Disabled Persons 6

7 Total Taxable Income by .00 .00 .00 .00 .00 .00 .00 .00

Districts for 0.5% Activities 7

.00 .00 .00 .00 .00 .00 .00 .00

Tax Rate X .005 X .005 X .005 X .005

TOTAL TAXES BY

24 DISTRICT AT 0.5% RATE 24

PART II –– STATE TAXABLE INCOME AND TAXES REPORTED BY DISTRICT @ 4% RATE

8 Retailing 8

.00 .00 .00 .00 .00 .00 .00 .00

9 Services Including Professional 9

.00 .00 .00 .00 .00 .00 .00 .00

10 Contracting 10

11 Theater Amusement .00 .00 .00 .00 .00 .00 .00 .00

and Broadcasting 11

.00 .00 .00 .00 .00 .00 .00 .00

12 Commissions 12

13 Transient Accommodations .00 .00 .00 .00 .00 .00 .00 .00

Rentals 13

.00 .00 .00 .00 .00 .00 .00 .00

14 Other Rentals 14

.00 .00 .00 .00 .00 .00 .00 .00

15 Interest and All Others 15

.00 .00 .00 .00 .00 .00 .00 .00

16 Imports for Consumption 16

17 Total Taxable Income by .00 .00 .00 .00 .00 .00 .00 .00

Districts for 4% Activities 17

.00 .00 .00 .00 .00 .00 .00 .00

Tax Rate X .04 X .04 X .04 X .04

TOTAL TAXES BY

25 DISTRICT AT 4% RATE 25

PART III –– STATE TAXABLE INCOME AND TAXES REPORTED BY DISTRICT @0.15% RATE

18 Insurance Commissions 18

.00 .00 .00 .00 .00 .00 .00 .00

Tax Rate X .0015 X .0015 X .0015 X .0015

TOTAL TAXES BY

26 DISTRICT AT 0.15% RATE 26

PART IV –– COUNTY SURCHARGE

19, 20, 21 and 22 County

Surcharge Taxable Income .00 .00 .00 .00 .00 .00 .00 .00

Tax Rate X .005 X .005 X .005 X .005

TOTAL COUNTY TAXES BY

27 DISTRICT 27

PART V –– SCHEDULE OF ASSIGNMENT OF TAXES BY DISTRICT

23 Add Part I, line 24; Part II, line 25;

Part III, line 26; AND Part IV, line 27 23

G75_I 2023A 01 VID01 FORM G-75 (REV. 2023)

G751H7V9 ID NO 01