Enlarge image

Clear Form

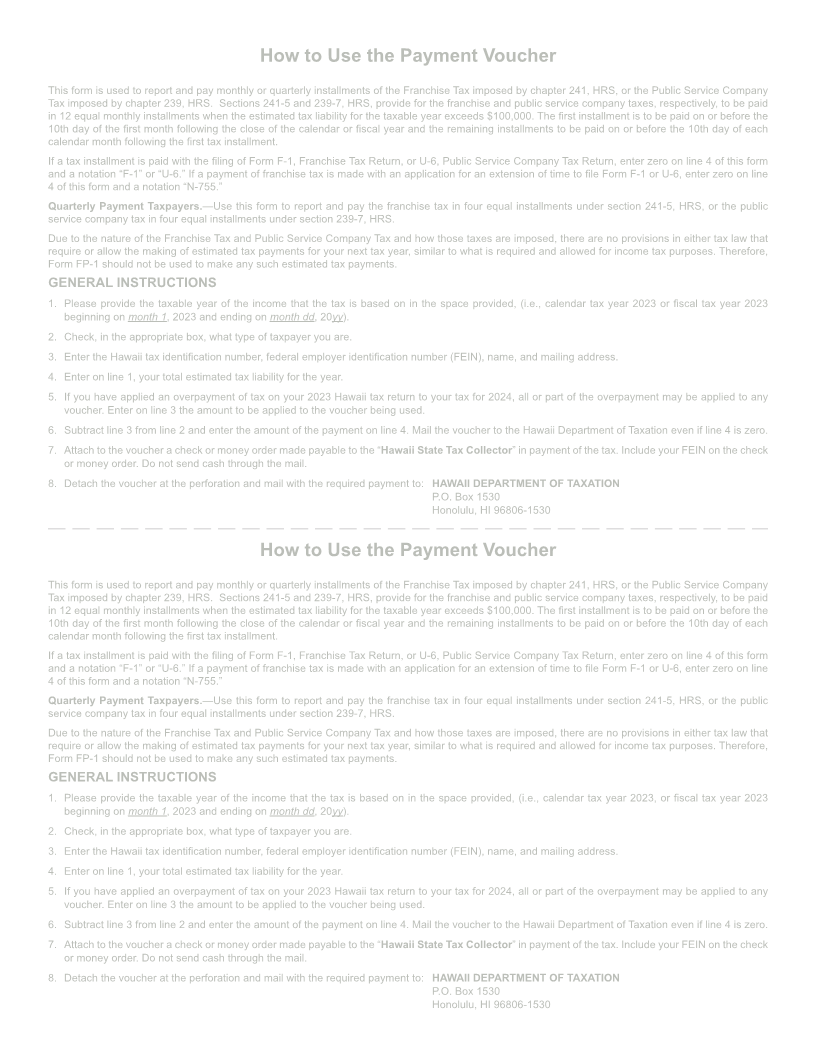

Form FP-1 STATE OF HAWAII — DEPARTMENT OF TAXATION DO NOT WRITE OR STAPLE IN THIS SPACE

(REV. 2023) FRANCHISE TAX OR

PUBLIC SERVICE COMPANY TAX

2024 INSTALLMENT PAYMENT VOUCHER

Based on income for calendar tax year 2023, or fiscal tax year 2023

beginning on _______________, 2023 and ending on _______________, 20 _______

Check one: Franchise Tax Public Service Company Tax Payment Number 2

Hawaii Tax I.D. No. Federal Employer I.D. No.

_ _ - _ _ _ - _ _ _ - _ _ _ _ - _ _ 1. Estimated tax liability for the year .............. $

Name

2. Amount of this installment ......................... $

DBA (if any) 3. Amount of any unused overpayment

credit to be applied .................................... $

Mailing Address (number and street) 4. Amount of this payment.

PRINT OR TYPE (Line 2 minus line 3.) ................................. $

City, State, and Postal/ZIP Code MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE

TO “HAWAII STATE TAX COLLECTOR.”

Write your Federal Employer I.D. Number on your check or money order.

DUE DATES FOR MONTHLY PAYMENTS:

Payment due on or before February 10, 2024, for calendar year taxpayers

and on or before the 10th day of the second month after the close of the

-MAILING ADDRESS- fiscal year for fiscal year taxpayers.

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1530

HONOLULU, HI 96806-1530

FP1_I 2023A 02 VID01

See Instructions on the reverse side.

ID NO 01 Form FP-1

CUT HERE

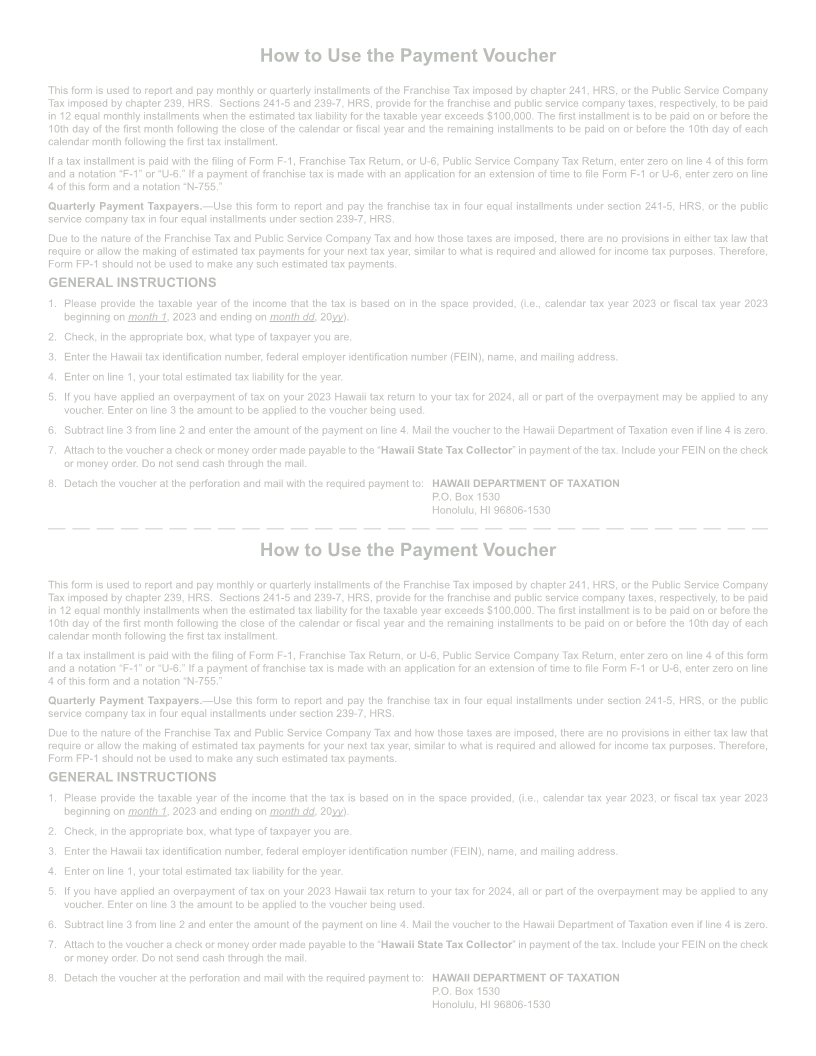

Form FP-1 STATE OF HAWAII — DEPARTMENT OF TAXATION DO NOT WRITE OR STAPLE IN THIS SPACE

(REV. 2023) FRANCHISE TAX OR

PUBLIC SERVICE COMPANY TAX

2024 INSTALLMENT PAYMENT VOUCHER

Based on income for calendar tax year 2023, or fiscal tax year 2023

beginning on _______________, 2023 and ending on _______________, 20 _______

Check one: Franchise Tax Public Service Company Tax Payment Number 1

Hawaii Tax I.D. No. Federal Employer I.D. No.

_ _ - _ _ _ - _ _ _ - _ _ _ _ - _ _ 1. Estimated tax liability for the year .............. $

Name

2. Amount of this installment ......................... $

DBA (if any) 3. Amount of any unused overpayment

credit to be applied .................................... $

Mailing Address (number and street) 4. Amount of this payment.

PRINT OR TYPE (Line 2 minus line 3.) ................................. $

City, State, and Postal/ZIP Code MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE

TO “HAWAII STATE TAX COLLECTOR.”

Write your Federal Employer I.D. Number on your check or money order.

DUE DATES FOR MONTHLY PAYMENTS:

Payment due on or before January 10, 2024, for calendar year taxpayers

and on or before the 10th day of the first month after the close of the fiscal

-MAILING ADDRESS- year for fiscal year taxpayers.

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1530

HONOLULU, HI 96806-1530

FP1_I 2023A 01 VID01

See Instructions on the reverse side.

ID NO 01 Form FP-1