Enlarge image

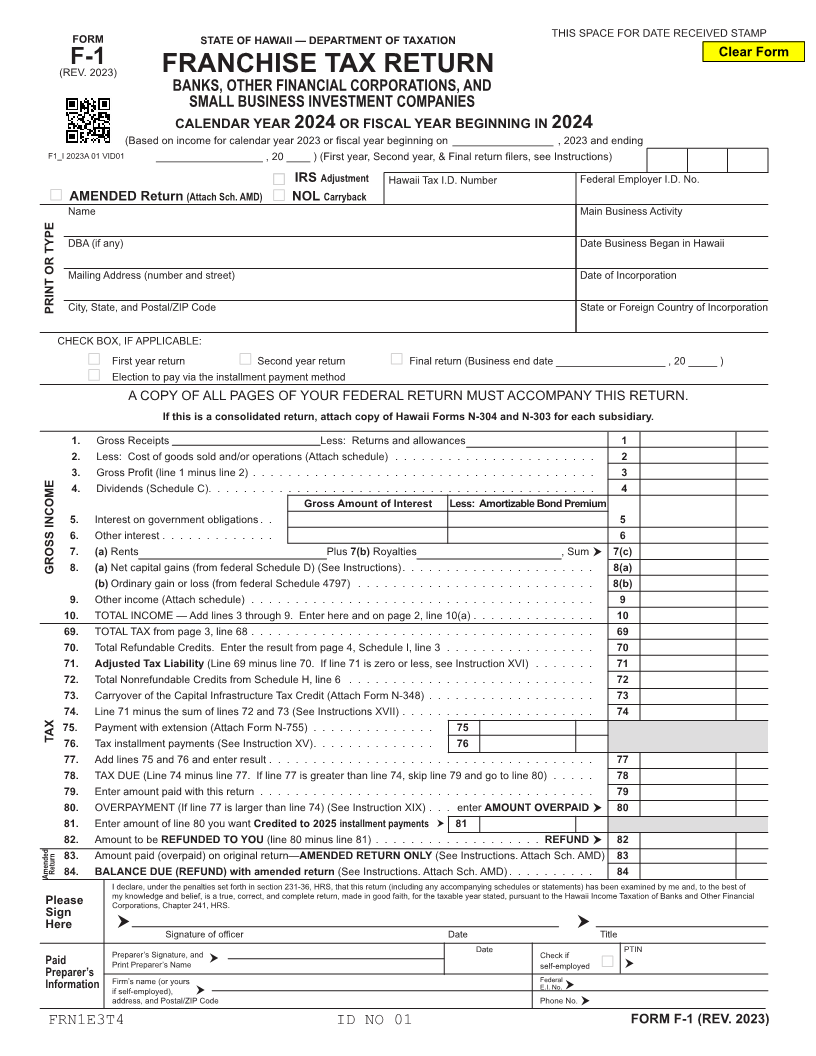

THIS SPACE FOR DATE RECEIVED STAMP

FORM STATE OF HAWAII — DEPARTMENT OF TAXATION

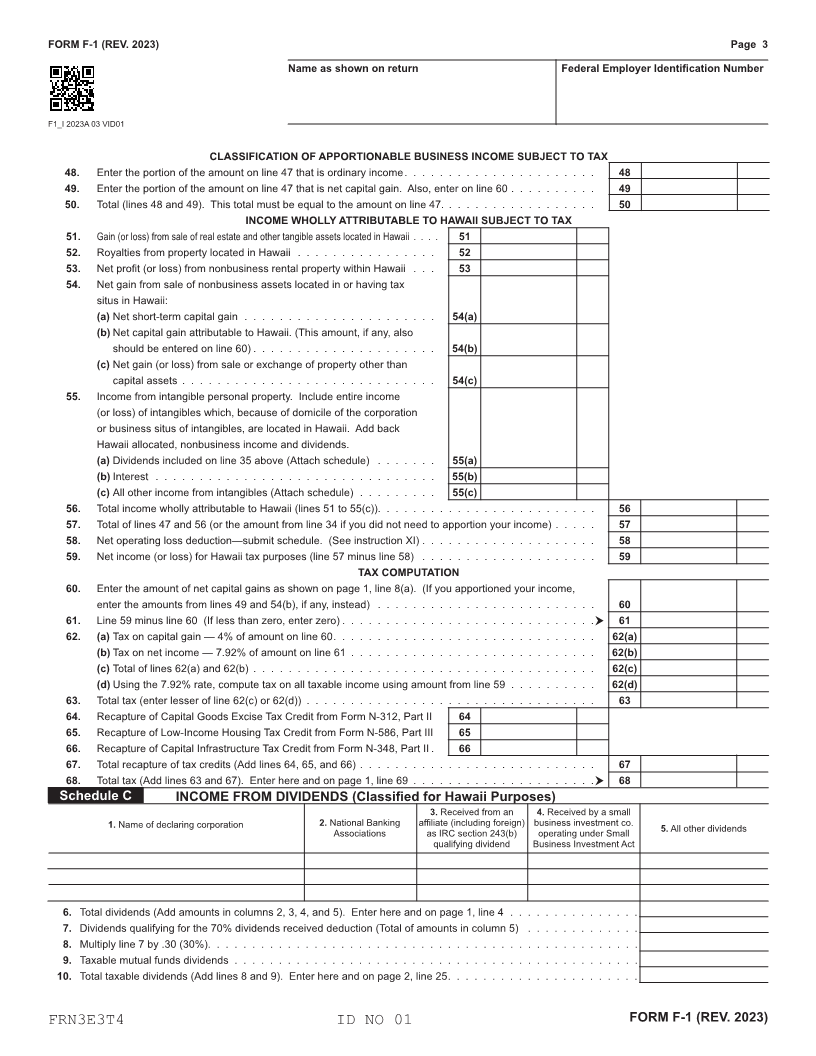

Clear Form

F-1

(REV. 2023) FRANCHISE TAX RETURN

BANKS, OTHER FINANCIAL CORPORATIONS, AND

SMALL BUSINESS INVESTMENT COMPANIES

CALENDAR YEAR 2024 OR FISCAL YEAR BEGINNING IN 2024

(Based on income for calendar year 2023 or fiscal year beginning on _________________ , 2023 and ending

F1_I 2023A 01 VID01 __________________ , 20 ____ ) (First year, Second year, & Final return filers, see Instructions)

IRS Adjustment Hawaii Tax I.D. Number Federal Employer I.D. No.

AMENDED Return (Attach Sch. AMD) NOL Carryback

Name Main Business Activity

DBA (if any) Date Business Began in Hawaii

Mailing Address (number and street) Date of Incorporation

PRINT OR TYPE City, State, and Postal/ZIP Code State or Foreign Country of Incorporation

CHECK BOX, IF APPLICABLE:

First year return Second year return Final return (Business end date ___________________ , 20 _____ )

Election to pay via the installment payment method

A COPY OF ALL PAGES OF YOUR FEDERAL RETURN MUST ACCOMPANY THIS RETURN.

If this is a consolidated return, attach copy of Hawaii Forms N-304 and N-303 for each subsidiary.

1. Gross Receipts Less: Returns and allowances 1

2. Less: Cost of goods sold and/or operations (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . 2

3. Gross Profit (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4. Dividends (Schedule C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Gross Amount of Interest Less: Amortizable Bond Premium

5. Interest on government obligations . . 5

6. Other interest . . . . . . . . . . . . . 6

7. (a) Rents Plus 7(b) Royalties , Sum 7(c)

GROSS INCOME 8. (a) Net capital gains (from federal Schedule D) (See Instructions) . . . . . . . . . . . . . . . . . . . . . . 8(a)

(b) Ordinary gain or loss (from federal Schedule 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . 8(b)

9. Other income (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10. TOTAL INCOME — Add lines 3 through 9. Enter here and on page 2, line 10(a) . . . . . . . . . . . . . . 10

69. TOTAL TAX from page 3, line 68 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

70. Total Refundable Credits. Enter the result from page 4, Schedule I, line 3 . . . . . . . . . . . . . . . . . 70

71. Adjusted Tax Liability (Line 69 minus line 70. If line 71 is zero or less, see Instruction XVI) . . . . . . . 71

72. Total Nonrefundable Credits from Schedule H, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

73. Carryover of the Capital Infrastructure Tax Credit (Attach Form N-348) . . . . . . . . . . . . . . . . . . . 73

74. Line 71 minus the sum of lines 72 and 73 (See Instructions XVII) . . . . . . . . . . . . . . . . . . . . . . 74

75. Payment with extension (Attach Form N-755) . . . . . . . . . . . . . . 75

TAX

76. Tax installment payments (See Instruction XV) . . . . . . . . . . . . . . 76

77. Add lines 75 and 76 and enter result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

78. TAX DUE (Line 74 minus line 77. If line 77 is greater than line 74, skip line 79 and go to line 80) . . . . . 78

79. Enter amount paid with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

80. OVERPAYMENT (If line 77 is larger than line 74) (See Instruction XIX) . . . enter AMOUNT OVERPAID 80

81. Enter amount of line 80 you want Credited to 2025 installment payments 81

82. Amount to be REFUNDED TO YOU (line 80 minus line 81) . . . . . . . . . . . . . . . . . . . REFUND 82

83. Amount paid (overpaid) on original return—AMENDED RETURN ONLY (See Instructions. Attach Sch. AMD) 83

Amended Return 84. BALANCE DUE (REFUND) with amended return (See Instructions. Attach Sch. AMD) . . . . . . . . . . 84

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of

my knowledge and belief, is a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Taxation of Banks and Other Financial

Please Corporations, Chapter 241, HRS.

Sign

Here

Signature of officer Date Title

Preparer’s Signature, and Date Check if PTIN

Paid Print Preparer’s Name self-employed

Preparer’s Firm’s name (or yours Federal

Information if self-employed), E.I. No.

address, and Postal/ZIP Code Phone No.

FRN1E3T4 ID NO 01 FORM F-1 (REV. 2023)