Enlarge image

Clear Form

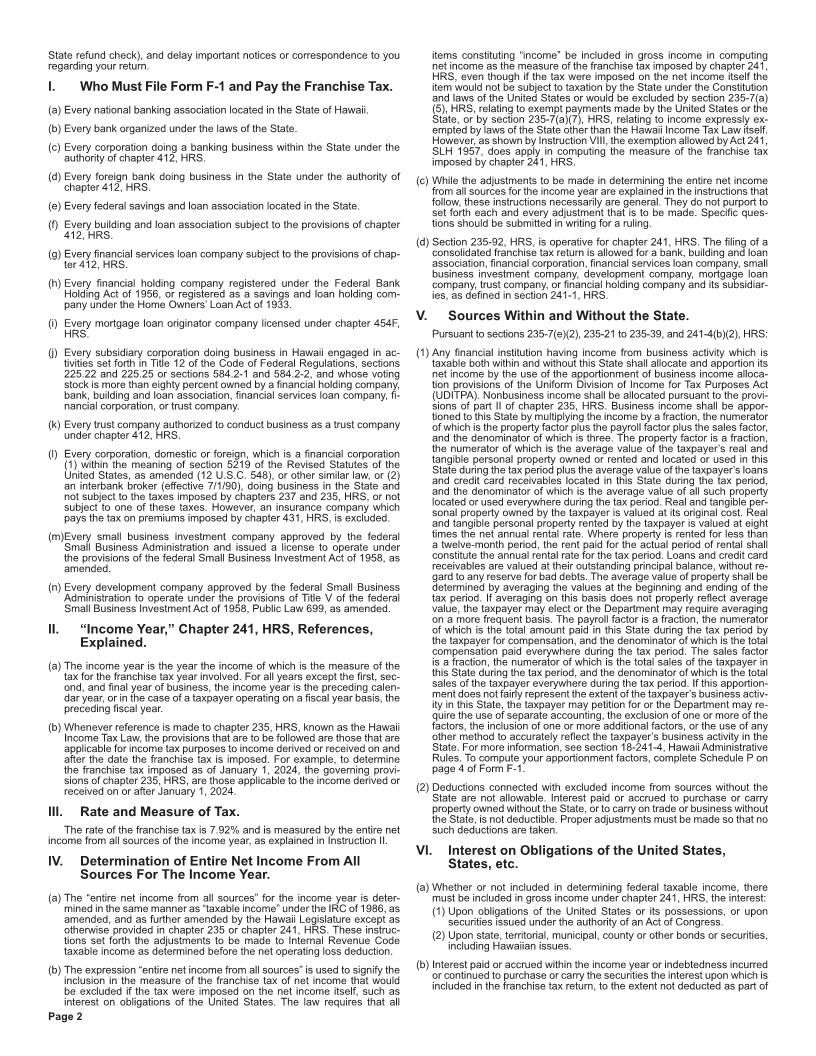

INSTRUCTIONS STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM F-1 GENERAL INSTRUCTIONS FOR

(REV. 2023) THE FILING OF FORM F-1

FRANCHISE TAX RETURN FOR BANKS, BUILDING AND LOAN ASSOCIATIONS,

FINANCIAL SERVICES LOAN COMPANIES, OTHER FINANCIAL CORPORATIONS,

AND SMALL BUSINESS INVESTMENT COMPANIES

Chapter 241, Hawaii Revised Statutes (HRS)

References to sections are to Internal Revenue Code (IRC) sections, unless otherwise stated.

ATTENTION Third and Subsequent Years Of Doing Business. Taxpayers

engaged in their third and subsequent year of operations would compute the

A tax is imposed by chapter 241, Hawaii Revised Statutes (HRS), on tax in the usual manner provided in sections 241-4 and 241-5, HRS.

certain types of income of banks and other financial institutions. The tax is

commonly referred to as the franchise tax and is in lieu of the income tax and Consolidation Or Merger Of Banks, Building And Loan

general excise tax. Associations, Development Companies, Financial Cor-

Chapter 241, HRS, incorporates some of the definitions in chapter 235, porations, Financial Services Loan Companies, Trust

HRS (the Hawaii Income Tax Law). While the Hawaii Income Tax Law gener- Companies, Mortgage Loan Companies, Financial Hold-

ally conforms to subtitle A, chapter 1 of the IRC as it applies to the determi- ing Companies And Qualifying Subsidiaries, and Small

nation of gross income, adjusted gross income, ordinary income, and loss,

and taxable income, Hawaii has not adopted the increased expensing de- Business Investment Companies.

duction under section 179 (Hawaii’s limit is $25,000) or the bonus deprecia- Whenever there is a consolidation or merger of taxpayers subject to the

tion provisions. franchise tax, the tax shall attach to the taxpayer thus formed and the net

income which shall be used for measuring the tax of the taxpayer thus

Changes To Note. formed shall include the net income of the taxpayers which were consoli-

dated or merged.

Act 56, Session Laws of Hawaii (SLH) 2023 — This act amends Hawaii

Income Tax Law under chapter 235, HRS, to conform to certain provisions of Taxpayer Terminating Business Operations. If a taxpayer

the IRC, as amended as of December 31, 2022. subject to the franchise tax, terminates business operations during the cal-

endar or fiscal year and other than in an acquisition by another company, or

Where To Get Tax Forms. merger, or consolidation:

Hawaii tax forms, instructions, and schedules may be obtained at any (1) Before the tax return is filed as required under section 241-5, HRS, a

taxation district office or from the Department of Taxation’s website at short year return shall be filed and the tax shall apply to the actual net

tax.hawaii.gov, or you may contact a customer service representative at: income for the taxable year or part of the taxable year during which the

808-587-4242 or 1-800-222-3229 (Toll-Free). taxpayer conducted business operations; or

Initial Year Of Doing Business. Banks, building and loan associa- (2) After the return has been filed as provided in section 241-5, HRS, an

tions, development companies, financial corporations, financial services amended return shall be filed to show the actual net income for the tax-

loan companies, trust companies, mortgage loan companies, financial hold- able year or part of the taxable year during which the taxpayer conducted

ing companies and qualifying subsidiaries, and small business investment business operations. Any variance between the tax computed and paid

companies engaged in their initial year of doing business and filing a fran- on the basis of the entire net income of the preceding calendar or fiscal

chise tax return for the first time must file an estimated franchise tax return year and the actual net income for the final year or part of a year of busi-

of the tax due. The tax shall be based on an estimate of the net income of ness operations shall be adjusted by showing a credit or refund or paying

the taxpayer for the first year of doing business or for the part of the first year the additional tax.

in which it is in business. The tax is levied at the rate of 7.92%. The esti- The return made shall be filed and the tax shall be paid on or before the

mated tax return shall be filed and the amount of estimated tax paid on or 20th day of the 4th month following the month business operations ceased

before the 20th day of the third month after the first month the taxpayer be- or the close of the taxable year, whichever is earlier. The box on Form F-1

gan business. The payment of the tax shall accompany the return unless an indicating “Final return” should be checked off and the “Business end date”

extension of time for the payment has been granted in writing by the Director should be noted.

of Taxation (Director). Any request for an extension of time for payment of

the tax must be made in writing to the Director before the filing due date of

the initial year estimated tax return. The box on Form F-1 indicating “First Changing Accounting Period from Calendar Year to Fis-

year return” should be checked off on the estimated return filed. cal Year.

After the close of the initial year of doing business, an amended franchise The amount of the franchise tax which is assessed for the calendar year

tax return shall be made to reflect the tax on the actual net income for the and the payment schedule for the tax that is established at the beginning of

initial year of doing business. Any variance between the estimated tax paid the calendar year are not affected or canceled when the taxpayer changes

and the tax on the actual net income for the initial year shall be adjusted by its accounting period to a fiscal year.

showing a credit or refund, or payment of additional tax due on the amended A taxpayer which changes its accounting period from a calendar to a fis-

tax return. The boxes on Form F-1 indicating “AMENDED Return” and “First cal year is subject to the following requirements:

year return” should be checked off. Attach a completed Schedule AMD, Ex- 1. Submit a written request for a change in the accounting period which

planation of Changes on Amended Return, to the amended return. Also, at- is approved by the Department of Taxation (Department).

tach all schedules, forms, and attachments required to file a complete return.

The amended return shall be made and filed, and any tax due paid on or 2. File Form F-1 for the new accounting period reporting the entire net

before the 20th day of the 4th month following the close of the taxable year income from all sources for the fiscal year. The original Form F-1

in which the taxpayer commenced business. reporting the entire net income from all sources for the calendar year

must also be filed.

Second Year Of Doing Business. An estimated tax return is also 3. Offset the entire net income from all sources for the duplicated

required of taxpayers in the second year of doing business. months. To avoid being taxed twice for the duplicated months, an

The estimated net income is determined by utilizing the average monthly offset for the entire net income from all sources for the duplicated

net income of the first taxable year of doing business multiplied by twelve. months will be allowed on the Form F-1 for the new accounting pe-

Both the payment of the tax as well as the filing of the return shall be made riod.

on or before the 20th day of the 4th month following the close of the 1st tax- 4. No carryover of excess amounts. If the entire net income from all

able year of doing business. sources for the duplicated months on the original Form F-1 exceeds

An amended franchise tax return shall be filed after the close of the sec- the entire net income from all sources for the duplicated months on

ond year of doing business. Any variance between the estimated tax paid the Form F-1 for the new accounting period, the excess amounts

and the tax on the actual net income for the second year shall be adjusted shall not be carried over and offset against the entire net income from

by showing a credit or refund, or payment of the additional tax due. The all sources for the unduplicated months on the Form F-1 for the new

amended tax return shall be filed on or before the 20th day of the 4th month accounting period.

following the close of the 2nd taxable year. The boxes on the Form F-1 indi-

cating “AMENDED Return” and “Second year return” should be checked off. Change of Address.

Attach a completed Schedule AMD, Explanation of Changes on Amended If your mailing address has changed, you must notify the Department of

Return, to the amended return. Also, attach all schedules, forms, and attach- the change by completing Form ITPS-COA, Change of Address Form, or log

ments required to file a complete return. in to your Hawaii Tax Online account at hitax.hawaii.gov. Failure to do so

may prevent your address from being updated, any refund due to you from

being delivered (the U.S. Postal Service is not permitted to forward your

Page 1