Enlarge image

Clear Form

FORM CM-1 STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2022)

OFFER IN COMPROMISE

CM1_I 2022A 01 VID01

Attach your check or money order payable to the "Hawaii State Tax Collector" here.

Section 1 Your Contact Information

Your first name, middle initial, last name Your social security number

If this is a joint offer, spouse’s first name, middle initial, last name Your spouse’s social security number

Your mailing address (number and street)

City or town, state, and postal/ZIP code Your telephone number

Business name Federal employer identification number

Your business mailing address (number and street)

City or town, state, and postal/ZIP code Business telephone number

Name of your representative (attach Form N-848) Your representative's telephone number

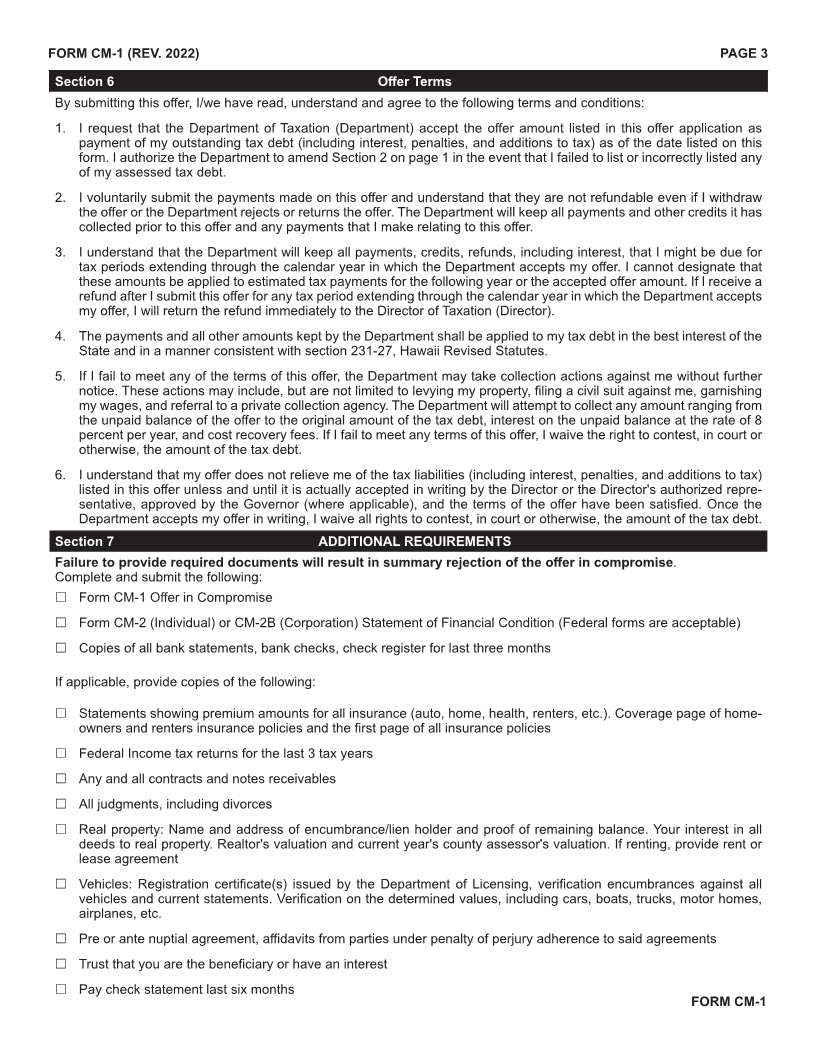

Section 2 Proposed Tax Amounts

To: Director of Taxation

In the following agreement, the pronoun “we” may be assumed in place of “I” when there are joint liabilities and

both parties have signed this agreement.

I submit this offer to compromise the tax liabilities including interest, penalties, additions to tax, and additional

amounts required by law for the tax type(s) and period(s) listed below:

Type of Tax Period Amount of Tax Amount of Penalty Amount of Interest Total Amount

If you need more space, attach another sheet of paper titled “Attachment to Form CM-1 dated_____.”

Section 3 Reason for Offer (Select one reason)

Doubt as to Collectability - I have insufficient assets and income to pay the full amount.

Doubt as to Liability - I have a legitimate reason that I do not owe part or all of the tax debt. I am submitting a

written narrative with this offer to explain my circumstances.

Exceptional Circumstances (Effective Tax Administration) - I owe this amount and have sufficient assets to pay

the full amount, but due to my exceptional circumstances, requiring full payment would cause an economic

hardship or would be unfair and inequitable. I am submitting a written narrative with this offer to explain my

circumstances.

FORM CM-1

ID NO 01