Enlarge image

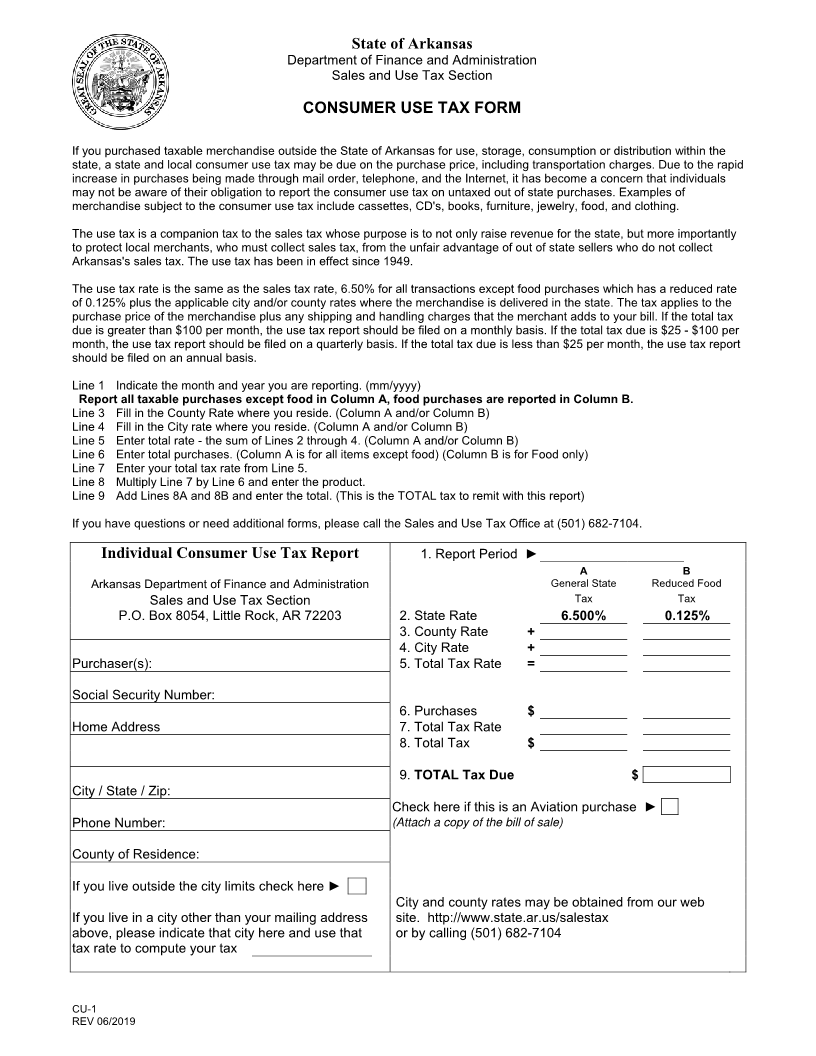

State of Arkansas

Department of Finance and Administration

Sales and Use Tax Section

CONSUMER USE TAX FORM

If you purchased taxable merchandise outside the State of Arkansas for use, storage, consumption or distribution within the

state, a state and local consumer use tax may be due on the purchase price, including transportation charges. Due to the rapid

increase in purchases being made through mail order, telephone, and the Internet, it has become a concern that individuals

may not be aware of their obligation to report the consumer use tax on untaxed out of state purchases. Examples of

merchandise subject to the consumer use tax include cassettes, CD's, books, furniture, jewelry, food, and clothing.

The use tax is a companion tax to the sales tax whose purpose is to not only raise revenue for the state, but more importantly

to protect local merchants, who must collect sales tax, from the unfair advantage of out of state sellers who do not collect

Arkansas's sales tax. The use tax has been in effect since 1949.

The use tax rate is the same as the sales tax rate, 6.50% for all transactions except food purchases which has a reduced rate

of 0.125% plus the applicable city and/or county rates where the merchandise is delivered in the state. The tax applies to the

purchase price of the merchandise plus any shipping and handling charges that the merchant adds to your bill. If the total tax

due is greater than $100 per month, the use tax report should be filed on a monthly basis. If the total tax due is $25 - $100 per

month, the use tax report should be filed on a quarterly basis. If the total tax due is less than $25 per month, the use tax report

should be filed on an annual basis.

Line 1 Indicate the month and year you are reporting. (mm/yyyy)

Report all taxable purchases except food in Column A, food purchases are reported in Column B.

Line 3 Fill in the County Rate where you reside .(Column A and/or Column B)

Line 4 Fill in the City rate where you reside. (Column A and/or Column B)

Line 5 Enter total rate - the sum of inesL2 through 4. (Column A and/or Column B)

Line 6 Enter total purchases .(Column A is for all items except food) ( olumnCB is for Food only)

Line 7 Enter your total tax rate from ineL 5 .

Line 8 Multiply ineL 7 by ineL6 and enter the product.

Line 9 Add inesL 8A and 8B and enter the total. (This is the TOTAL tax to remit with this report)

If you have questions or need additional forms, please call the Sales and Use Tax Office at (501) 682-7104.

Individual Consumer Use Tax Report 1. Report Period ►

A B

Arkansas Department of Finance and Administration General State Reduced Food

Sales and Use Tax Section Tax Tax

P.O. Box 8054, Little Rock, AR 72203 02. State Rate 6.500% 0.125%

03. County Rate +

04. City Rate +

Purchaser(s): 05. Total Tax Rate =

Social Security Number:

06. Purchases $

Home Address 07. Total Tax Rate

08. Total Tax $

09. TOTAL Tax Due $

City / State / Zip:

Check here if this is an Aviation purchase ►

Phone Number: (Attach a copy of the bill of sale)

County of Residence:

If you live outside the city limits check here ►

City and county rates may be obtained from our web

If you live in a city other than your mailing address site. http://www.state.ar.us/salestax

above, please indicate that city here and use that or by calling (501) 682-7104

tax rate to compute your tax

CU-1

REV 06/201 9