Enlarge image

IRS Paid Preparer Tax Identification Number (PTIN)

Form (Rev. October 2024) W-12 Application and Renewal OMB No. 1545-2190

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/FormW12 for instructions and the latest information.

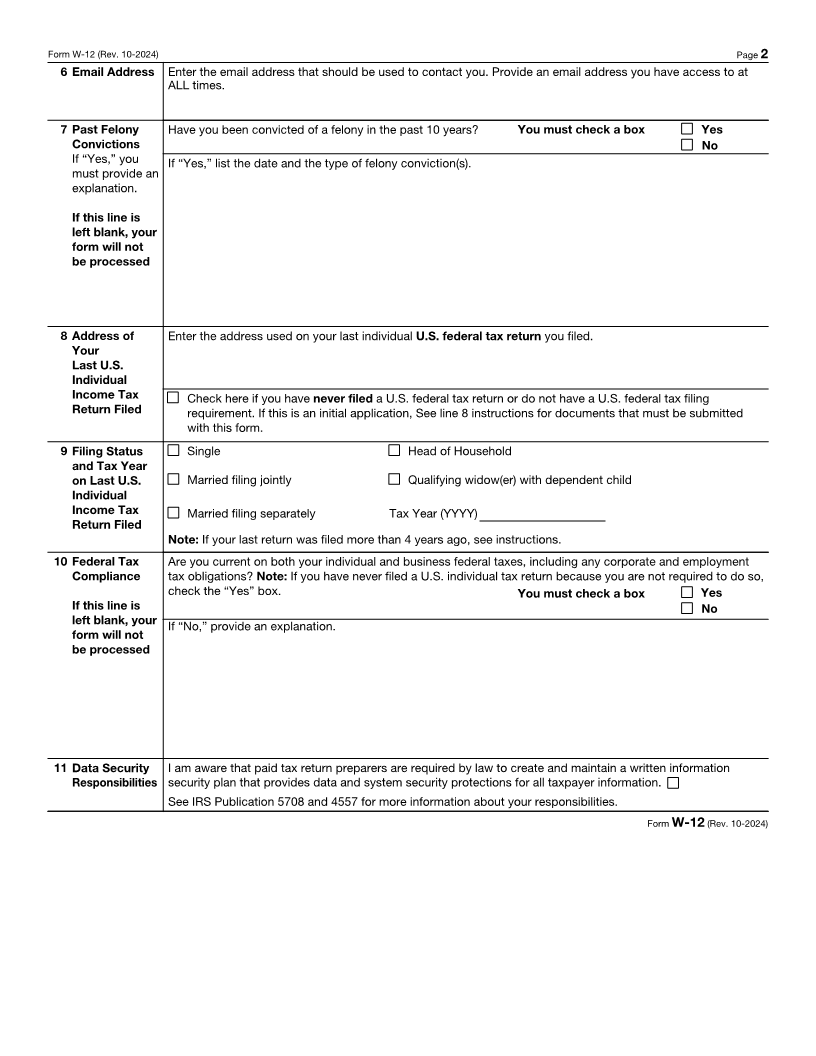

1 Name and PTIN First name Middle name Last name

(Print in ink or

Type)

Initial application Renewal application (Enter PTIN: P )

2 Year of If you checked the “Initial application” box and are submitting this form between October 1 and December 31,

Application/ indicate below whether you want your PTIN to be valid for the current calendar year or the next calendar year.

Renewal

Current calendar year Next calendar year

Prior year(s) (YYYY): If you are applying for a prior year(s), write each year(s) below. Use the following format.

(YYYY) See line 2 instructions for additional guidance.

Prior year(s)

3 SSN and Date Provide your U.S. issued Social Security Number SSN Provide your Date of Birth.

of Birth (SSN). If you have an SSN, you are required to Make sure to use the standard

You must provide it. U.S. format (Month/Day/Year)

(Example: “April 01, 1956" =

provide your If you do not have an SSN, 04/01/1956)

SSN or check Failure to provide your SSN or check the N/A

the N/A box box will result in your PTIN application being then check the N/A box.

rejected. N/A

4 Personal Street address. Use a P.O. box number only if the post office does not deliver mail to your street address.

Mailing

Address and

Phone Number City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

Phone Number

5a Business Business address Check here if your business address is the same as your personal mailing address. If

Mailing different, enter it below.

Address and

Phone Number

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

Domestic business phone number International business phone number

EXT. +

b Business Are you self-employed or an owner, partner, or officer of a tax return preparation business? Yes No

Identification If “Yes,” then complete this line. If “No,” go to line 6.

Enter the business name.

Your CAF Number EIN EFIN

Website address (optional)

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 55469F Form W-12 (Rev. 10-2024)

For Internal Use Only

PID:

CS:

Date & Int:

LTR: