Enlarge image

Withholding Certificate for Nonperiodic Payments and OMB No. 1545-0074

Form W-4R Eligible Rollover Distributions

Department of the Treasury Give Form W-4R to the payer of your retirement payments. 2025

Internal Revenue Service

1a First name and middle initial Last name 1b Social security number

Address

City or town, state, and ZIP code

Your withholding rate is determined by the type of payment you will receive.

• For nonperiodic payments, the default withholding rate is 10%. You can choose to have a different rate by entering a rate between

0% and 100% on line 2. Generally, you can’t choose less than 10% for payments to be delivered outside the United States and its

territories.

• For an eligible rollover distribution, the default withholding rate is 20%. You can choose a rate greater than 20% by entering the rate

on line 2. You may not choose a rate less than 20%.

See page 2 for more information.

2 Complete this line if you would like a rate of withholding that is different from the default withholding

rate. See the instructions on page 2 and the Marginal Rate Tables below for additional information.

Enter the rate as a whole number (no decimals) . . . . . . . . . . . . . . . . . . 2 %

Sign

Here

Your signature (This form is not valid unless you sign it.) Date

General Instructions intervals over a period of more than 1 year) from these plans

or arrangements. Instead, use Form W-4P, Withholding

Section references are to the Internal Revenue Code. Certificate for Periodic Pension or Annuity Payments. For

Future developments. For the latest information about any more information on withholding, see Pub. 505, Tax

future developments related to Form W-4R, such as Withholding and Estimated Tax.

legislation enacted after it was published, go to Caution: If you have too little tax withheld, you will generally

www.irs.gov/FormW4R. owe tax when you file your tax return and may owe a penalty

Purpose of form. Complete Form W-4R to have payers unless you make timely payments of estimated tax. If too

withhold the correct amount of federal income tax from your much tax is withheld, you will generally be due a refund

nonperiodic payment or eligible rollover distribution from an when you file your tax return. Your withholding choice (or an

employer retirement plan, annuity (including a commercial election not to have withholding on a nonperiodic payment)

annuity), or individual retirement arrangement (IRA). See will generally apply to any future payment from the same

page 2 for the rules and options that are available for each plan or IRA. Submit a new Form W-4R if you want to change

type of payment. Don’t use Form W-4R for periodic your election.

payments (payments made in installments at regular

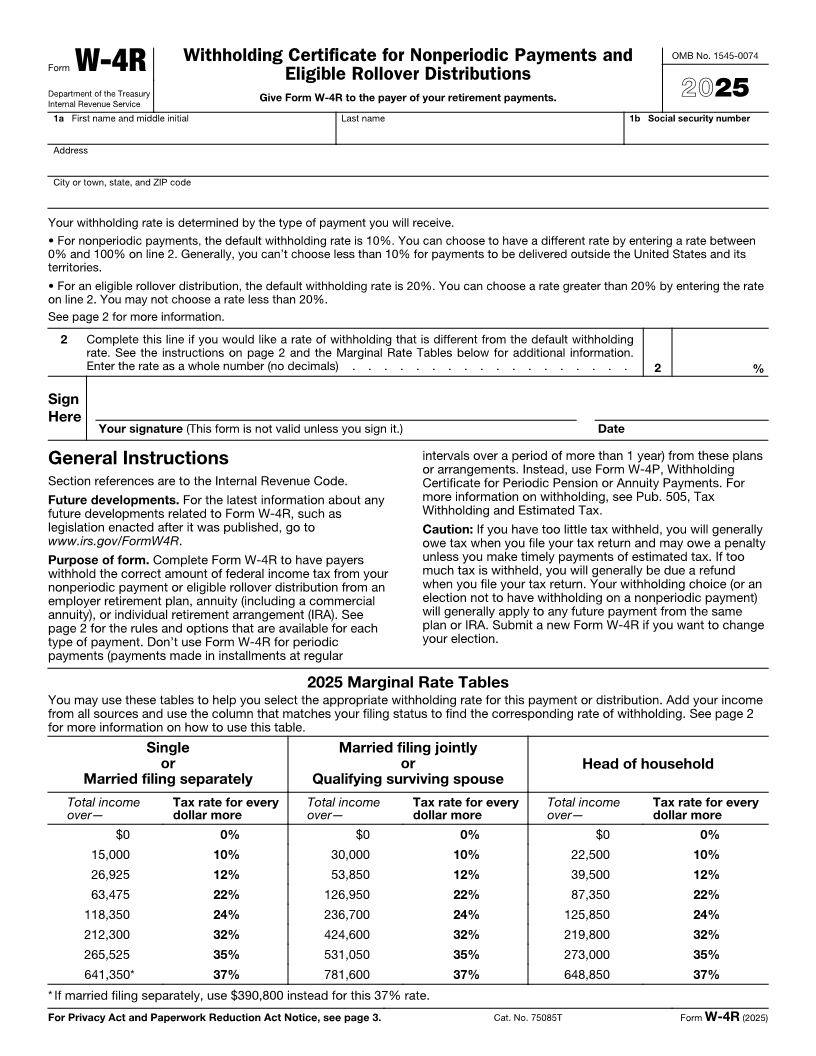

2025 Marginal Rate Tables

You may use these tables to help you select the appropriate withholding rate for this payment or distribution. Add your income

from all sources and use the column that matches your filing status to find the corresponding rate of withholding. See page 2

for more information on how to use this table.

Single Married filing jointly

or or Head of household

Married filing separately Qualifying surviving spouse

Total income Tax rate for every Total income Tax rate for every Total income Tax rate for every

over— dollar more over— dollar more over— dollar more

$0 0% $0 0% $0 0%

15,000 10% 30,000 10% 22,500 10%

26,925 12% 53,850 12% 39,500 12%

63,475 22% 126,950 22% 87,350 22%

118,350 24% 236,700 24% 125,850 24%

212,300 32% 424,600 32% 219,800 32%

265,525 35% 531,050 35% 273,000 35%

641,350* 37% 781,600 37% 648,850 37%

*If married filing separately, use $390,800 instead for this 37% rate.

For Privacy Act and Paperwork Reduction Act Notice, see page 3. Cat. No. 75085T Form W-4R (2025)