Enlarge image

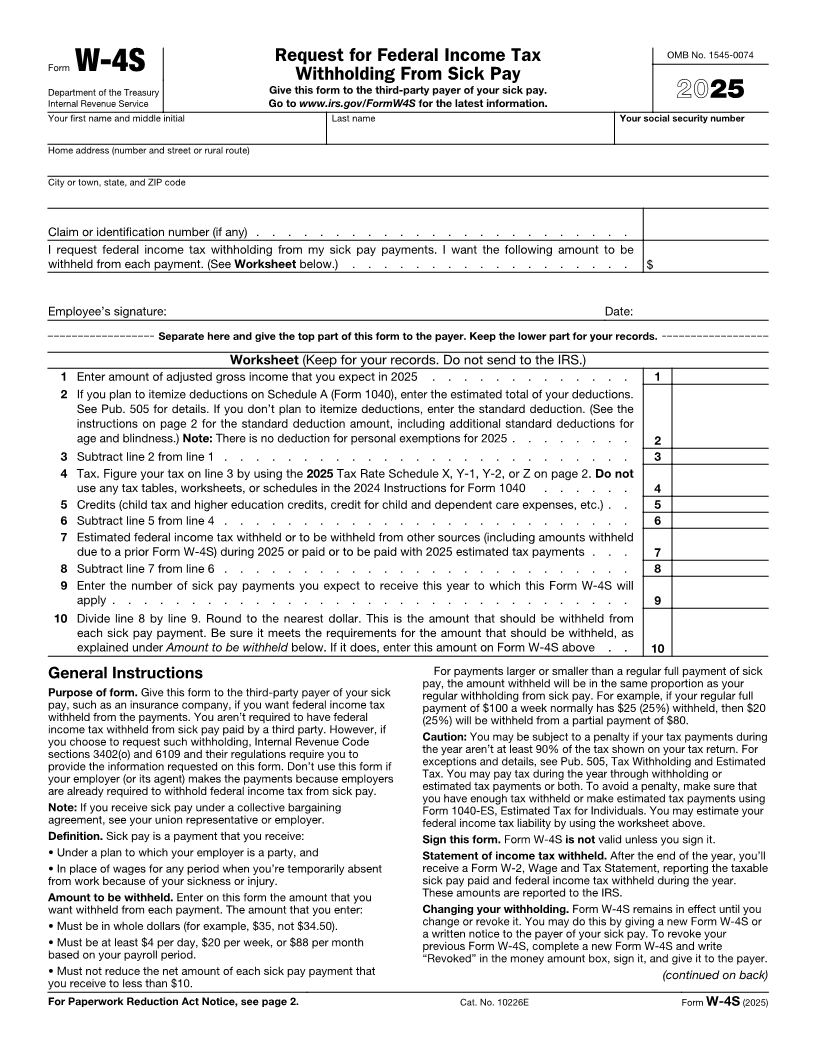

Request for Federal Income Tax OMB No. 1545-0074

Form W-4S Withholding From Sick Pay

Department of the Treasury Give this form to the third-party payer of your sick pay.

Internal Revenue Service Go to www.irs.gov/FormW4S for the latest information. 2025

Your first name and middle initial Last name Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Claim or identification number (if any) . . . . . . . . . . . . . . . . . . . . . . . .

I request federal income tax withholding from my sick pay payments. I want the following amount to be

withheld from each payment. (See Worksheet below.) . . . . . . . . . . . . . . . . . . $

Employee’s signature: Date:

Separate here and give the top part of this form to the payer. Keep the lower part for your records.

Worksheet (Keep for your records. Do not send to the IRS.)

1 Enter amount of adjusted gross income that you expect in 2025 . . . . . . . . . . . . . 1

2 If you plan to itemize deductions on Schedule A (Form 1040), enter the estimated total of your deductions.

See Pub. 505 for details. If you don’t plan to itemize deductions, enter the standard deduction. (See the

instructions on page 2 for the standard deduction amount, including additional standard deductions for

age and blindness.) Note: There is no deduction for personal exemptions for 2025 . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . 3

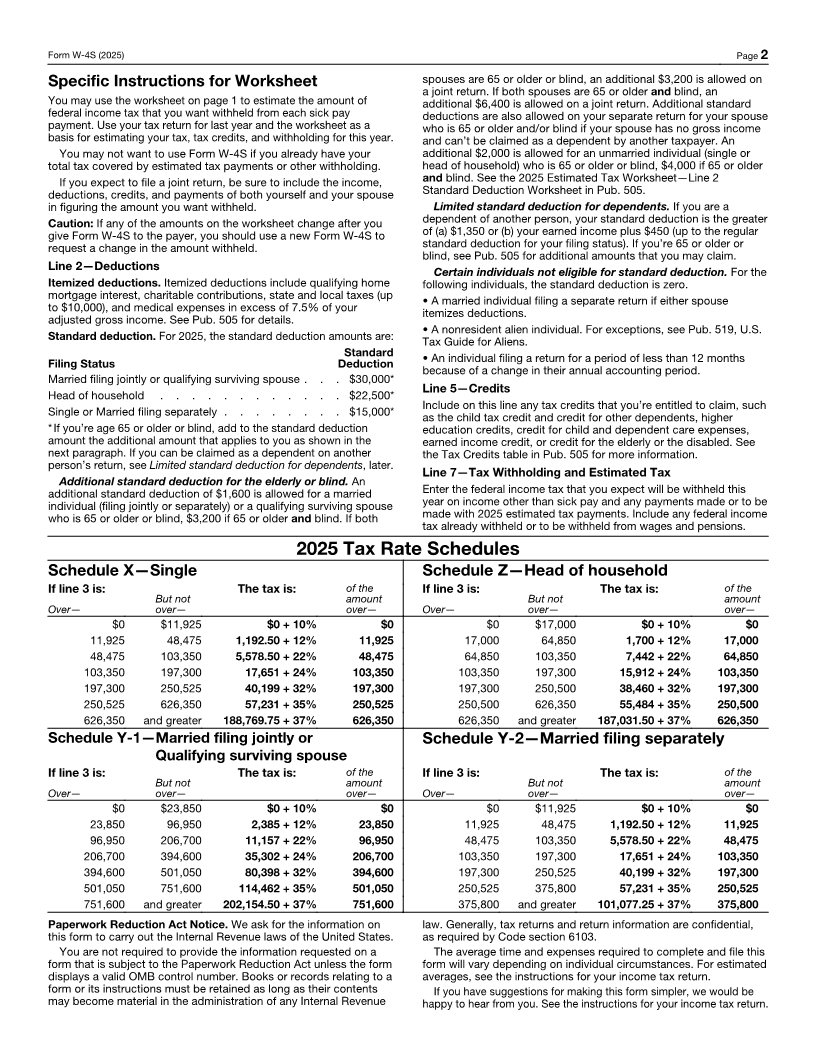

4 Tax. Figure your tax on line 3 by using the 2025 Tax Rate Schedule X, Y-1, Y-2, or Z on page 2. Do not

use any tax tables, worksheets, or schedules in the 2024 Instructions for Form 1040 . . . . . . 4

5 Credits (child tax and higher education credits, credit for child and dependent care expenses, etc.) . . 5

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Estimated federal income tax withheld or to be withheld from other sources (including amounts withheld

due to a prior Form W-4S) during 2025 or paid or to be paid with 2025 estimated tax payments . . . 7

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the number of sick pay payments you expect to receive this year to which this Form W-4S will

apply . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Divide line 8 by line 9. Round to the nearest dollar. This is the amount that should be withheld from

each sick pay payment. Be sure it meets the requirements for the amount that should be withheld, as

explained under Amount to be withheld below. If it does, enter this amount on Form W-4S above . . 10

General Instructions For payments larger or smaller than a regular full payment of sick

pay, the amount withheld will be in the same proportion as your

Purpose of form. Give this form to the third-party payer of your sick regular withholding from sick pay. For example, if your regular full

pay, such as an insurance company, if you want federal income tax payment of $100 a week normally has $25 (25%) withheld, then $20

withheld from the payments. You aren’t required to have federal (25%) will be withheld from a partial payment of $80.

income tax withheld from sick pay paid by a third party. However, if

you choose to request such withholding, Internal Revenue Code Caution: You may be subject to a penalty if your tax payments during

sections 3402(o) and 6109 and their regulations require you to the year aren’t at least 90% of the tax shown on your tax return. For

provide the information requested on this form. Don’t use this form if exceptions and details, see Pub. 505, Tax Withholding and Estimated

your employer (or its agent) makes the payments because employers Tax. You may pay tax during the year through withholding or

are already required to withhold federal income tax from sick pay. estimated tax payments or both. To avoid a penalty, make sure that

you have enough tax withheld or make estimated tax payments using

Note: If you receive sick pay under a collective bargaining Form 1040-ES, Estimated Tax for Individuals. You may estimate your

agreement, see your union representative or employer. federal income tax liability by using the worksheet above.

Definition. Sick pay is a payment that you receive: Sign this form. Form W-4S is not valid unless you sign it.

• Under a plan to which your employer is a party, and Statement of income tax withheld. After the end of the year, you’ll

• In place of wages for any period when you’re temporarily absent receive a Form W-2, Wage and Tax Statement, reporting the taxable

from work because of your sickness or injury. sick pay paid and federal income tax withheld during the year.

Amount to be withheld. Enter on this form the amount that you These amounts are reported to the IRS.

want withheld from each payment. The amount that you enter: Changing your withholding. Form W-4S remains in effect until you

• Must be in whole dollars (for example, $35, not $34.50). change or revoke it. You may do this by giving a new Form W-4S or

a written notice to the payer of your sick pay. To revoke your

• Must be at least $4 per day, $20 per week, or $88 per month previous Form W-4S, complete a new Form W-4S and write

based on your payroll period. “Revoked” in the money amount box, sign it, and give it to the payer.

• Must not reduce the net amount of each sick pay payment that (continued on back)

you receive to less than $10.

For Paperwork Reduction Act Notice, see page 2. Cat. No. 10226E Form W-4S (2025)