Enlarge image

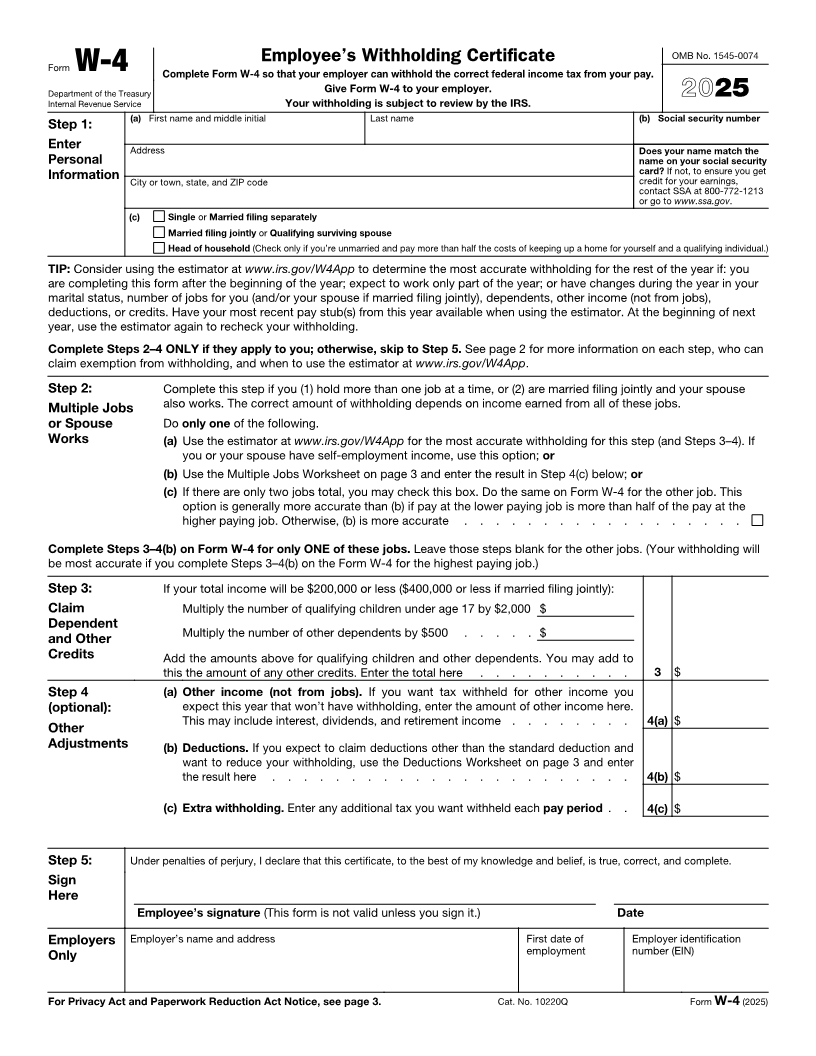

Employee’s Withholding Certificate OMB No. 1545-0074

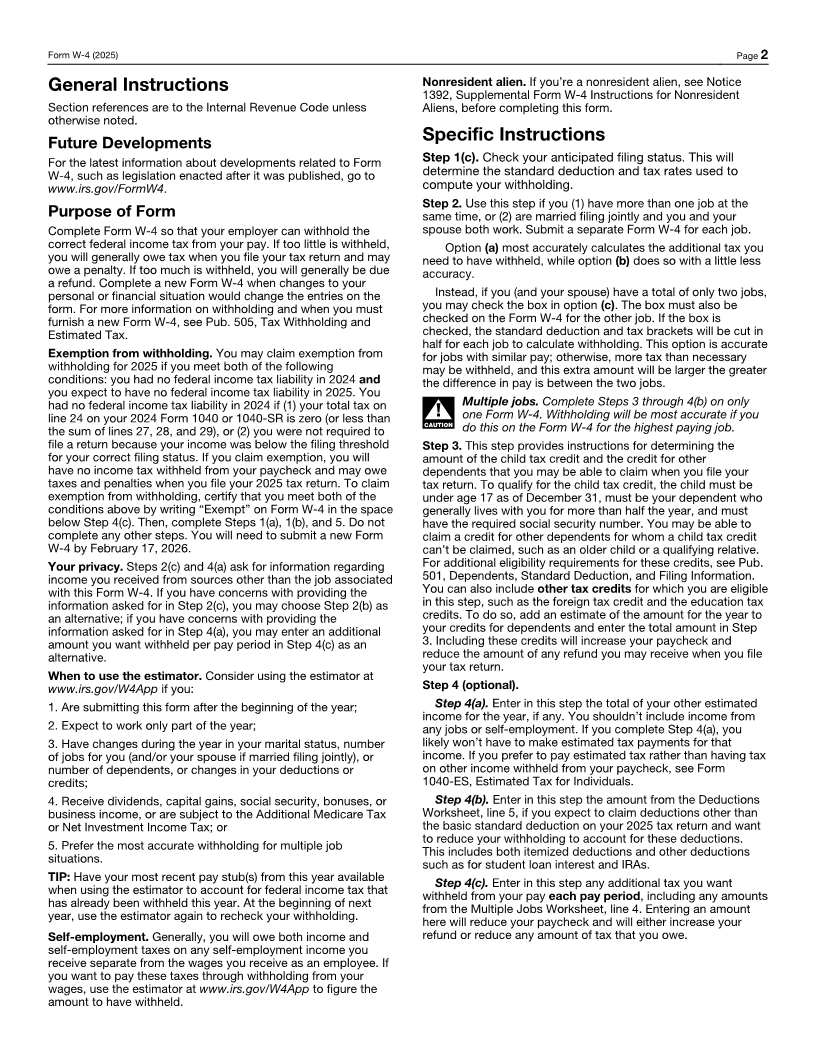

Form W-4 Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Department of the Treasury Give Form W-4 to your employer.

Internal Revenue Service Your withholding is subject to review by the IRS. 2025

(a) First name and middle initial Last name (b) Social security number

Step 1:

Enter Address Does your name match the

Personal name on your social security

card? If not, to ensure you get

Information City or town, state, and ZIP code credit for your earnings,

contact SSA at 800-772-1213

or go to www.ssa.gov.

(c) Single or Married filing separately

Married filing jointly or Qualifying surviving spouse

Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.)

TIP: Consider using the estimator at www.irs.gov/W4App to determine the most accurate withholding for the rest of the year if: you

are completing this form after the beginning of the year; expect to work only part of the year; or have changes during the year in your

marital status, number of jobs for you (and/or your spouse if married filing jointly), dependents, other income (not from jobs),

deductions, or credits. Have your most recent pay stub(s) from this year available when using the estimator. At the beginning of next

year, use the estimator again to recheck your withholding.

Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can

claim exemption from withholding, and when to use the estimator at www.irs.gov/W4App.

Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse

Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs.

or Spouse Do only one of the following.

Works (a) Use the estimator at www.irs.gov/W4App for the most accurate withholding for this step (and Steps 3–4). If

you or your spouse have self-employment income, use this option; or

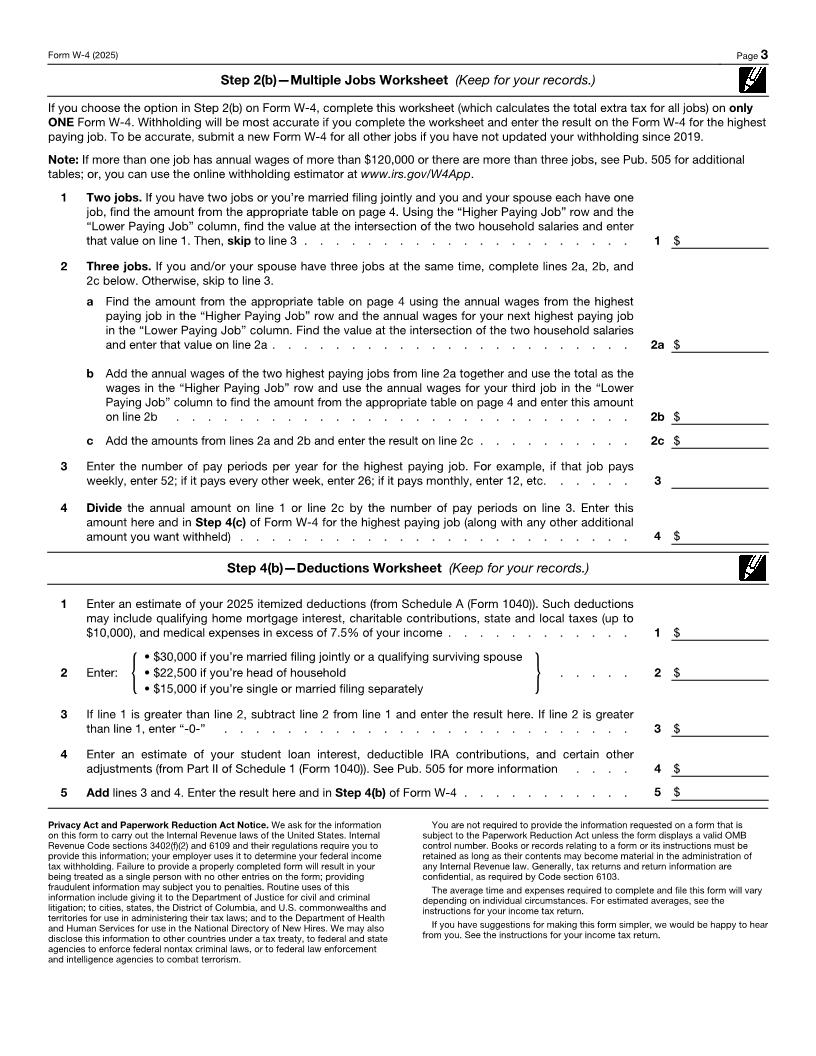

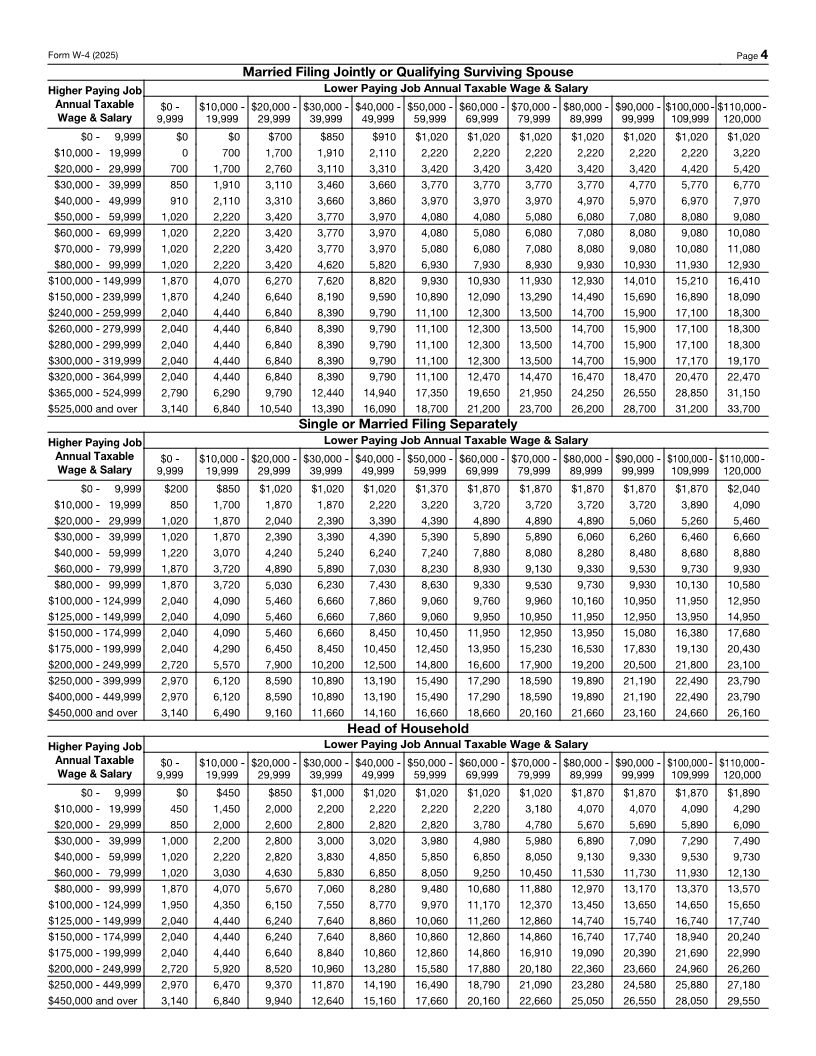

(b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below; or

(c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This

option is generally more accurate than (b) if pay at the lower paying job is more than half of the pay at the

higher paying job. Otherwise, (b) is more accurate . . . . . . . . . . . . . . . . . .

Complete Steps 3–4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will

be most accurate if you complete Steps 3–4(b) on the Form W-4 for the highest paying job.)

Step 3: If your total income will be $200,000 or less ($400,000 or less if married filing jointly):

Claim Multiply the number of qualifying children under age 17 by $2,000 $

Dependent

and Other Multiply the number of other dependents by $500 . . . . . $

Credits Add the amounts above for qualifying children and other dependents. You may add to

this the amount of any other credits. Enter the total here . . . . . . . . . . 3 $

Step 4 (a) Other income (not from jobs). If you want tax withheld for other income you

(optional): expect this year that won’t have withholding, enter the amount of other income here.

This may include interest, dividends, and retirement income . . . . . . . . 4(a) $

Other

Adjustments (b) Deductions. If you expect to claim deductions other than the standard deduction and

want to reduce your withholding, use the Deductions Worksheet on page 3 and enter

the result here . . . . . . . . . . . . . . . . . . . . . . . 4(b) $

(c) Extra withholding. Enter any additional tax you want withheld each pay period . . 4(c) $

Step 5: Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete.

Sign

Here

Employee’s signature (This form is not valid unless you sign it.) Date

Employers Employer’s name and address First date of Employer identification

Only employment number (EIN)

For Privacy Act and Paperwork Reduction Act Notice, see page 3. Cat. No. 10220Q Form W-4 (2025)