Enlarge image

Click on the question-mark icons to display help windows.

The information provided will enable you to file a more complete return and reduce the chances the IRS will need to contact you.

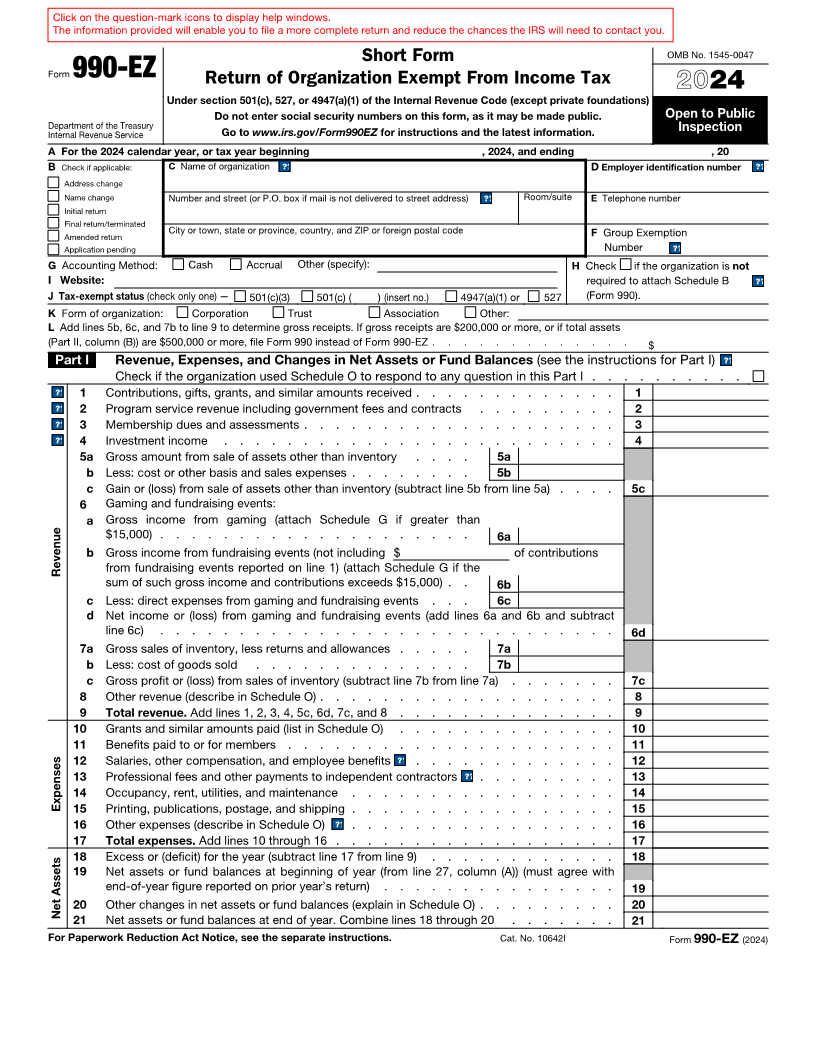

Short Form OMB No. 1545-0047

Form 990-EZ Return of Organization Exempt From Income Tax 24

20

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Do not enter social security numbers on this form, as it may be made public. Open to Public

Department of the Treasury Inspection

Internal Revenue Service Go to www.irs.gov/Form990EZ for instructions and the latest information.

A For the 2024 calendar year, or tax year beginning , 2024, and ending , 20

B Check if applicable: C Name of organization ?? help D Employer identification number ?? help

Address change

Name change Number and street (or P.O. box if mail is not delivered to street address) ?? help Room/suite E Telephone number

Initial return

Final return/terminated

Amended return City or town, state or province, country, and ZIP or foreign postal code F Group Exemption

Application pending Number ?? help

G Accounting Method: Cash Accrual Other (specify): H Check if the organization is not

I Website: required to attach Schedule B ?? help

J Tax-exempt status (check only one) — 501(c)(3) 501(c) ( ) (insert no.) 4947(a)(1) or 527 (Form 990).

K Form of organization: Corporation Trust Association Other:

L Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets

(Part II, column (B)) are $500,000 or more, file Form 990 instead of Form 990-EZ . . . . . . . . . . . . . $

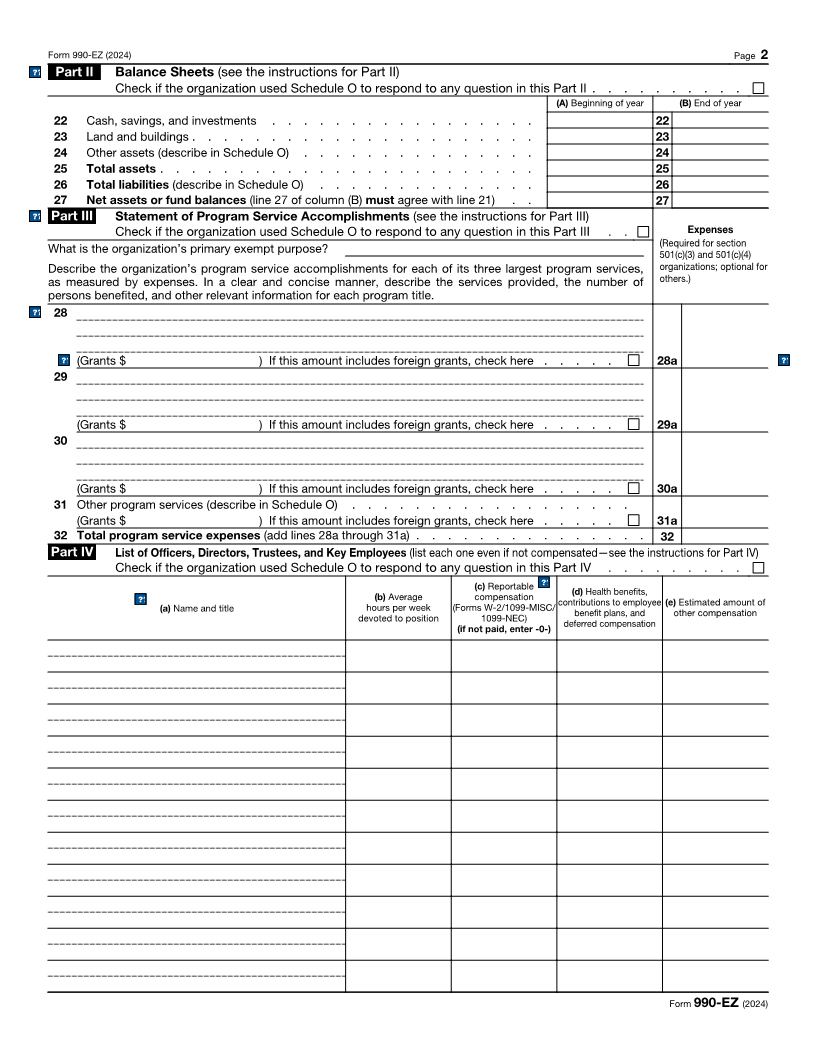

Part I Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I) ?? help

Check if the organization used Schedule O to respond to any question in this Part I . . . . . . . . . .

?? help1 Contributions, gifts, grants, and similar amounts received . . . . . . . . . . . . . 1

?? help2 Program service revenue including government fees and contracts . . . . . . . . . 2

?? help3 Membership dues and assessments . . . . . . . . . . . . . . . . . . . . 3

?? help4 Investment income . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 a Gross amount from sale of assets other than inventory . . . . 5a

b Less: cost or other basis and sales expenses . . . . . . . . 5b

c Gain or (loss) from sale of assets other than inventory (subtract line 5b from line 5a) . . . . 5c

6 Gaming and fundraising events:

a Gross income from gaming (attach Schedule G if greater than

$15,000) . . . . . . . . . . . . . . . . . . . . 6a

b Gross income from fundraising events (not including $ of contributions

Revenue from fundraising events reported on line 1) (attach Schedule G if the

sum of such gross income and contributions exceeds $15,000) . . 6b

c Less: direct expenses from gaming and fundraising events . . . 6c

d Net income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract

line 6c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

7 a Gross sales of inventory, less returns and allowances . . . . . 7a

b Less: cost of goods sold . . . . . . . . . . . . . . 7b

c Gross profit or (loss) from sales of inventory (subtract line 7b from line 7a) . . . . . . . 7c

8 Other revenue (describe in Schedule O) . . . . . . . . . . . . . . . . . . . 8

9 Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8 . . . . . . . . . . . . . . 9

10 Grants and similar amounts paid (list in Schedule O) . . . . . . . . . . . . . . 10

11 Benefits paid to or for members . . . . . . . . . . . . . . . . . . . . . 11

12 Salaries, other compensation, and employee benefits .?? help. . . . . . . . . . . . . 12

13 Professional fees and other payments to independent contractors .?? help. . . . . . . . . 13

14 Occupancy, rent, utilities, and maintenance . . . . . . . . . . . . . . . . . 14

Expenses 15 Printing, publications, postage, and shipping . . . . . . . . . . . . . . . . . 15

16 Other expenses (describe in Schedule O) .?? help. . . . . . . . . . . . . . . . . 16

17 Total expenses. Add lines 10 through 16 . . . . . . . . . . . . . . . . . . 17

18 Excess or (deficit) for the year (subtract line 17 from line 9) . . . . . . . . . . . . 18

19 Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with

end-of-year figure reported on prior year’s return) . . . . . . . . . . . . . . . 19

20 Other changes in net assets or fund balances (explain in Schedule O) . . . . . . . . . 20

Net Assets

21 Net assets or fund balances at end of year. Combine lines 18 through 20 . . . . . . . 21

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10642I Form 990-EZ (2024)