- 74 -

Enlarge image

|

Page 74 of 113 Fileid: … -form-1040/2024/a/xml/cycle07/source 15:51 - 16-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

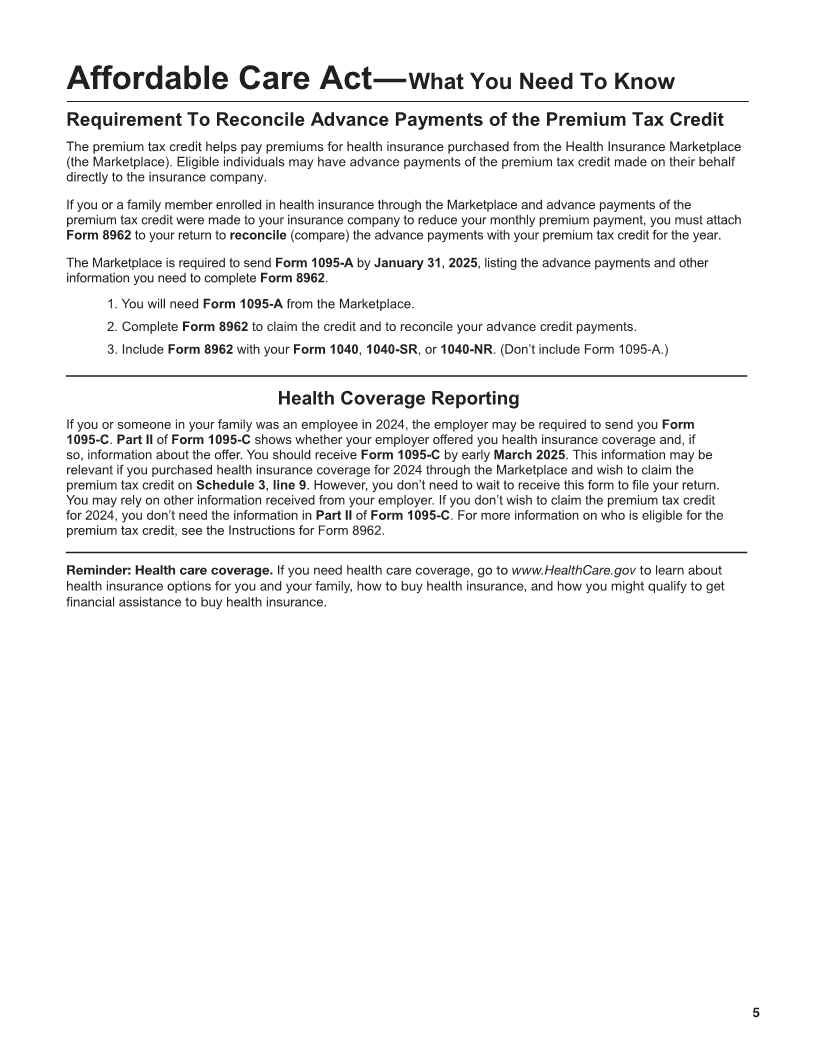

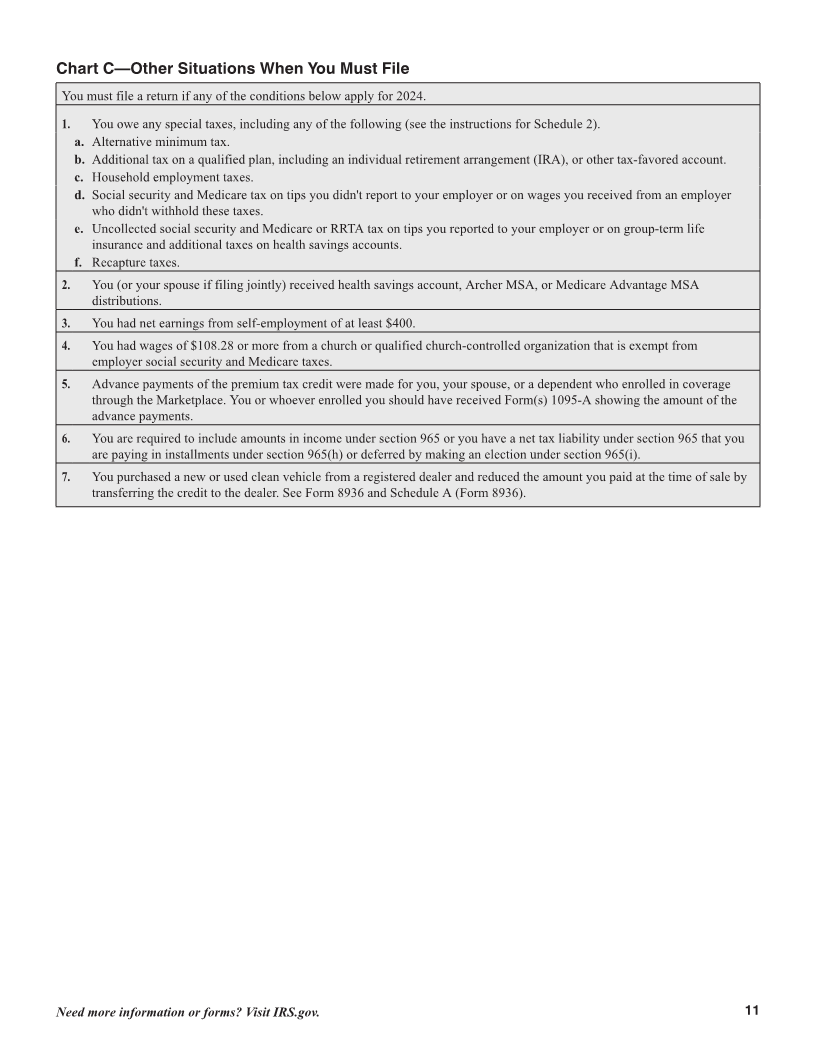

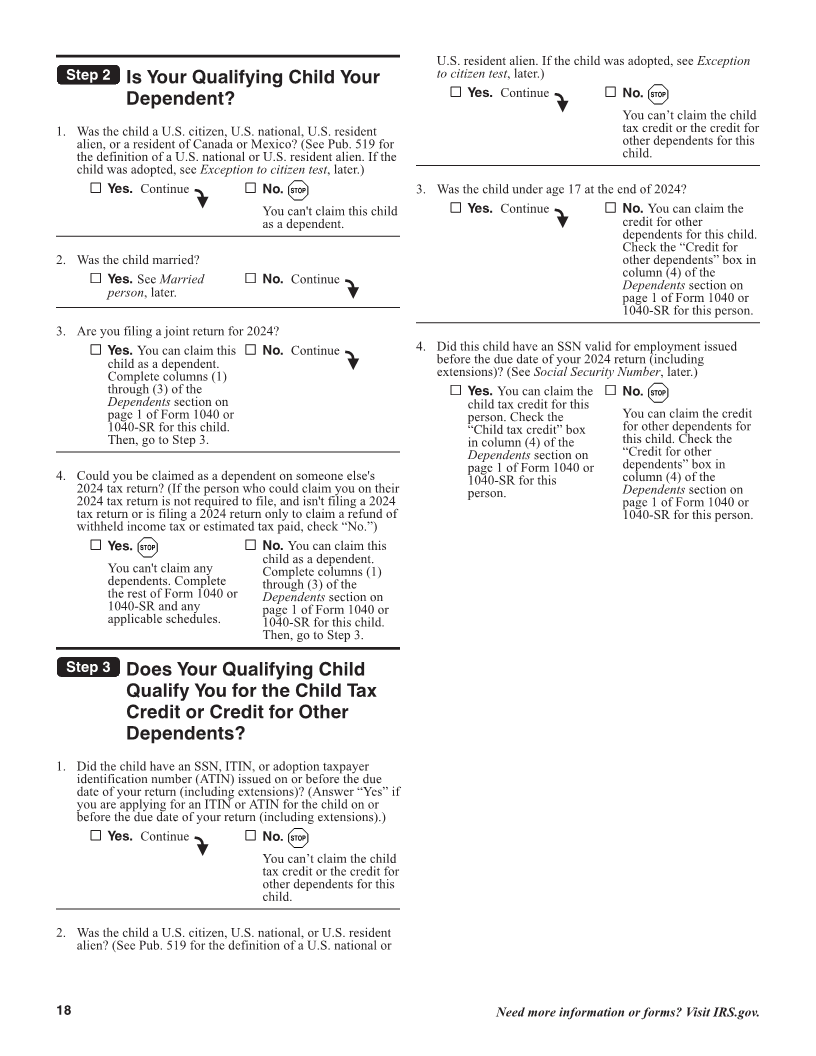

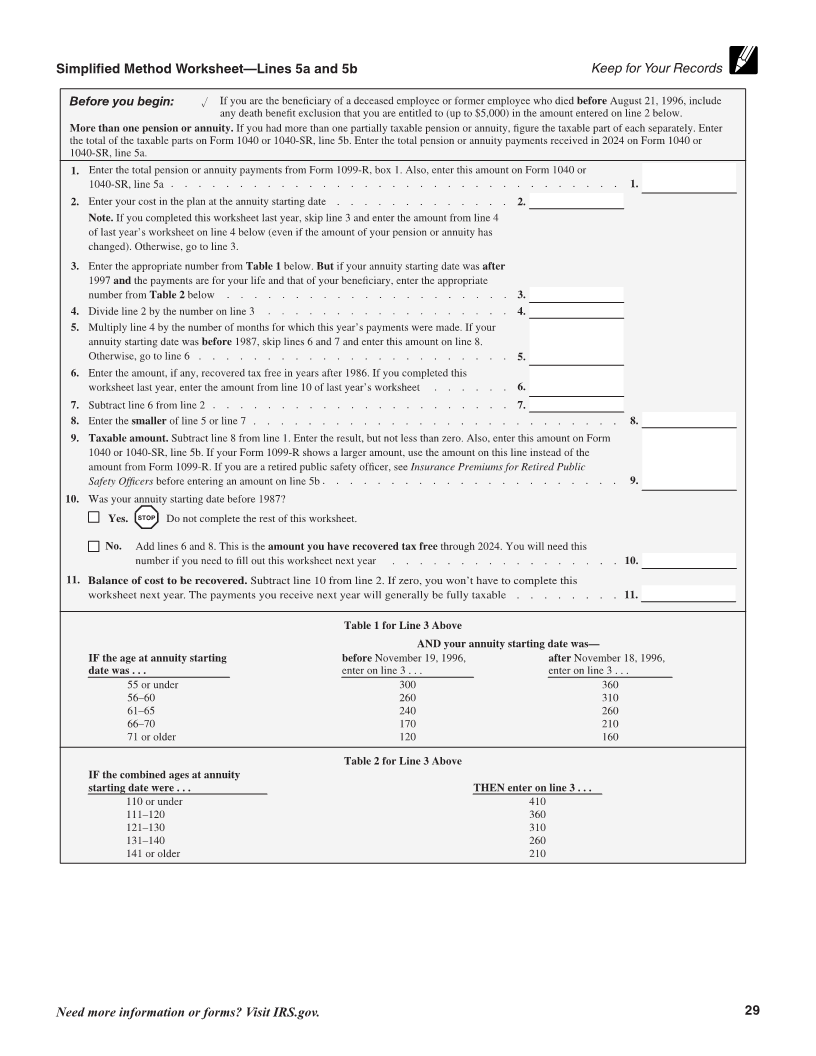

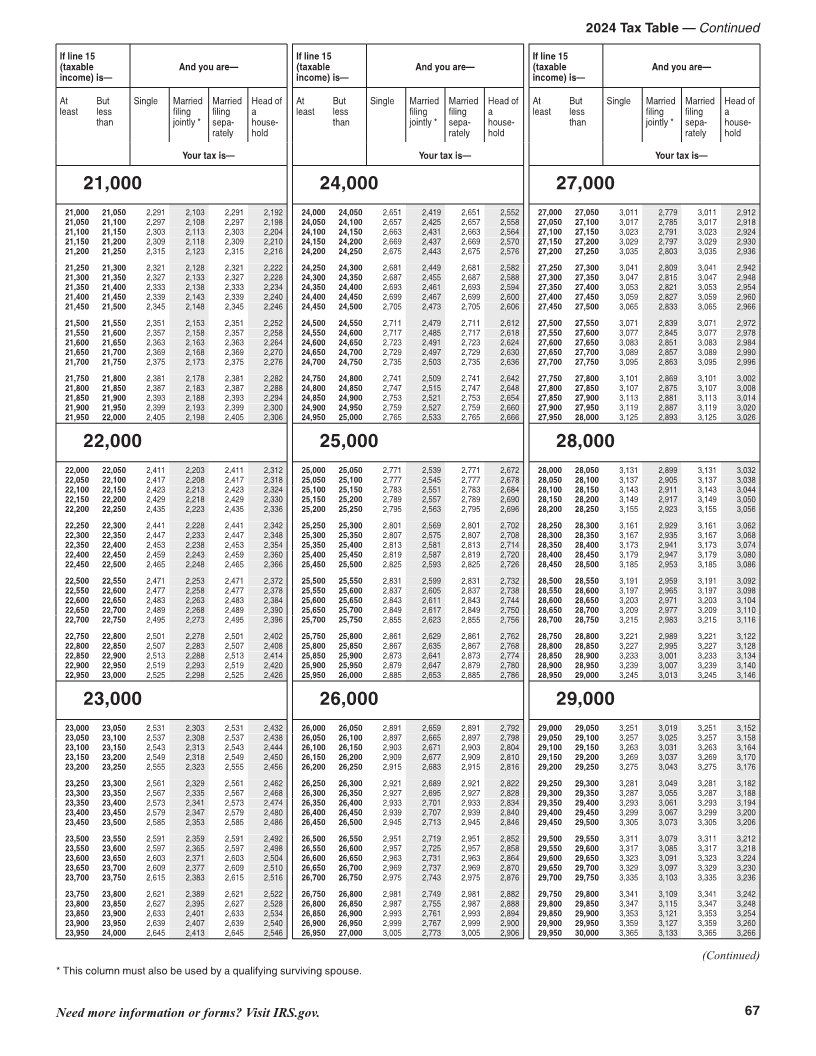

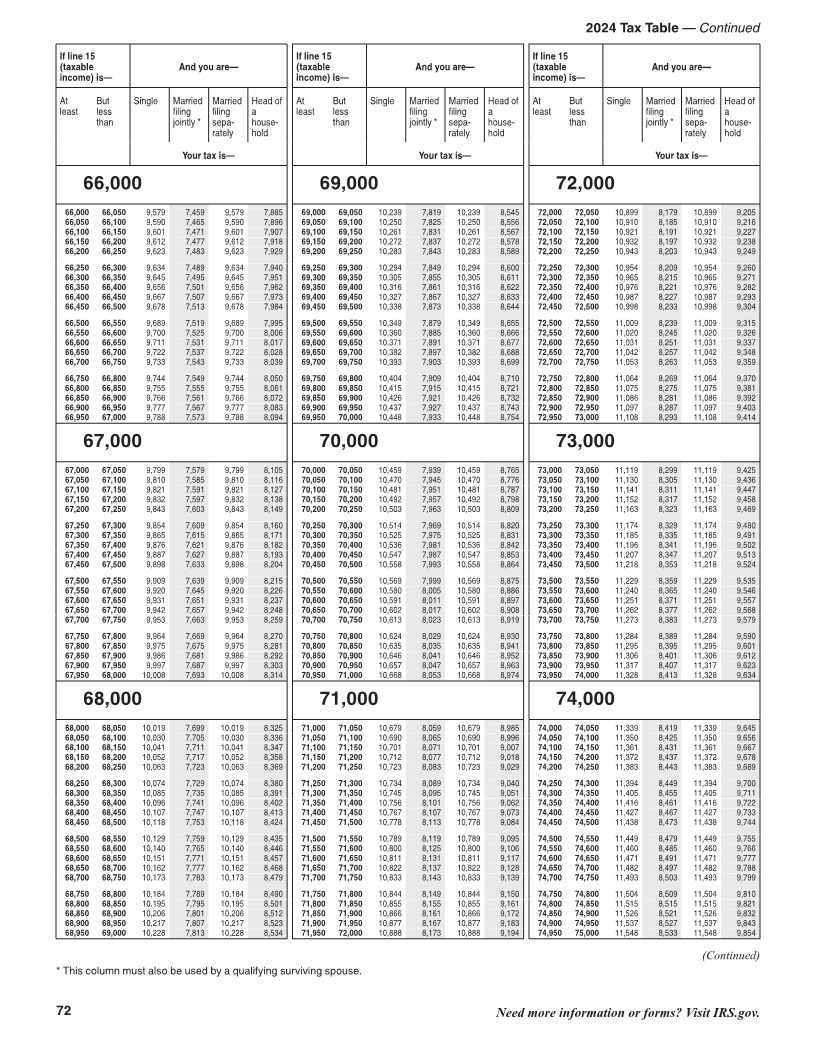

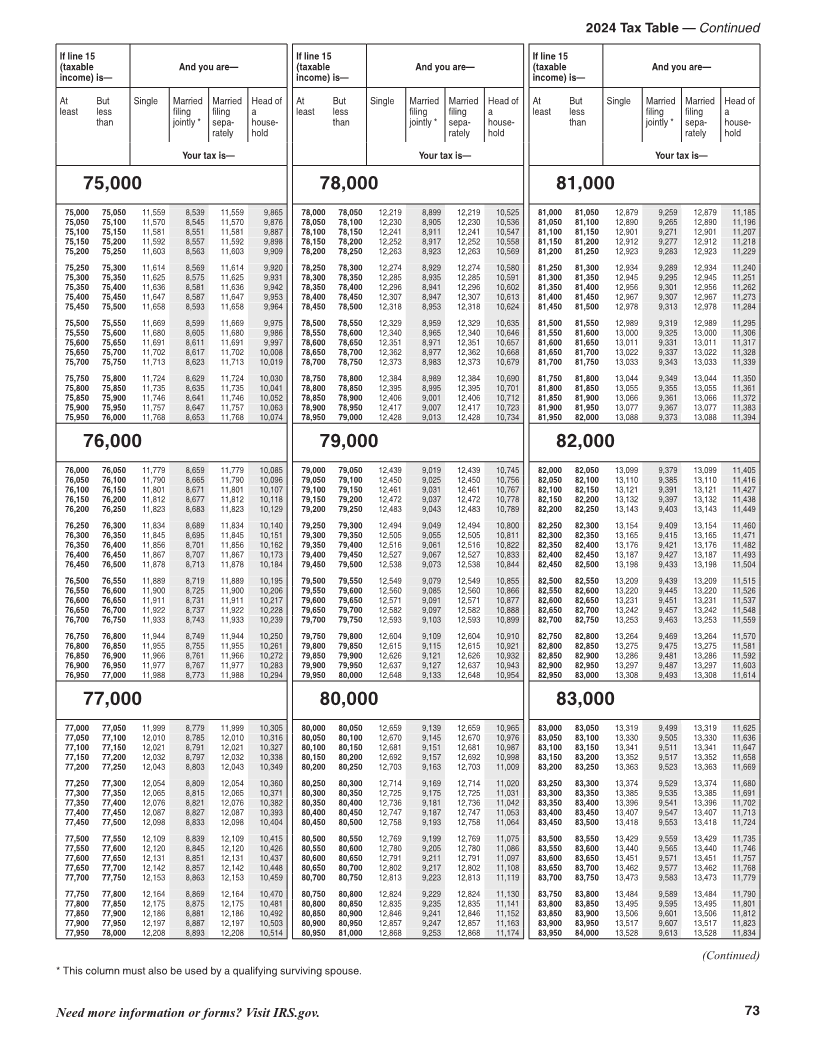

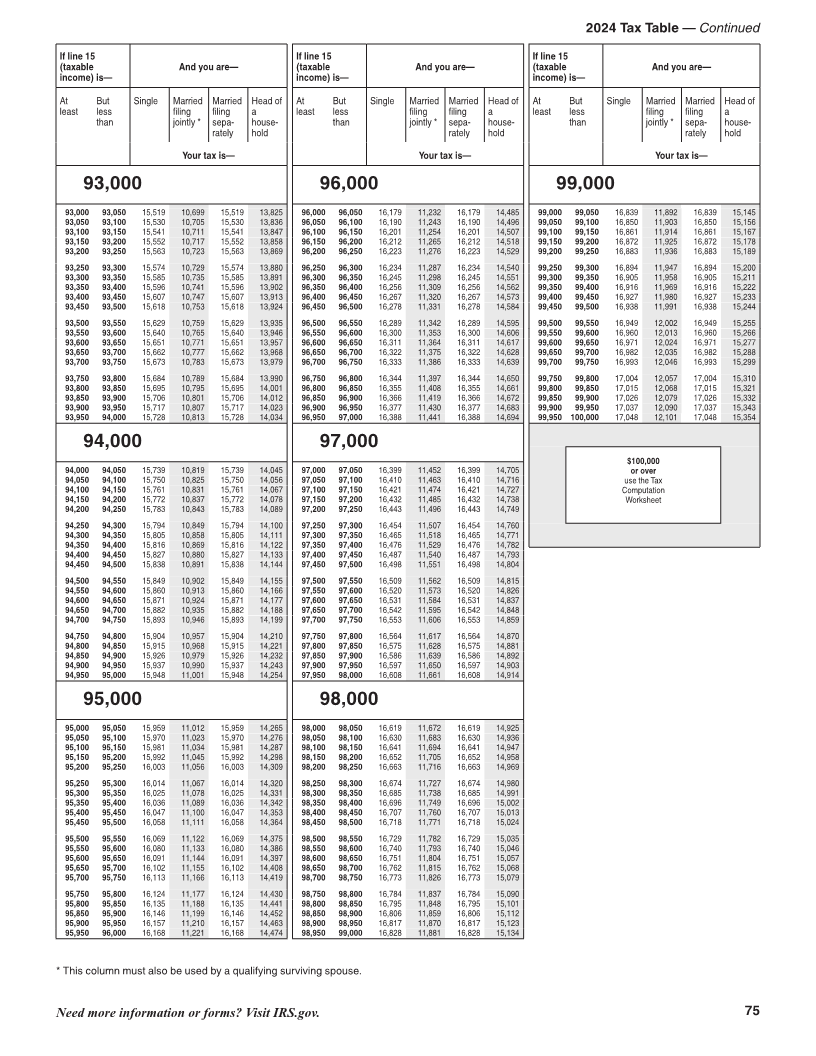

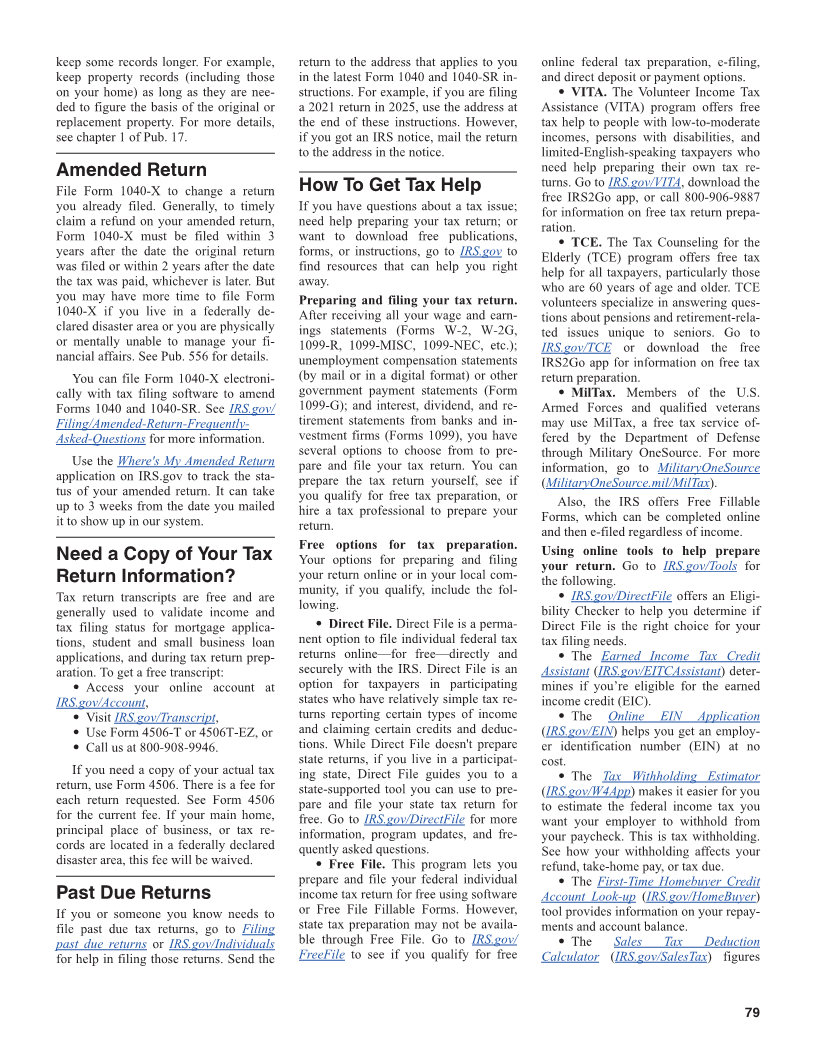

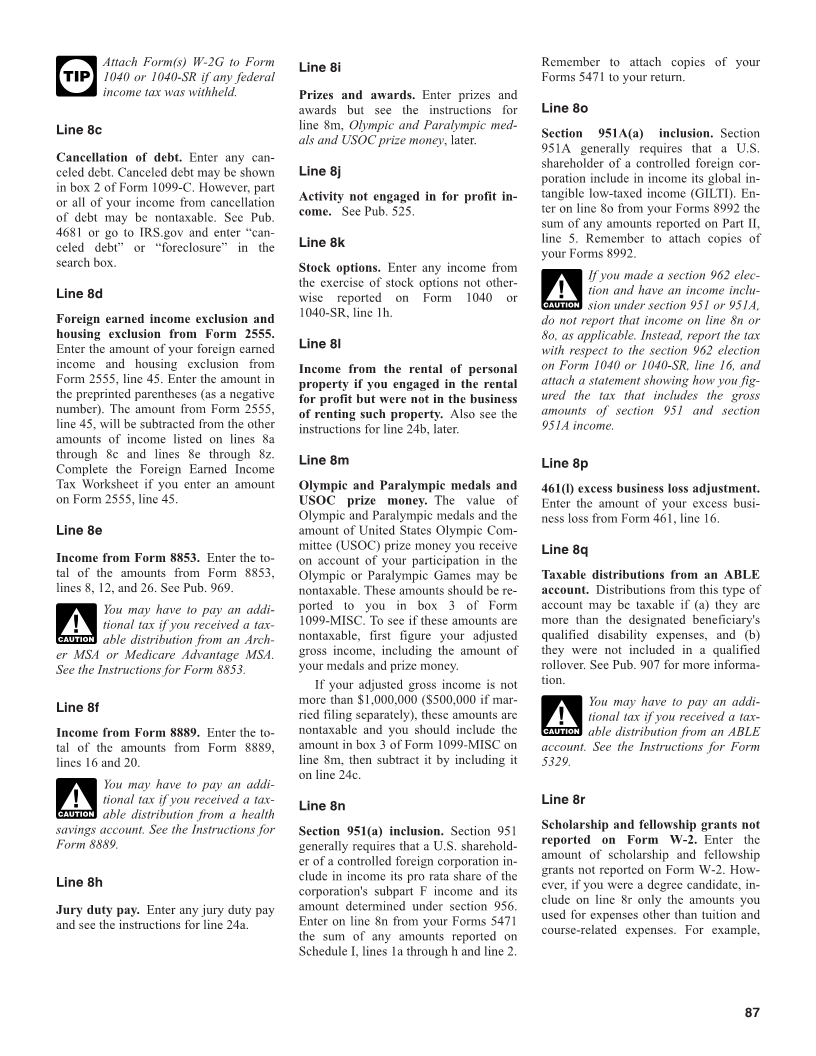

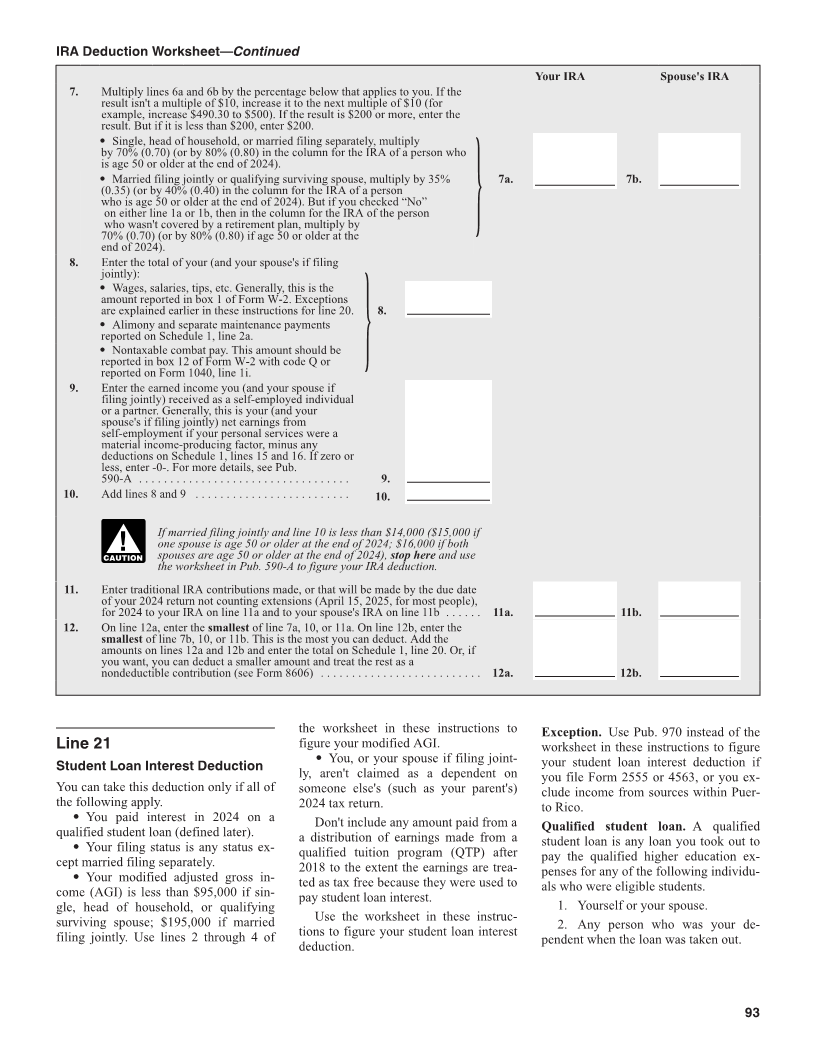

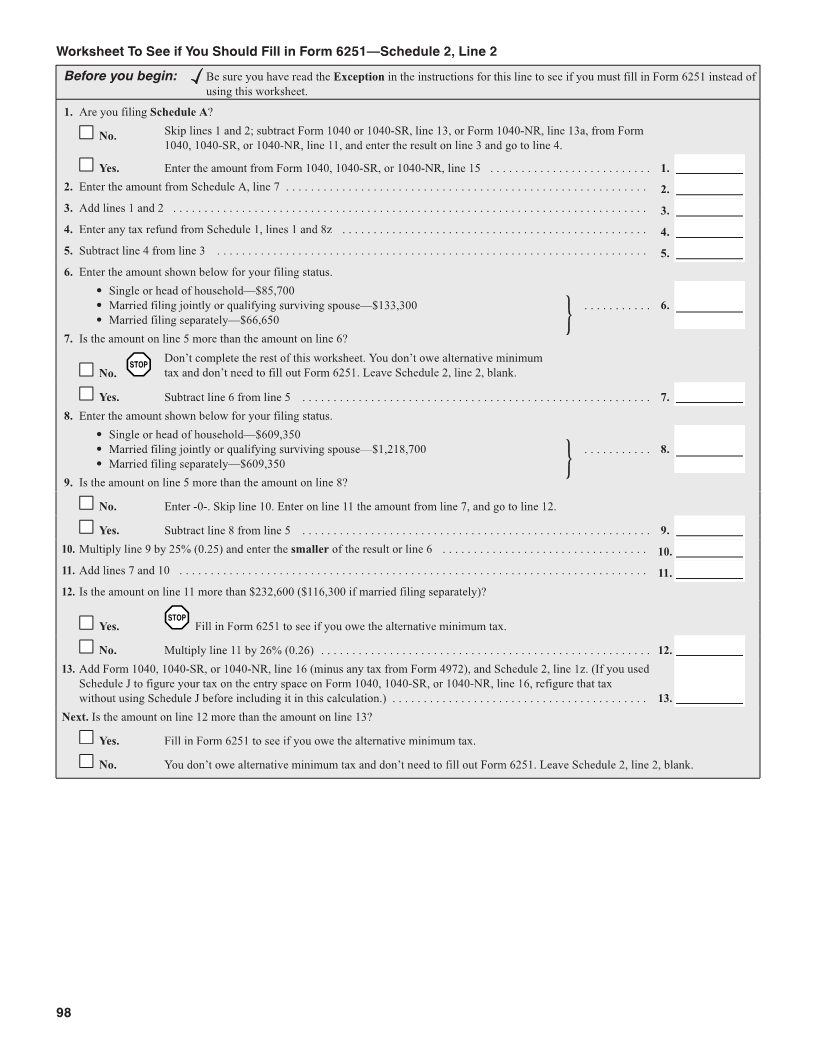

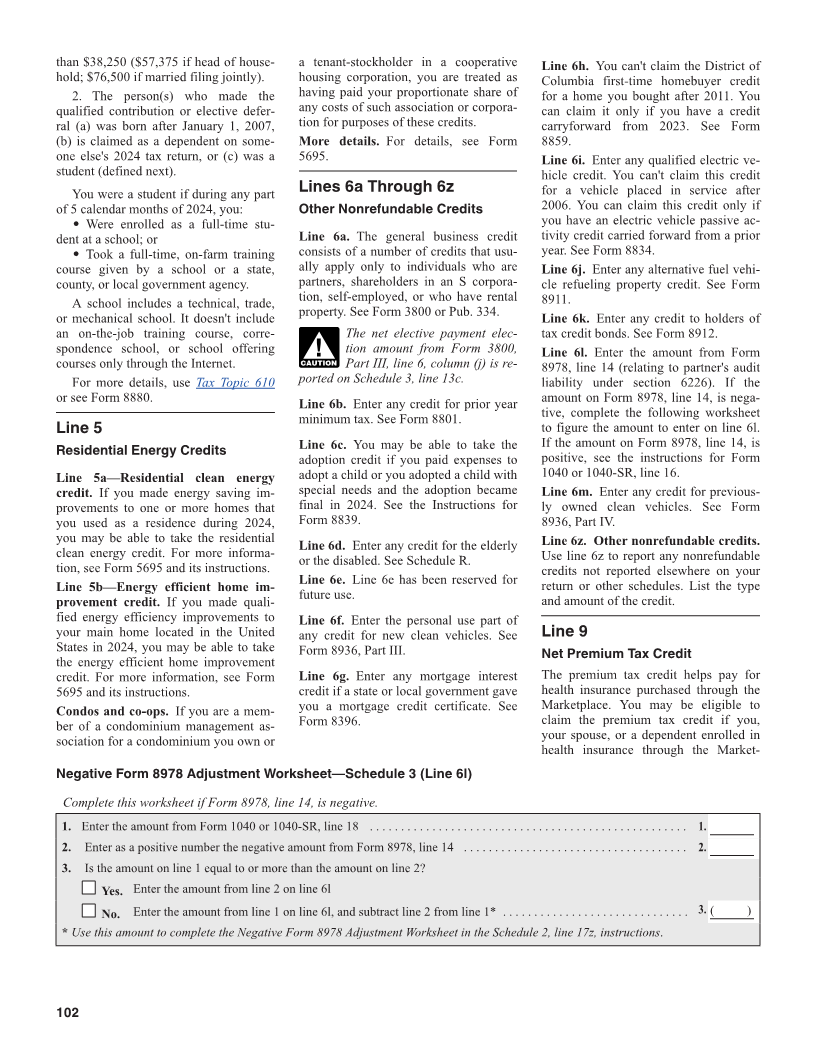

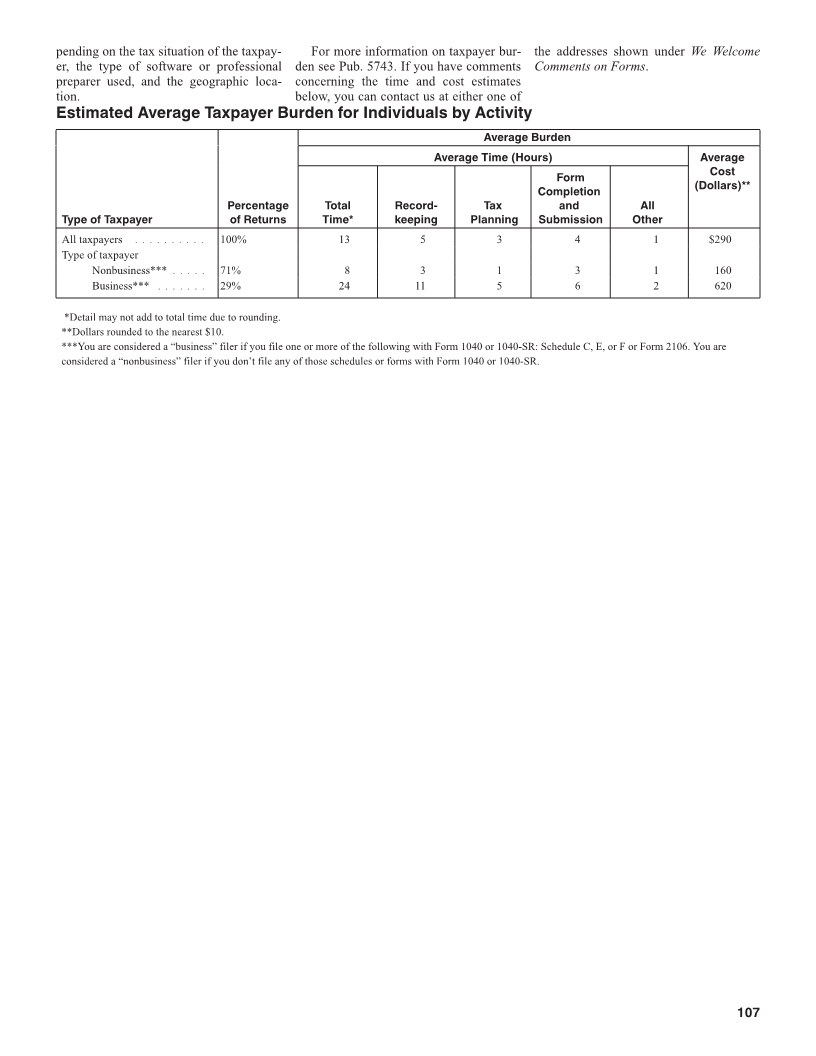

2024 Tax Table — Continued

If line 15 If line 15 If line 15

(taxable And you are— (taxable And you are— (taxable And you are—

income) is— income) is— income) is—

At But Single Married Married Head of At But Single Married Married Head of At But Single Married Married Head of

least less filing filing a least less filing filing a least less filing filing a

than jointly * sepa- house- than jointly * sepa- house- than jointly * sepa- house-

rately hold rately hold rately hold

Your tax is— Your tax is— Your tax is—

84,000 87,000 90,000

84,000 84,050 13,539 9,619 13,539 11,845 87,000 87,050 14,199 9,979 14,199 12,505 90,000 90,050 14,859 10,339 14,859 13,165

84,050 84,100 13,550 9,625 13,550 11,856 87,050 87,100 14,210 9,985 14,210 12,516 90,050 90,100 14,870 10,345 14,870 13,176

84,100 84,150 13,561 9,631 13,561 11,867 87,100 87,150 14,221 9,991 14,221 12,527 90,100 90,150 14,881 10,351 14,881 13,187

84,150 84,200 13,572 9,637 13,572 11,878 87,150 87,200 14,232 9,997 14,232 12,538 90,150 90,200 14,892 10,357 14,892 13,198

84,200 84,250 13,583 9,643 13,583 11,889 87,200 87,250 14,243 10,003 14,243 12,549 90,200 90,250 14,903 10,363 14,903 13,209

84,250 84,300 13,594 9,649 13,594 11,900 87,250 87,300 14,254 10,009 14,254 12,560 90,250 90,300 14,914 10,369 14,914 13,220

84,300 84,350 13,605 9,655 13,605 11,911 87,300 87,350 14,265 10,015 14,265 12,571 90,300 90,350 14,925 10,375 14,925 13,231

84,350 84,400 13,616 9,661 13,616 11,922 87,350 87,400 14,276 10,021 14,276 12,582 90,350 90,400 14,936 10,381 14,936 13,242

84,400 84,450 13,627 9,667 13,627 11,933 87,400 87,450 14,287 10,027 14,287 12,593 90,400 90,450 14,947 10,387 14,947 13,253

84,450 84,500 13,638 9,673 13,638 11,944 87,450 87,500 14,298 10,033 14,298 12,604 90,450 90,500 14,958 10,393 14,958 13,264

84,500 84,550 13,649 9,679 13,649 11,955 87,500 87,550 14,309 10,039 14,309 12,615 90,500 90,550 14,969 10,399 14,969 13,275

84,550 84,600 13,660 9,685 13,660 11,966 87,550 87,600 14,320 10,045 14,320 12,626 90,550 90,600 14,980 10,405 14,980 13,286

84,600 84,650 13,671 9,691 13,671 11,977 87,600 87,650 14,331 10,051 14,331 12,637 90,600 90,650 14,991 10,411 14,991 13,297

84,650 84,700 13,682 9,697 13,682 11,988 87,650 87,700 14,342 10,057 14,342 12,648 90,650 90,700 15,002 10,417 15,002 13,308

84,700 84,750 13,693 9,703 13,693 11,999 87,700 87,750 14,353 10,063 14,353 12,659 90,700 90,750 15,013 10,423 15,013 13,319

84,750 84,800 13,704 9,709 13,704 12,010 87,750 87,800 14,364 10,069 14,364 12,670 90,750 90,800 15,024 10,429 15,024 13,330

84,800 84,850 13,715 9,715 13,715 12,021 87,800 87,850 14,375 10,075 14,375 12,681 90,800 90,850 15,035 10,435 15,035 13,341

84,850 84,900 13,726 9,721 13,726 12,032 87,850 87,900 14,386 10,081 14,386 12,692 90,850 90,900 15,046 10,441 15,046 13,352

84,900 84,950 13,737 9,727 13,737 12,043 87,900 87,950 14,397 10,087 14,397 12,703 90,900 90,950 15,057 10,447 15,057 13,363

84,950 85,000 13,748 9,733 13,748 12,054 87,950 88,000 14,408 10,093 14,408 12,714 90,950 91,000 15,068 10,453 15,068 13,374

85,000 88,000 91,000

85,000 85,050 13,759 9,739 13,759 12,065 88,000 88,050 14,419 10,099 14,419 12,725 91,000 91,050 15,079 10,459 15,079 13,385

85,050 85,100 13,770 9,745 13,770 12,076 88,050 88,100 14,430 10,105 14,430 12,736 91,050 91,100 15,090 10,465 15,090 13,396

85,100 85,150 13,781 9,751 13,781 12,087 88,100 88,150 14,441 10,111 14,441 12,747 91,100 91,150 15,101 10,471 15,101 13,407

85,150 85,200 13,792 9,757 13,792 12,098 88,150 88,200 14,452 10,117 14,452 12,758 91,150 91,200 15,112 10,477 15,112 13,418

85,200 85,250 13,803 9,763 13,803 12,109 88,200 88,250 14,463 10,123 14,463 12,769 91,200 91,250 15,123 10,483 15,123 13,429

85,250 85,300 13,814 9,769 13,814 12,120 88,250 88,300 14,474 10,129 14,474 12,780 91,250 91,300 15,134 10,489 15,134 13,440

85,300 85,350 13,825 9,775 13,825 12,131 88,300 88,350 14,485 10,135 14,485 12,791 91,300 91,350 15,145 10,495 15,145 13,451

85,350 85,400 13,836 9,781 13,836 12,142 88,350 88,400 14,496 10,141 14,496 12,802 91,350 91,400 15,156 10,501 15,156 13,462

85,400 85,450 13,847 9,787 13,847 12,153 88,400 88,450 14,507 10,147 14,507 12,813 91,400 91,450 15,167 10,507 15,167 13,473

85,450 85,500 13,858 9,793 13,858 12,164 88,450 88,500 14,518 10,153 14,518 12,824 91,450 91,500 15,178 10,513 15,178 13,484

85,500 85,550 13,869 9,799 13,869 12,175 88,500 88,550 14,529 10,159 14,529 12,835 91,500 91,550 15,189 10,519 15,189 13,495

85,550 85,600 13,880 9,805 13,880 12,186 88,550 88,600 14,540 10,165 14,540 12,846 91,550 91,600 15,200 10,525 15,200 13,506

85,600 85,650 13,891 9,811 13,891 12,197 88,600 88,650 14,551 10,171 14,551 12,857 91,600 91,650 15,211 10,531 15,211 13,517

85,650 85,700 13,902 9,817 13,902 12,208 88,650 88,700 14,562 10,177 14,562 12,868 91,650 91,700 15,222 10,537 15,222 13,528

85,700 85,750 13,913 9,823 13,913 12,219 88,700 88,750 14,573 10,183 14,573 12,879 91,700 91,750 15,233 10,543 15,233 13,539

85,750 85,800 13,924 9,829 13,924 12,230 88,750 88,800 14,584 10,189 14,584 12,890 91,750 91,800 15,244 10,549 15,244 13,550

85,800 85,850 13,935 9,835 13,935 12,241 88,800 88,850 14,595 10,195 14,595 12,901 91,800 91,850 15,255 10,555 15,255 13,561

85,850 85,900 13,946 9,841 13,946 12,252 88,850 88,900 14,606 10,201 14,606 12,912 91,850 91,900 15,266 10,561 15,266 13,572

85,900 85,950 13,957 9,847 13,957 12,263 88,900 88,950 14,617 10,207 14,617 12,923 91,900 91,950 15,277 10,567 15,277 13,583

85,950 86,000 13,968 9,853 13,968 12,274 88,950 89,000 14,628 10,213 14,628 12,934 91,950 92,000 15,288 10,573 15,288 13,594

86,000 89,000 92,000

86,000 86,050 13,979 9,859 13,979 12,285 89,000 89,050 14,639 10,219 14,639 12,945 92,000 92,050 15,299 10,579 15,299 13,605

86,050 86,100 13,990 9,865 13,990 12,296 89,050 89,100 14,650 10,225 14,650 12,956 92,050 92,100 15,310 10,585 15,310 13,616

86,100 86,150 14,001 9,871 14,001 12,307 89,100 89,150 14,661 10,231 14,661 12,967 92,100 92,150 15,321 10,591 15,321 13,627

86,150 86,200 14,012 9,877 14,012 12,318 89,150 89,200 14,672 10,237 14,672 12,978 92,150 92,200 15,332 10,597 15,332 13,638

86,200 86,250 14,023 9,883 14,023 12,329 89,200 89,250 14,683 10,243 14,683 12,989 92,200 92,250 15,343 10,603 15,343 13,649

86,250 86,300 14,034 9,889 14,034 12,340 89,250 89,300 14,694 10,249 14,694 13,000 92,250 92,300 15,354 10,609 15,354 13,660

86,300 86,350 14,045 9,895 14,045 12,351 89,300 89,350 14,705 10,255 14,705 13,011 92,300 92,350 15,365 10,615 15,365 13,671

86,350 86,400 14,056 9,901 14,056 12,362 89,350 89,400 14,716 10,261 14,716 13,022 92,350 92,400 15,376 10,621 15,376 13,682

86,400 86,450 14,067 9,907 14,067 12,373 89,400 89,450 14,727 10,267 14,727 13,033 92,400 92,450 15,387 10,627 15,387 13,693

86,450 86,500 14,078 9,913 14,078 12,384 89,450 89,500 14,738 10,273 14,738 13,044 92,450 92,500 15,398 10,633 15,398 13,704

86,500 86,550 14,089 9,919 14,089 12,395 89,500 89,550 14,749 10,279 14,749 13,055 92,500 92,550 15,409 10,639 15,409 13,715

86,550 86,600 14,100 9,925 14,100 12,406 89,550 89,600 14,760 10,285 14,760 13,066 92,550 92,600 15,420 10,645 15,420 13,726

86,600 86,650 14,111 9,931 14,111 12,417 89,600 89,650 14,771 10,291 14,771 13,077 92,600 92,650 15,431 10,651 15,431 13,737

86,650 86,700 14,122 9,937 14,122 12,428 89,650 89,700 14,782 10,297 14,782 13,088 92,650 92,700 15,442 10,657 15,442 13,748

86,700 86,750 14,133 9,943 14,133 12,439 89,700 89,750 14,793 10,303 14,793 13,099 92,700 92,750 15,453 10,663 15,453 13,759

86,750 86,800 14,144 9,949 14,144 12,450 89,750 89,800 14,804 10,309 14,804 13,110 92,750 92,800 15,464 10,669 15,464 13,770

86,800 86,850 14,155 9,955 14,155 12,461 89,800 89,850 14,815 10,315 14,815 13,121 92,800 92,850 15,475 10,675 15,475 13,781

86,850 86,900 14,166 9,961 14,166 12,472 89,850 89,900 14,826 10,321 14,826 13,132 92,850 92,900 15,486 10,681 15,486 13,792

86,900 86,950 14,177 9,967 14,177 12,483 89,900 89,950 14,837 10,327 14,837 13,143 92,900 92,950 15,497 10,687 15,497 13,803

86,950 87,000 14,188 9,973 14,188 12,494 89,950 90,000 14,848 10,333 14,848 13,154 92,950 93,000 15,508 10,693 15,508 13,814

(Continued)

* This column must also be used by a qualifying surviving spouse.

74 Need more information or forms? Visit IRS.gov.

|