Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 9.5 Draft Ok to Print

instrx

AH XSL/XML Fileid: … orm-1042-s/2025/a/xml/cycle06/source (Init. & Date) _______

Page 1 of 42 11:29 - 4-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

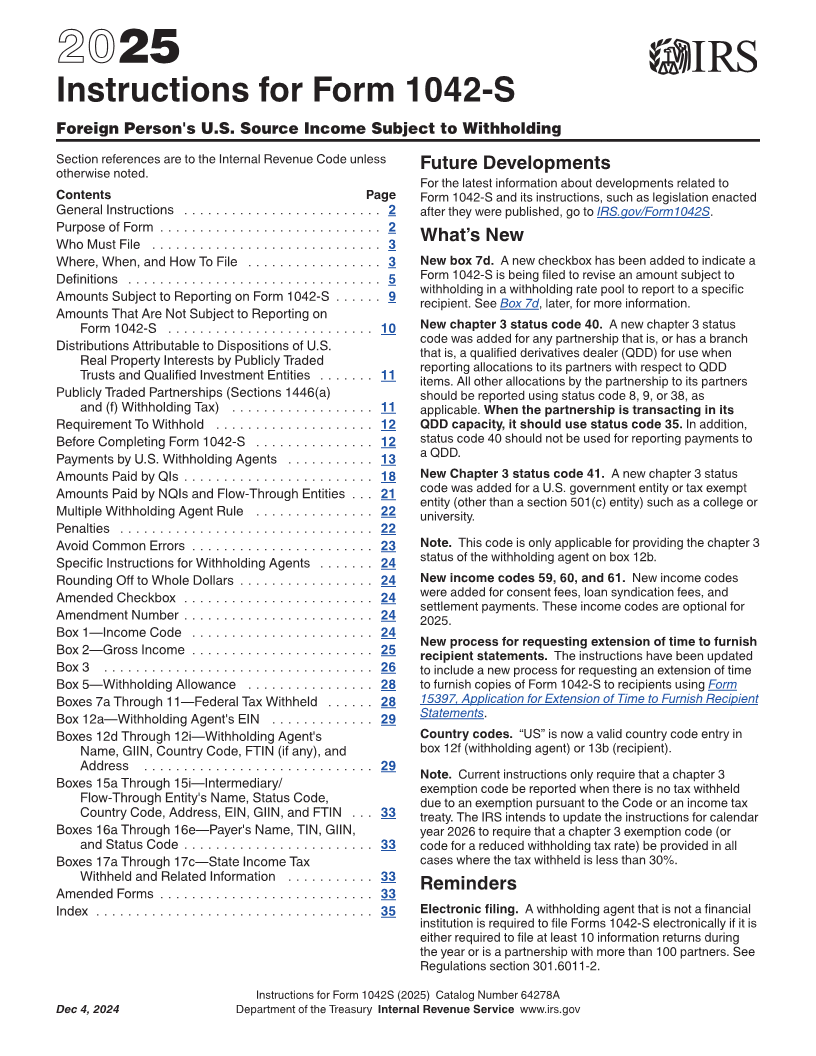

2025

Instructions for Form 1042-S

Foreign Person's U.S. Source Income Subject to Withholding

Section references are to the Internal Revenue Code unless

Future Developments

otherwise noted.

For the latest information about developments related to

Contents Page Form 1042-S and its instructions, such as legislation enacted

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 2 after they were published, go to IRS.gov/Form1042S.

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Who Must File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 What’s New

Where, When, and How To File . . . . . . . . . . . . . . . . . 3 New box 7d. A new checkbox has been added to indicate a

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Form 1042-S is being filed to revise an amount subject to

withholding in a withholding rate pool to report to a specific

Amounts Subject to Reporting on Form 1042-S . . . . . . 9 recipient. See Box 7d, later, for more information.

Amounts That Are Not Subject to Reporting on

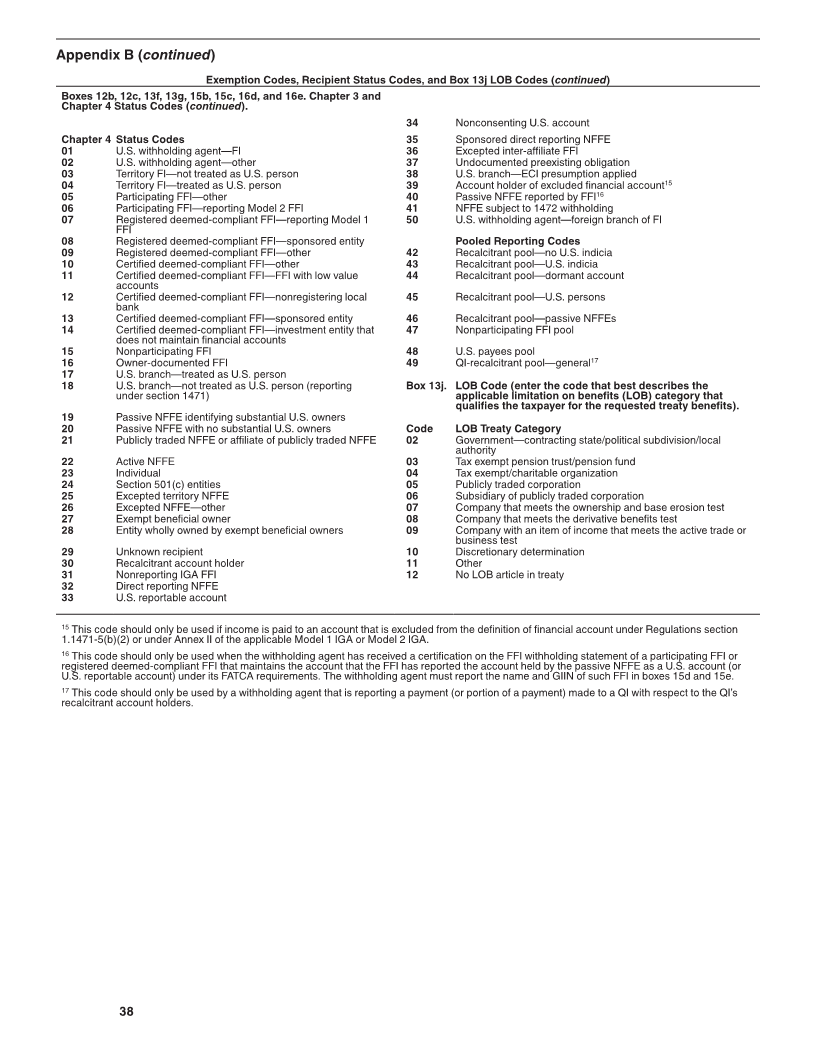

Form 1042-S . . . . . . . . . . . . . . . . . . . . . . . . . . 10 New chapter 3 status code 40. A new chapter 3 status

code was added for any partnership that is, or has a branch

Distributions Attributable to Dispositions of U.S.

that is, a qualified derivatives dealer (QDD) for use when

Real Property Interests by Publicly Traded reporting allocations to its partners with respect to QDD

Trusts and Qualified Investment Entities . . . . . . . 11 items. All other allocations by the partnership to its partners

Publicly Traded Partnerships (Sections 1446(a) should be reported using status code 8, 9, or 38, as

and (f) Withholding Tax) . . . . . . . . . . . . . . . . . . 11 applicable. When the partnership is transacting in its

Requirement To Withhold . . . . . . . . . . . . . . . . . . . . 12 QDD capacity, it should use status code 35. In addition,

Before Completing Form 1042-S . . . . . . . . . . . . . . . 12 status code 40 should not be used for reporting payments to

a QDD.

Payments by U.S. Withholding Agents . . . . . . . . . . . 13

Amounts Paid by QIs . . . . . . . . . . . . . . . . . . . . . . . . 18 New Chapter 3 status code 41. A new chapter 3 status

Amounts Paid by NQIs and Flow-Through Entities . . . 21 code was added for a U.S. government entity or tax exempt

entity (other than a section 501(c) entity) such as a college or

Multiple Withholding Agent Rule . . . . . . . . . . . . . . . 22 university.

Penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Avoid Common Errors . . . . . . . . . . . . . . . . . . . . . . . 23 Note. This code is only applicable for providing the chapter 3

Specific Instructions for Withholding Agents . . . . . . . 24 status of the withholding agent on box 12b.

Rounding Off to Whole Dollars . . . . . . . . . . . . . . . . . 24 New income codes 59, 60, and 61. New income codes

Amended Checkbox . . . . . . . . . . . . . . . . . . . . . . . . 24 were added for consent fees, loan syndication fees, and

settlement payments. These income codes are optional for

Amendment Number . . . . . . . . . . . . . . . . . . . . . . . . 24 2025.

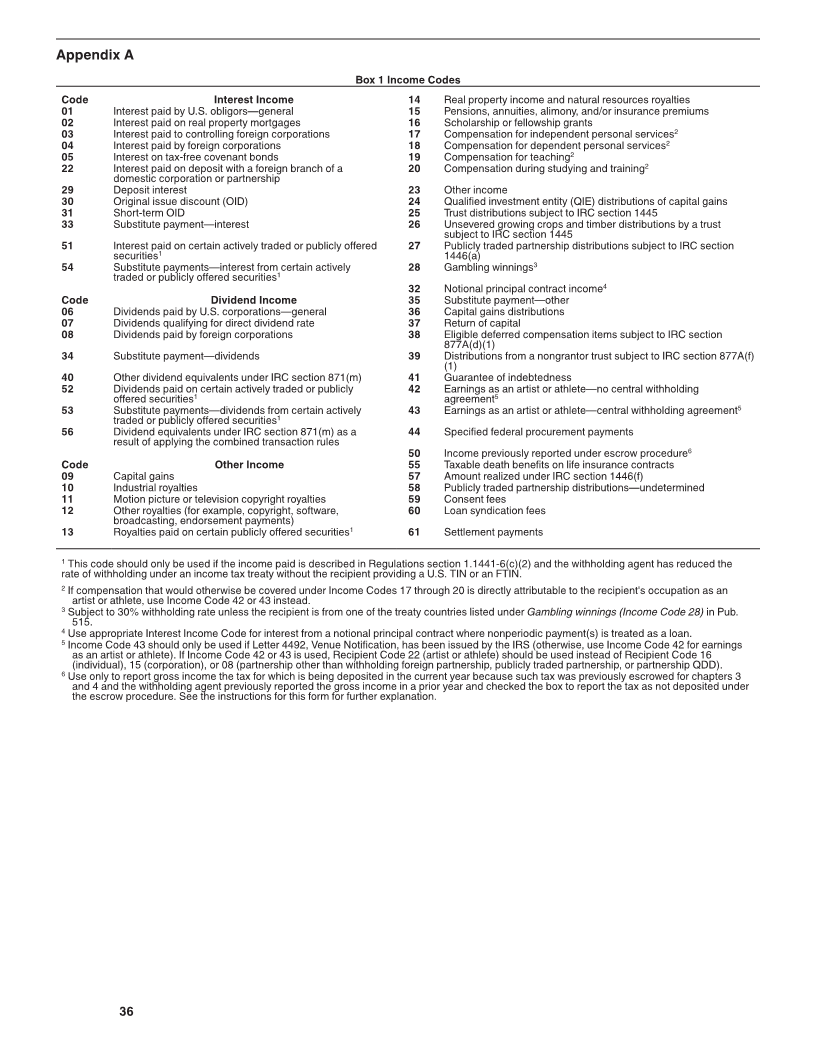

Box 1—Income Code . . . . . . . . . . . . . . . . . . . . . . . 24

New process for requesting extension of time to furnish

Box 2—Gross Income . . . . . . . . . . . . . . . . . . . . . . . 25 recipient statements. The instructions have been updated

Box 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 to include a new process for requesting an extension of time

Box 5—Withholding Allowance . . . . . . . . . . . . . . . . 28 to furnish copies of Form 1042-S to recipients using Form

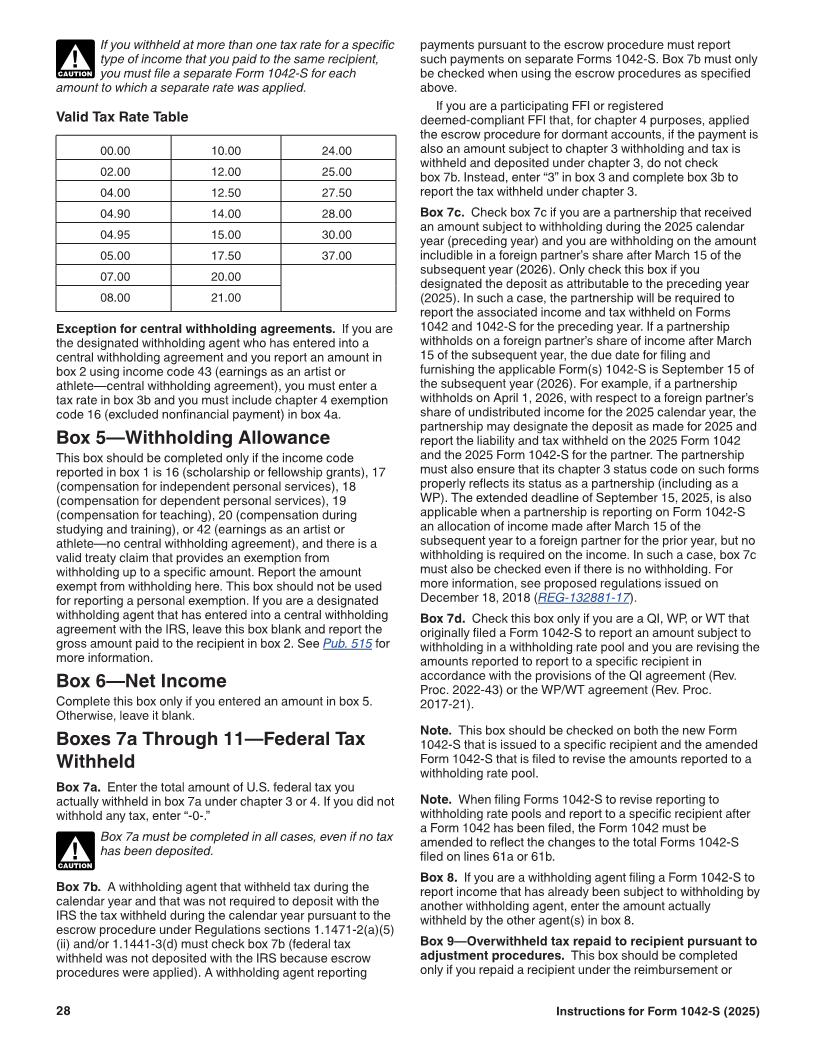

Boxes 7a Through 11—Federal Tax Withheld . . . . . . 28 15397, Application for Extension of Time to Furnish Recipient

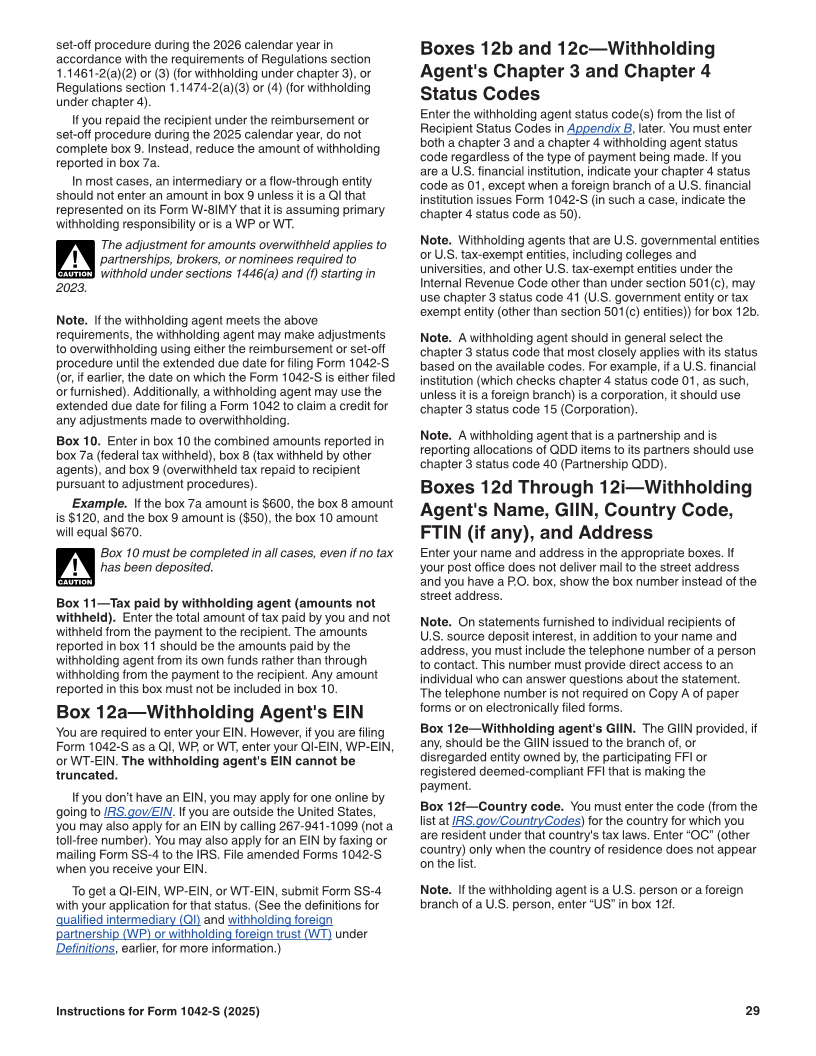

Box 12a—Withholding Agent's EIN . . . . . . . . . . . . . 29 Statements.

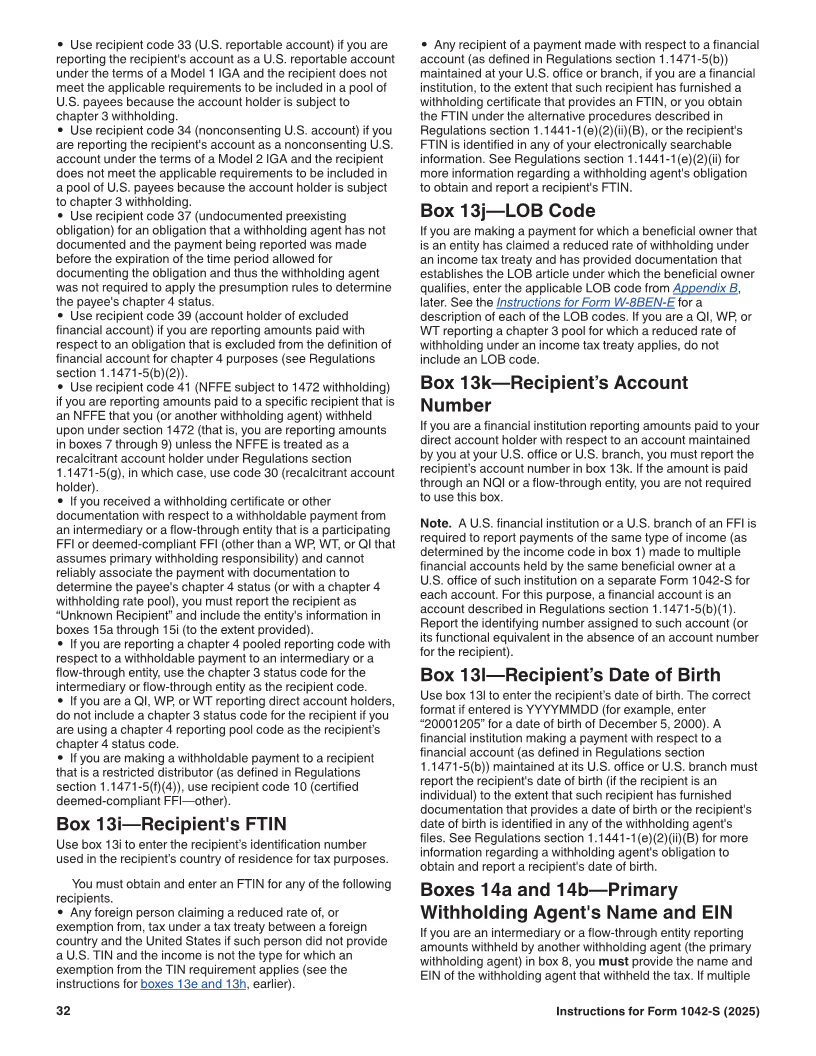

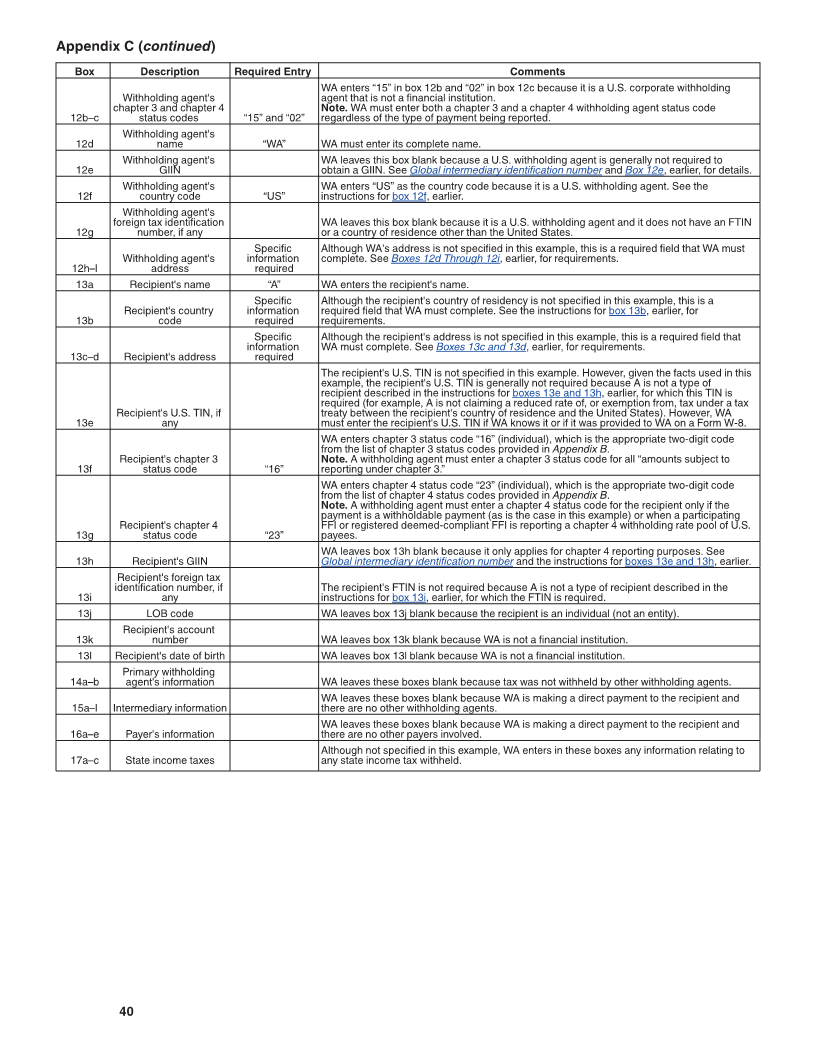

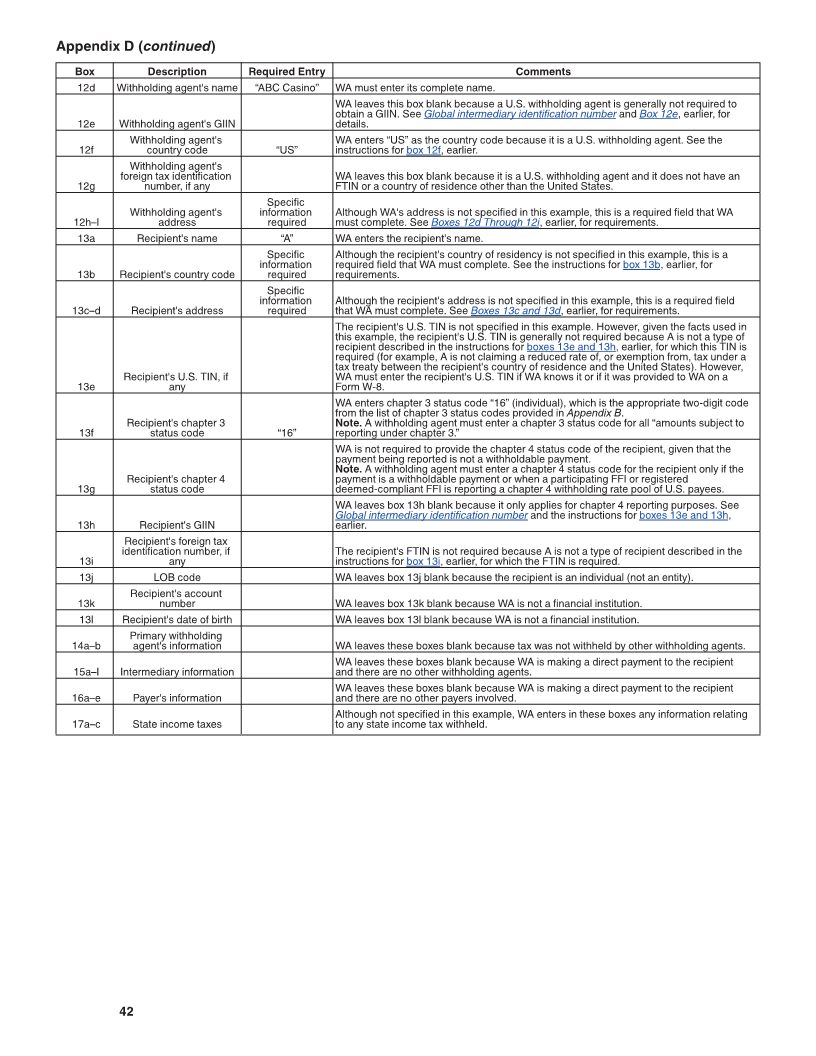

Boxes 12d Through 12i—Withholding Agent's Country codes. “US” is now a valid country code entry in

Name, GIIN, Country Code, FTIN (if any), and box 12f (withholding agent) or 13b (recipient).

Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Note. Current instructions only require that a chapter 3

Boxes 15a Through 15i—Intermediary/ exemption code be reported when there is no tax withheld

Flow-Through Entity's Name, Status Code, due to an exemption pursuant to the Code or an income tax

Country Code, Address, EIN, GIIN, and FTIN . . . 33 treaty. The IRS intends to update the instructions for calendar

Boxes 16a Through 16e—Payer's Name, TIN, GIIN, year 2026 to require that a chapter 3 exemption code (or

and Status Code . . . . . . . . . . . . . . . . . . . . . . . . 33 code for a reduced withholding tax rate) be provided in all

Boxes 17a Through 17c—State Income Tax cases where the tax withheld is less than 30%.

Withheld and Related Information . . . . . . . . . . . 33

Reminders

Amended Forms . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

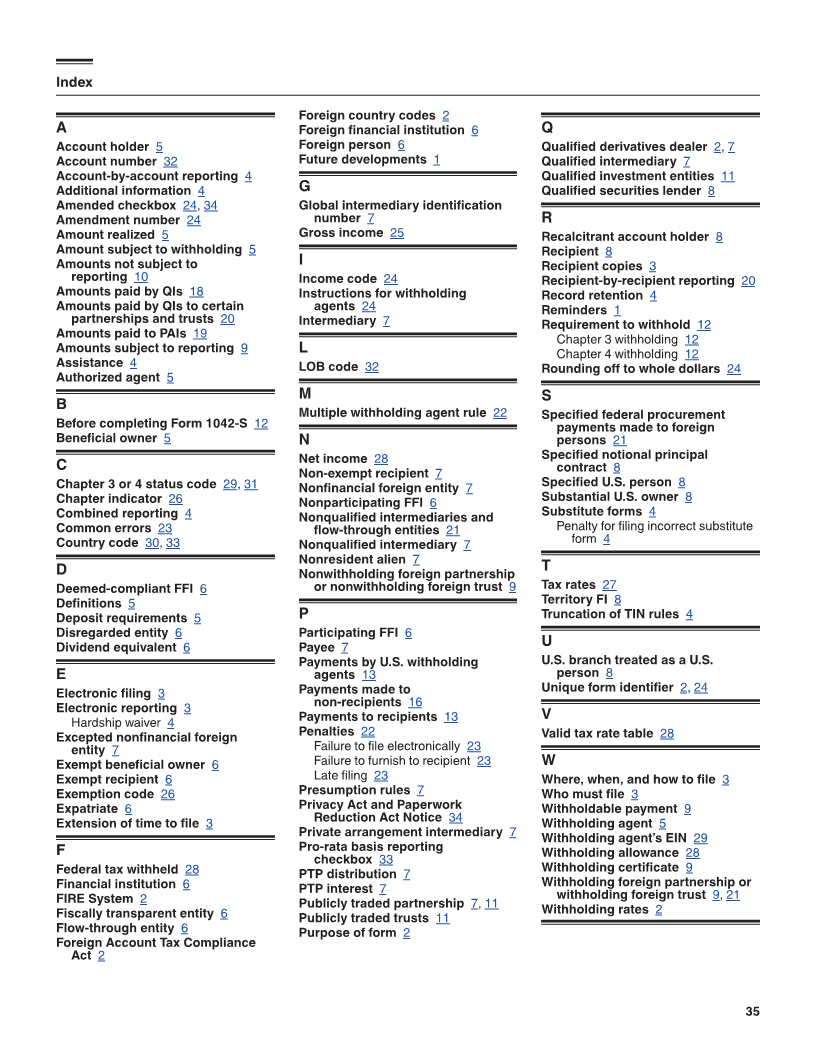

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 Electronic filing. A withholding agent that is not a financial

institution is required to file Forms 1042-S electronically if it is

either required to file at least 10 information returns during

the year or is a partnership with more than 100 partners. See

Regulations section 301.6011-2.

Instructions for Form 1042S (2025) Catalog Number 64278A

Dec 4, 2024 Department of the Treasury Internal Revenue Service www.irs.gov