Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

i1040x

AH XSL/XML Fileid: … form-1040)/2024/a/xml/cycle08/source (Init. & Date) _______

Page 1 of 21 10:23 - 6-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

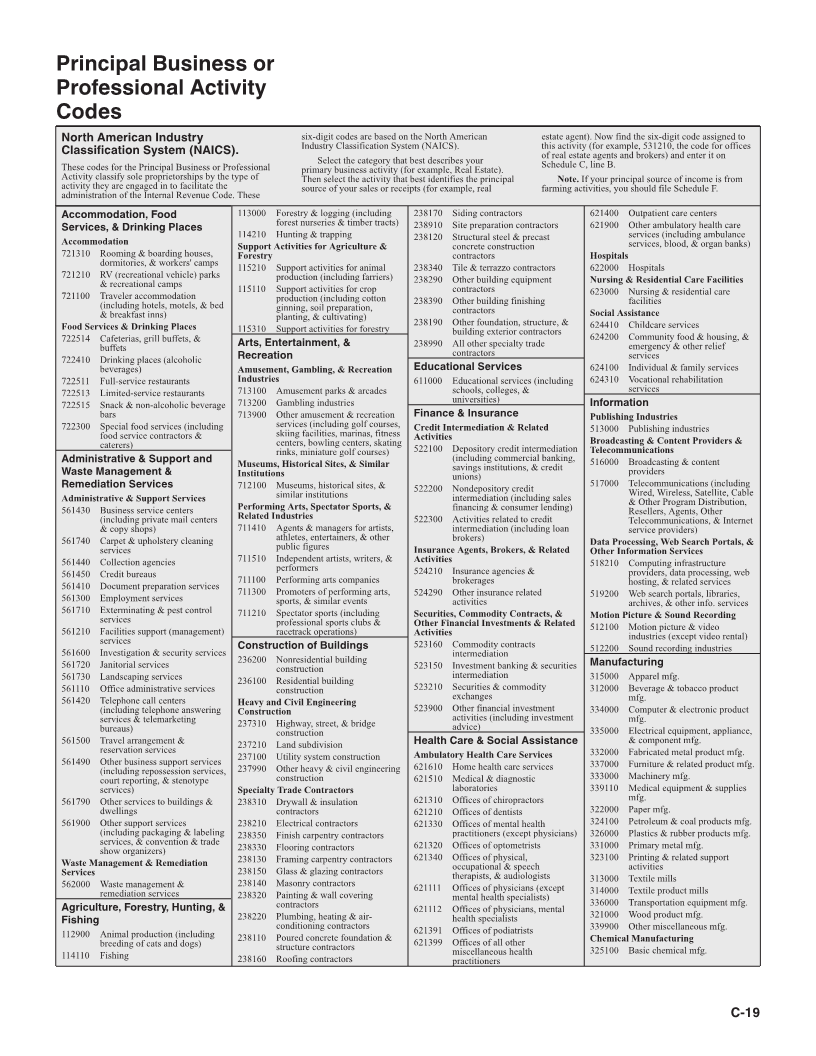

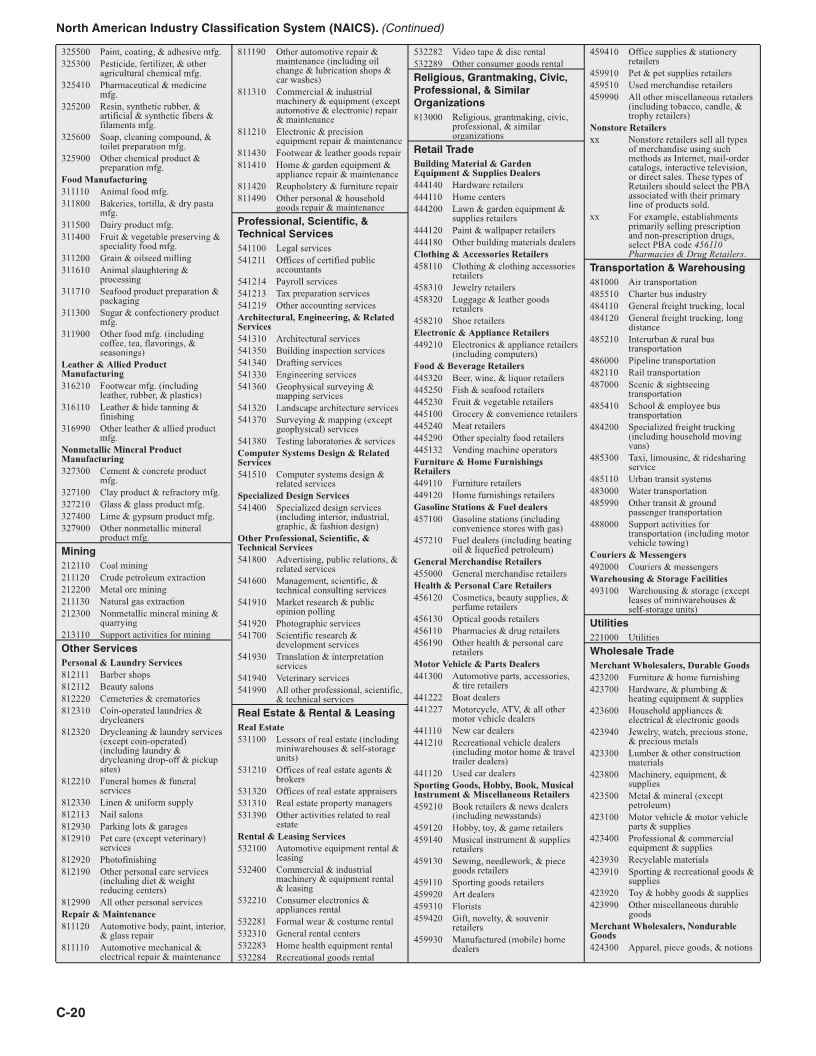

2024 Instructions for Schedule C

Use Schedule C (Form 1040) to report income or (loss) from a business you operated

Profit or Loss or a profession you practiced as a sole proprietor. An activity qualifies as a business if

your primary purpose for engaging in the activity is for income or profit and you are

From Business involved in the activity with continuity and regularity. For example, a sporadic activi-

ty, a not-for-profit activity, or a hobby does not qualify as a business. To report income

from a nonbusiness activity, see the instructions for Schedule 1 (Form 1040), line 8j.

Also, use Schedule C to report (a) wages and expenses you had as a statutory em-

ployee; (b) income and deductions of certain qualified joint ventures; and (c) certain

amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and

Form 1099-K. See the instructions on your Form 1099 for more information about

what to report on Schedule C.

You may be subject to state and local taxes and other requirements such as business

licenses and fees. Check with your state and local governments for more information.

Section references are to the Internal additional information, see the Instruc- See Form 461 and its instructions for

Revenue Code unless otherwise noted. tions for Form 1040-SS. details on the excess business loss limi-

Business meals deduction. The busi- tation.

Future Developments ness meals deduction is 50%. Small Business and Self-Employed

For the latest information about devel- Reporting nontaxable Medicaid waiv- (SB/SE) Tax Center. Do you need help

opments related to Schedule C and its er payments. Certain Medicaid waiver with a tax issue or preparing your return,

instructions, such as legislation enacted payments that are reported to you on or do you need a free publication or

after they were published, go to IRS.gov/ Form 1099-MISC or Form 1099-NEC form? SB/SE serves taxpayers who file

ScheduleC. may be nontaxable. For information on Form 1040, 1040-SR, Schedules C, E, F,

how to report those payments on Sched- or Form 2106, as well as small business

What's New ule C, see Medicaid waiver payments, taxpayers with assets under $10 million.

later. For additional information, go to the

Form 1040-SS filers and business use Small Business and Self-Employed Tax

of home. For 2024, taxpayers who file Gig economy tax center. The gig (or

Center at IRS.gov/SmallBiz.

Form 1040-SS and claim a deduction for on-demand, sharing, or access) economy

business use of home will report the ex- refers to an activity where people earn

pense on Schedule C (Form 1040). Fil- income providing on-demand work, General

ers will use Form 8829, Expenses for services, or goods. Go to IRS.gov/Gig to

Business Use of Your Home, if applica- get more information about the tax con- Instructions

ble, to figure the deduction and report sequences of participating in the gig Other Schedules and Forms

the amount on Schedule C, line 30. economy.

You May Have To File

Standard mileage rate. The business Excess business loss limitation. If you

standard mileage rate for 2024 is 67 report a loss on line 31 of your Sched- • Schedule A (Form 1040) to deduct

interest, taxes, and casualty losses not

cents per mile. ule C (Form 1040), you may be subject

related to your business.

to a business loss limitation. The disal-

Bonus depreciation. The bonus depre- • Schedule E (Form 1040) to report

lowed loss resulting from the limitation

ciation deduction under section 168(k) rental real estate and royalty income or

will not be reflected on line 31 of your

continues its phaseout in 2024 with a re- (loss) that is not subject to

Schedule C. Instead, use Form 461 to

duction of the applicable limit from 80% self-employment tax.

determine the amount of your excess

to 60%. • Schedule F (Form 1040) to report

business loss, which will be included as

profit or (loss) from farming.

income on Schedule 1 (Form 1040),

Reminders line 8p. Any disallowed loss resulting • Schedule J (Form 1040) to figure

your tax by averaging your farming or

Redesigned Form 1040-SS. Sched- from this limitation will be treated as a

fishing income over the previous 3

ule C (Form 1040) is available to be net operating loss that must be carried

years. Doing so may reduce your tax.

filed with Form 1040-SS, if applicable. forward and deducted in a subsequent

It replaces Form 1040-SS, Part IV. For year. • Schedule SE (Form 1040) to pay

self-employment tax on income from

any trade or business.

Instructions for Schedule C (Form 1040) (2024) Catalog Number 24329W

Dec 6, 2024 Department of the Treasury Internal Revenue Service www.irs.gov