Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 11 Draft Ok to Print

i1040x

AH XSL/XML Fileid: … form-1040)/2024/b/xml/cycle06/source (Init. & Date) _______

Page 1 of 8 6:26 - 20-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024 Instructions for Schedule R

Use Schedule R (Form 1040) to figure the credit for the elderly or the disa-

Credit for the bled.

Elderly or the

Disabled

Future developments. For the latest information about Age 65

developments related to Schedule R (Form 1040) and its You are considered age 65 on the day before your 65th

instructions, such as legislation enacted after they were birthday. As a result, if you were born on January 1,

published, go to IRS.gov/ScheduleR. 1960, you are considered to be age 65 at the end of 2024.

Death of taxpayer. If you are preparing a return for

What’s New someone who died in 2024, consider the taxpayer to be

Pub. 524 discontinued. We have discontinued Pub. 524, age 65 at the end of 2024 if they were age 65 or older on

Credit for the Elderly or the Disabled; the last revision the day before their death. For example, if the taxpayer

was for 2023. All the pertinent information from Pub. was born on February 14, 1959, and died on February 13,

524 has been incorporated into the Instructions for 2024, the taxpayer is considered age 65 at the time of

Schedule R. Prior revisions of Pub. 524 will remain death. However, if the taxpayer died on February 12,

available at IRS.gov/Pub524. 2024, the taxpayer isn't considered age 65 at the time of

death or at the end of 2024.

General Instructions U.S. Citizen or Resident Alien

Who Can Take the Credit You must be a U.S. citizen or resident alien (or be treated

You can take the credit for the elderly or the disabled if as a resident alien) to take the credit. Generally, you can't

you meet both of the following requirements. take the credit if you were a nonresident alien at any time

• You are a qualified individual. during the tax year.

• Your income isn't more than certain limits. Exceptions. You may be able to take the credit if you are

a nonresident alien who is married to a U.S. citizen or

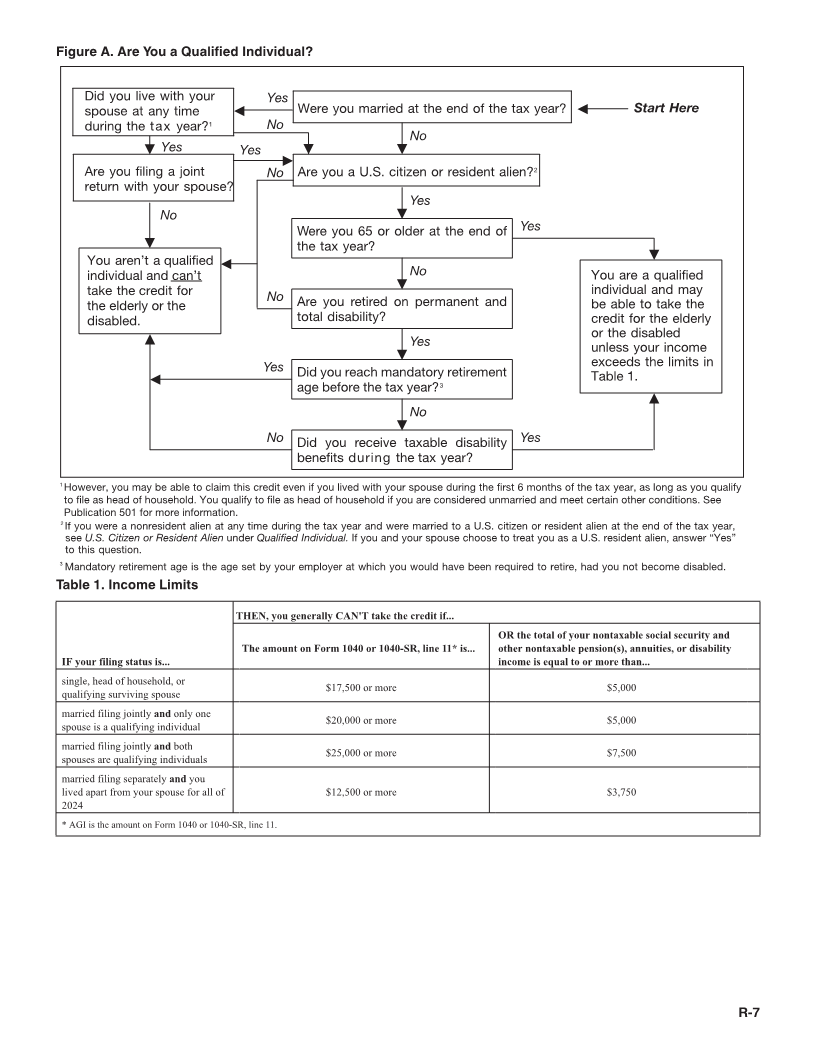

You can use Figure A and Table 1 as guides to see if

resident alien at the end of the tax year and you and your

you are eligible for the credit. Use Figure A first to see if

spouse choose to treat you as a U.S. resident alien. If you

you are a qualified individual. If you are, then go to Ta-

make that choice, both you and your spouse are taxed on

ble 1 to make sure your income isn’t too high to take the

your worldwide incomes.

credit.

If you were a nonresident alien at the beginning of the

Qualified Individual year and a resident alien at the end of the year, and you

You are a qualified individual for this credit if you are a were married to a U.S. citizen or resident alien at the end

U.S. citizen or resident alien, and either of the following of the year, you may be able to choose to be treated as a

applies. U.S. resident alien for the entire year. In that case, you

may be allowed to take the credit.

1. You were age 65 or older at the end of 2024.

For information on these choices, see chapter 1 of Pub.

2. You were under age 65 (discussed later) at the end

519.

of 2024 and all three of the following statements are true.

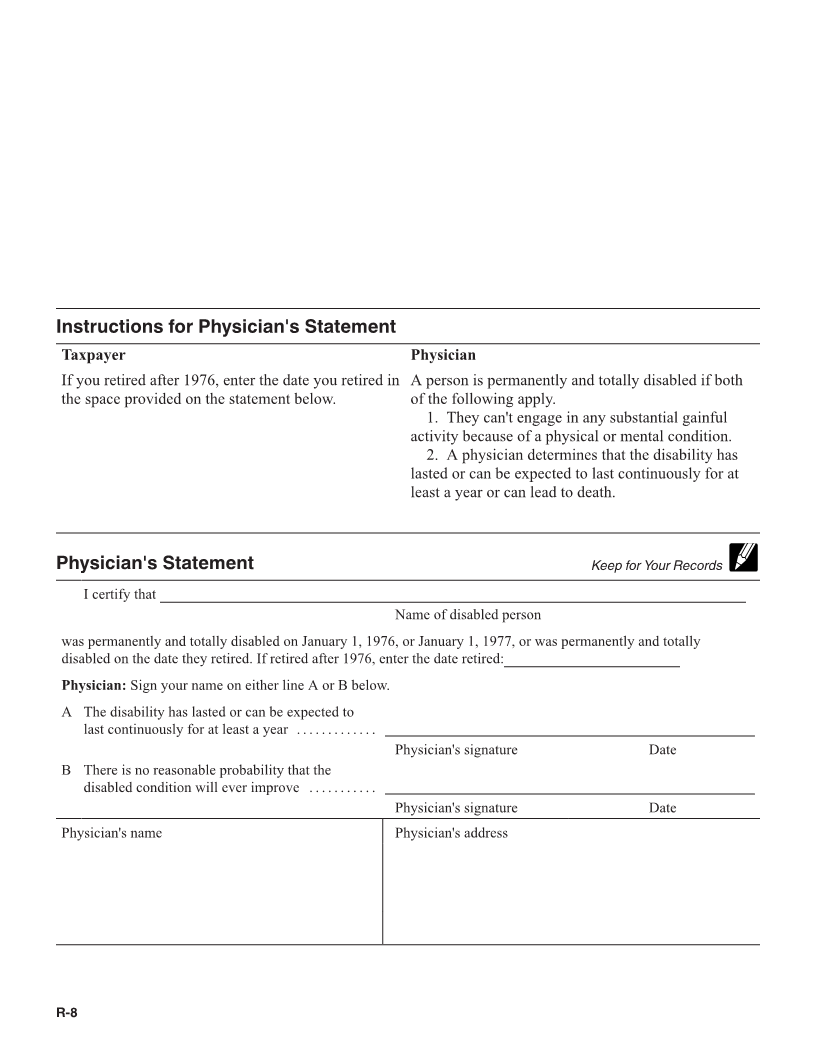

a. You retired on permanent and total disability. (See You can take the credit only if you file Form 1040

Permanent and Total Disability, later). TIP or 1040-SR. You can’t take the credit if you file

Form 1040-NR.

b. You receive taxable disability income for 2024.

c. On January 1, 2024, you had not reached mandato-

ry retirement age (defined later under Disability Income). Married Persons

Generally, if you are married at the end of the tax year,

you and your spouse must file a joint return to take the

Instructions for Schedule R (Form 1040) (2024) Catalog Number 11357O

Dec 18, 2024 Department of the Treasury Internal Revenue Service www.irs.gov