Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

i1040x

AH XSL/XML Fileid: … form-1040)/2024/a/xml/cycle06/source (Init. & Date) _______

Page 1 of 12 15:02 - 20-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024 Instructions for Schedule H

Here is a list of forms that household employers need to

Household

complete.

Employment • Schedule H (Form 1040) for figuring your household employment taxes.

• Form W-2 (or Form 499R-2/W-2PR for employers in Puerto Rico) for reporting

Taxes wages paid to your employees. References to Form W-2 also apply to Form

499R-2/W-2PR unless otherwise specified.

• Form W-3 (or Form W-3 (PR) for filers in Puerto Rico) for sending Copy A of

Form(s) W-2 to the Social Security Administration (SSA). References to Form W-3

also apply to Form W-3 (PR) unless otherwise specified.

For more information, see What Forms Must You File? in Pub. 926, Household Em-

ployer's Tax Guide.

We have been asked:

Do I need to pay household employment taxes for 2024? If you have a household

employee, you need to withhold and pay social security and Medicare taxes if you

paid cash wages of $2,700 or more in 2024 to any one household employee. See Did

you have a household employee? and Line A, later, for more information. You need to

pay federal unemployment tax under the Federal Unemployment Tax Act (FUTA), if

you paid total cash wages of $1,000 or more in any calendar quarter of 2023 or 2024

to household employees. See Part II. Federal Unemployment (FUTA) Tax, later, for

more information.

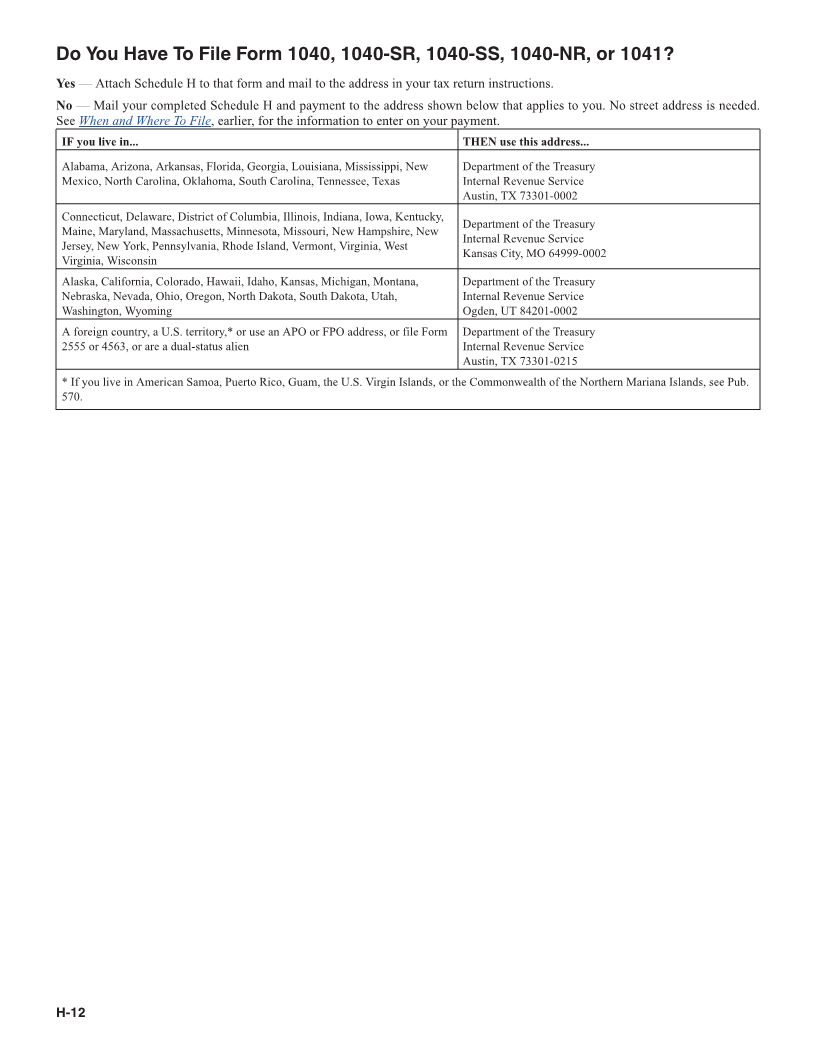

How do I file Schedule H? File Schedule H with your Form 1040, 1040-SR,

1040-SS, 1040-NR, or 1041. If you’re not filing a 2024 tax return, file Schedule H by

itself.

Do I make a separate payment? No. You pay both income and employment taxes to

the United States Treasury when you file Schedule H with your return.

Note. Taxpayers in Puerto Rico pay their income tax to the Department of the Treas-

ury, Government of Puerto Rico.

When do I pay? Most filers must pay by April 15, 2025.

How many copies of Form W-3 do I send to the SSA? Send one copy of Form W-3

with Copy A of Form(s) W-2 to the SSA, and keep one copy of Form W-3 for your

records.

Important Dates

By . . . . . . . . . . . . . . . . . . . . You must . . . . . . . . . . . . . . . . . . . . . . . . . . .

January 31, 2025 Give your employee Form W-2 and send Copy A of Form(s)

W-2 with Form W-3 to the SSA. Go to SSA.gov/employer

for details.

April 15, 2025 File Schedule H and pay your household employment taxes

with your 2024 tax return.

Section references are to the Internal Revenue Code unless Contents Page

otherwise noted.

Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Contents Page Who Needs To File Schedule H? . . . . . . . . . . . . . . . . . . 2

What's New . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Who Needs To File Form W-2 and Form W-3? . . . . . . . . 3

Instructions for Schedule H (Form 1040) (2024) Catalog Number 21451X

Nov 20, 2024 Department of the Treasury Internal Revenue Service www.irs.gov