Enlarge image

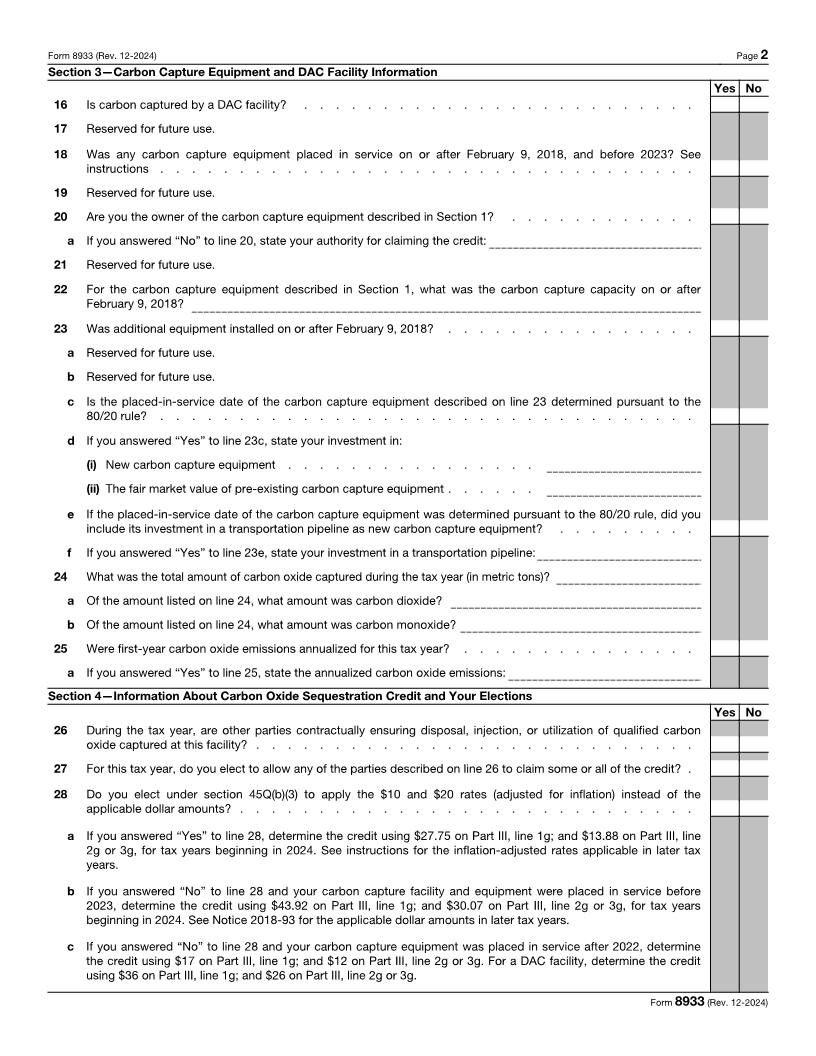

Form 8933 Carbon Oxide Sequestration Credit OMB No. 1545-0123 (Rev. December 2024) Attach to your tax return. Department of the Treasury Go to www.irs.gov/Form8933 for instructions and the latest information. Attachment Internal Revenue Service Sequence No. 165 Name(s) shown on return Identifying number Part I Information About Facility, Carbon Capture Equipment, DAC Facility, Carbon Oxide Sequestration Types, Credit Calculation, and Your Elections Section 1—Facility Information 1 If making an elective payment election or transfer election, enter the IRS-issued registration number for the facility: 2 Facility’s EPA e-GGRT ID number(s), if available: 3 Type (disposal in geological storage, enhanced oil or natural gas recovery, utilization): 4a If different than filer, enter (i) owner’s name: and (ii) owner’s TIN: b Address of the facility (if applicable): c Coordinates. (i) Latitude: . (ii) Longitude: . Enter a “+” (plus) or “-” (minus) sign in the first box. Enter a “+” (plus) or “-” (minus) sign in the first box. 5 Date construction began (MM/DD/YYYY): 6 Date placed in service (MM/DD/YYYY): 7 Total metric tons of carbon oxide captured during the tax year: Section 2—Industrial Facility Information Yes No 8 Reserved for future use. 9 Is the facility an electricity-generating facility? . . . . . . . . . . . . . . . . . . . . . . . 10 Is the facility a direct air capture (DAC) facility? If “Yes,” skip to line 16 . . . . . . . . . . . . . . 11 If the facility isn’t an electricity-generating or DAC facility, state the nature of the facility (for example, ethanol production, cement manufacturing, etc.): 12 Does the facility described above process carbon dioxide or any other gas from underground deposits? . . . a If you answered “Yes” to line 12, was any gas obtained from a carbon dioxide production well at natural carbon dioxide-bearing formations or at a naturally occurring subsurface spring, which means a well that contains 90% or greater carbon dioxide by volume? . . . . . . . . . . . . . . . . . . . . . . . . . . b If you answered “Yes” to line 12a, you can’t treat the facility as a qualified industrial facility to the extent that it processed gas described on line 12a during the tax year. See line 12c. c If you answered “Yes” to line 12a, do you attest that you meet the exception for a deposit that contains a product, other than carbon oxide, that’s commercially viable to extract and sell without taking into account the availability of a commercial market for the carbon oxide that’s extracted or any carbon oxide sequestration credit (credit) that might be available? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . d If you answered “Yes” to line 12c, have you attached an attestment letter from an independent registered engineer? Don’t treat the facility as a qualified industrial facility unless you answered “Yes” to both lines 12c and 12d. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 What were the emissions of carbon oxide during the tax year (amount released to the atmosphere plus amount captured)? a Of the amount listed on line 13, what amount was carbon dioxide? b Of the amount listed on line 13, what amount was carbon monoxide? 14 Were first-year carbon oxide emissions annualized for this tax year? . . . . . . . . . . . . . . . a If you answered “Yes” to line 14, state the annualized carbon oxide emissions and attach a statement that shows how you determined the annualized carbon oxide emissions: 15 Was aggregation of multiple facilities required to achieve the requisite carbon capture thresholds? . . . . . a If you answered “Yes” to line 15, attach a statement that lists the facilities and describes the appropriateness of their aggregation. For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37748H Form 8933 (Rev. 12-2024)