Enlarge image

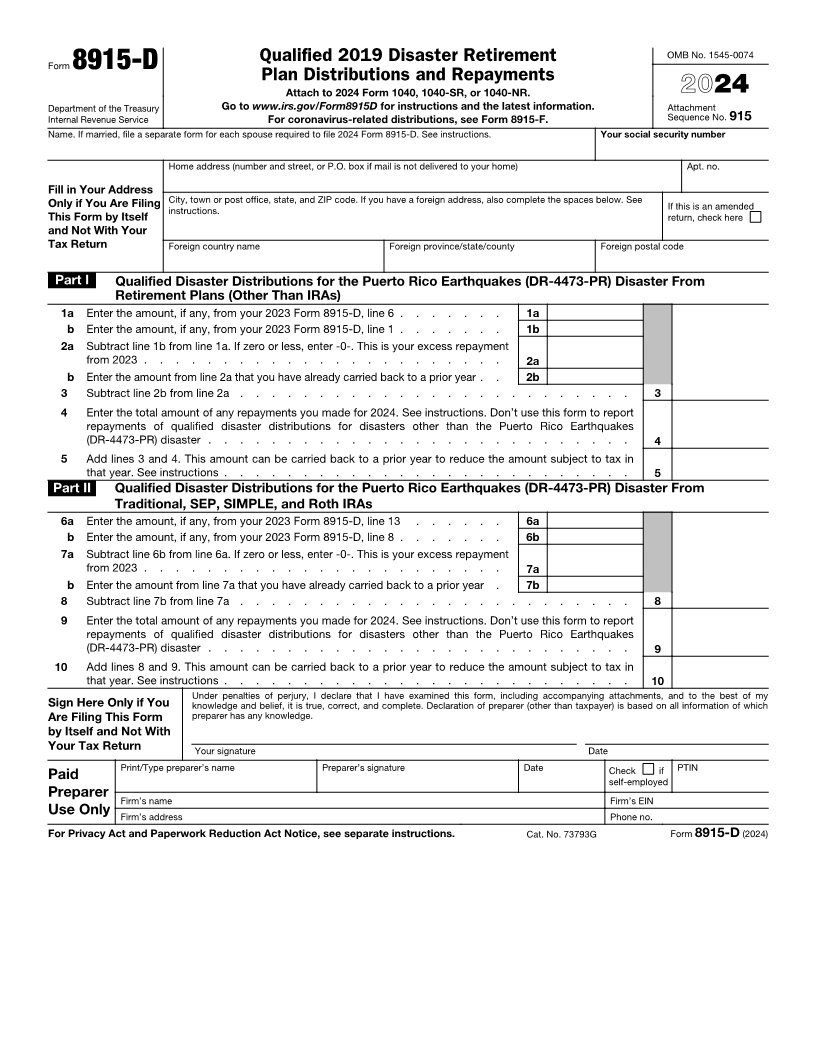

Qualified 2019 Disaster Retirement OMB No. 1545-0074 Form 8915-D Plan Distributions and Repayments Attach to 2024 Form 1040, 1040-SR, or 1040-NR. 2024 Department of the Treasury Go to www.irs.gov/Form8915D for instructions and the latest information. Attachment Internal Revenue Service For coronavirus-related distributions, see Form 8915-F. Sequence No. 915 Name. If married, file a separate form for each spouse required to file 2024 Form 8915-D. See instructions. Your social security number Home address (number and street, or P.O. box if mail is not delivered to your home) Apt. no. Fill in Your Address Only if You Are Filing City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below. See instructions. If this is an amended This Form by Itself return, check here and Not With Your Tax Return Foreign country name Foreign province/state/county Foreign postal code Part I Qualified Disaster Distributions for the Puerto Rico Earthquakes (DR-4473-PR) Disaster From Retirement Plans (Other Than IRAs) 1a Enter the amount, if any, from your 2023 Form 8915-D, line 6 . . . . . . . 1a b Enter the amount, if any, from your 2023 Form 8915-D, line 1 . . . . . . . 1b 2 a Subtract line 1b from line 1a. If zero or less, enter -0-. This is your excess repayment from 2023 . . . . . . . . . . . . . . . . . . . . . . . 2a b Enter the amount from line 2a that you have already carried back to a prior year . . 2b 3 Subtract line 2b from line 2a . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Enter the total amount of any repayments you made for 2024. See instructions. Don’t use this form to report repayments of qualified disaster distributions for disasters other than the Puerto Rico Earthquakes (DR-4473-PR) disaster . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5 Add lines 3 and 4. This amount can be carried back to a prior year to reduce the amount subject to tax in that year. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Part II Qualified Disaster Distributions for the Puerto Rico Earthquakes (DR-4473-PR) Disaster From Traditional, SEP, SIMPLE, and Roth IRAs 6a Enter the amount, if any, from your 2023 Form 8915-D, line 13 . . . . . . 6a b Enter the amount, if any, from your 2023 Form 8915-D, line 8 . . . . . . . 6b 7 a Subtract line 6b from line 6a. If zero or less, enter -0-. This is your excess repayment from 2023 . . . . . . . . . . . . . . . . . . . . . . . 7a b Enter the amount from line 7a that you have already carried back to a prior year . 7b 8 Subtract line 7b from line 7a . . . . . . . . . . . . . . . . . . . . . . . . . 8 9 Enter the total amount of any repayments you made for 2024. See instructions. Don’t use this form to report repayments of qualified disaster distributions for disasters other than the Puerto Rico Earthquakes (DR-4473-PR) disaster . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 10 Add lines 8 and 9. This amount can be carried back to a prior year to reduce the amount subject to tax in that year. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Under penalties of perjury, I declare that I have examined this form, including accompanying attachments, and to the best of my Sign Here Only if You knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which Are Filing This Form preparer has any knowledge. by Itself and Not With Your Tax Return Your signature Date Print/Type preparer’s name Preparer’s signature Date Paid Check if PTIN self-employed Preparer Firm’s name Firm’s EIN Use Only Firm’s address Phone no. For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 73793G Form 8915-D (2024)