Enlarge image

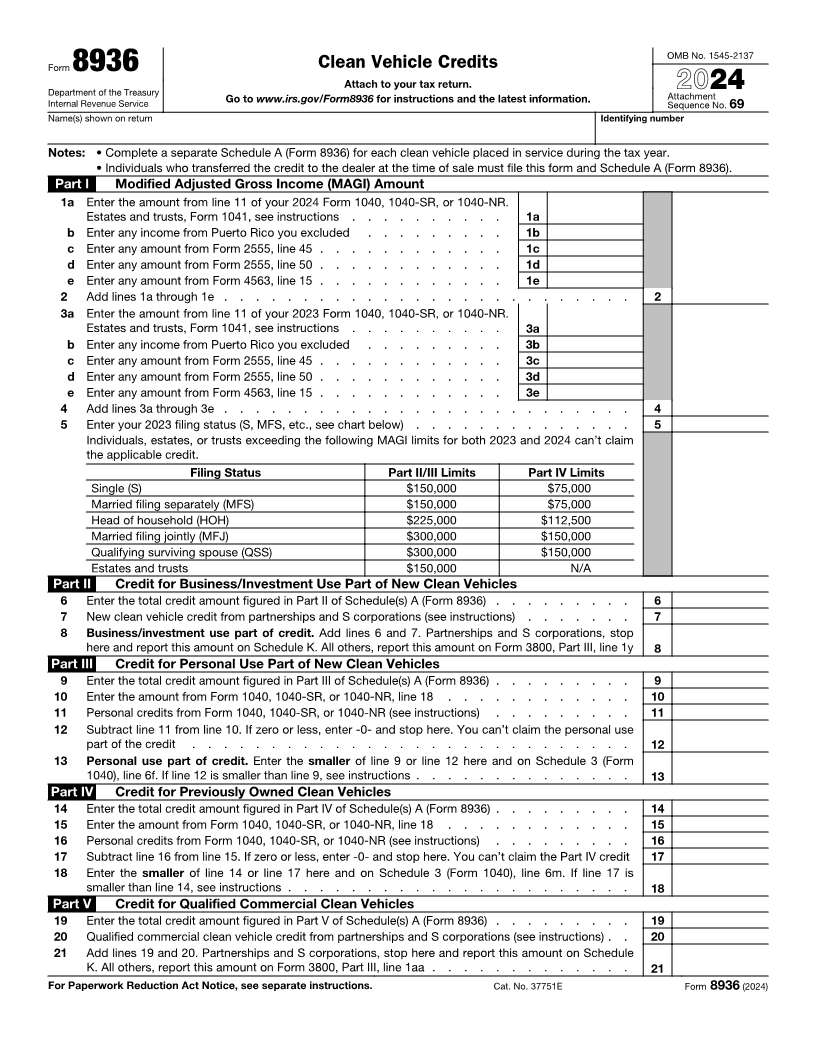

OMB No. 1545-2137 Form 8936 Clean Vehicle Credits Attach to your tax return. Department of the Treasury Attachment 2024 Internal Revenue Service Go to www.irs.gov/Form8936 for instructions and the latest information. Sequence No. 69 Name(s) shown on return Identifying number Notes: • Complete a separate Schedule A (Form 8936) for each clean vehicle placed in service during the tax year. • Individuals who transferred the credit to the dealer at the time of sale must file this form and Schedule A (Form 8936). Part I Modified Adjusted Gross Income (MAGI) Amount 1 a Enter the amount from line 11 of your 2024 Form 1040, 1040-SR, or 1040-NR. Estates and trusts, Form 1041, see instructions . . . . . . . . . . 1a b Enter any income from Puerto Rico you excluded . . . . . . . . . 1b c Enter any amount from Form 2555, line 45 . . . . . . . . . . . . 1c d Enter any amount from Form 2555, line 50 . . . . . . . . . . . . 1d e Enter any amount from Form 4563, line 15 . . . . . . . . . . . . 1e 2 Add lines 1a through 1e . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 a Enter the amount from line 11 of your 2023 Form 1040, 1040-SR, or 1040-NR. Estates and trusts, Form 1041, see instructions . . . . . . . . . . 3a b Enter any income from Puerto Rico you excluded . . . . . . . . . 3b c Enter any amount from Form 2555, line 45 . . . . . . . . . . . . 3c d Enter any amount from Form 2555, line 50 . . . . . . . . . . . . 3d e Enter any amount from Form 4563, line 15 . . . . . . . . . . . . 3e 4 Add lines 3a through 3e . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5 Enter your 2023 filing status (S, MFS, etc., see chart below) . . . . . . . . . . . . . . 5 Individuals, estates, or trusts exceeding the following MAGI limits for both 2023 and 2024 can’t claim the applicable credit. Filing Status Part II/III Limits Part IV Limits Single (S) $150,000 $75,000 Married filing separately (MFS) $150,000 $75,000 Head of household (HOH) $225,000 $112,500 Married filing jointly (MFJ) $300,000 $150,000 Qualifying surviving spouse (QSS) $300,000 $150,000 Estates and trusts $150,000 N/A Part II Credit for Business/Investment Use Part of New Clean Vehicles 6 Enter the total credit amount figured in Part II of Schedule(s) A (Form 8936) . . . . . . . . . 6 7 New clean vehicle credit from partnerships and S corporations (see instructions) . . . . . . . 7 8 Business/investment use part of credit. Add lines 6 and 7. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, report this amount on Form 3800, Part III, line 1y 8 Part III Credit for Personal Use Part of New Clean Vehicles 9 Enter the total credit amount figured in Part III of Schedule(s) A (Form 8936) . . . . . . . . . 9 10 Enter the amount from Form 1040, 1040-SR, or 1040-NR, line 18 . . . . . . . . . . . . 10 11 Personal credits from Form 1040, 1040-SR, or 1040-NR (see instructions) . . . . . . . . . 11 12 Subtract line 11 from line 10. If zero or less, enter -0- and stop here. You can’t claim the personal use part of the credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 13 Personal use part of credit. Enter the smaller of line 9 or line 12 here and on Schedule 3 (Form 1040), line 6f. If line 12 is smaller than line 9, see instructions . . . . . . . . . . . . . . 13 Part IV Credit for Previously Owned Clean Vehicles 14 Enter the total credit amount figured in Part IV of Schedule(s) A (Form 8936) . . . . . . . . . 14 15 Enter the amount from Form 1040, 1040-SR, or 1040-NR, line 18 . . . . . . . . . . . . 15 16 Personal credits from Form 1040, 1040-SR, or 1040-NR (see instructions) . . . . . . . . . 16 17 Subtract line 16 from line 15. If zero or less, enter -0- and stop here. You can’t claim the Part IV credit 17 18 Enter the smaller of line 14 or line 17 here and on Schedule 3 (Form 1040), line 6m. If line 17 is smaller than line 14, see instructions . . . . . . . . . . . . . . . . . . . . . . 18 Part V Credit for Qualified Commercial Clean Vehicles 19 Enter the total credit amount figured in Part V of Schedule(s) A (Form 8936) . . . . . . . . . 19 20 Qualified commercial clean vehicle credit from partnerships and S corporations (see instructions) . . 20 21 Add lines 19 and 20. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, report this amount on Form 3800, Part III, line 1aa . . . . . . . . . . . . . 21 For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37751E Form 8936 (2024)