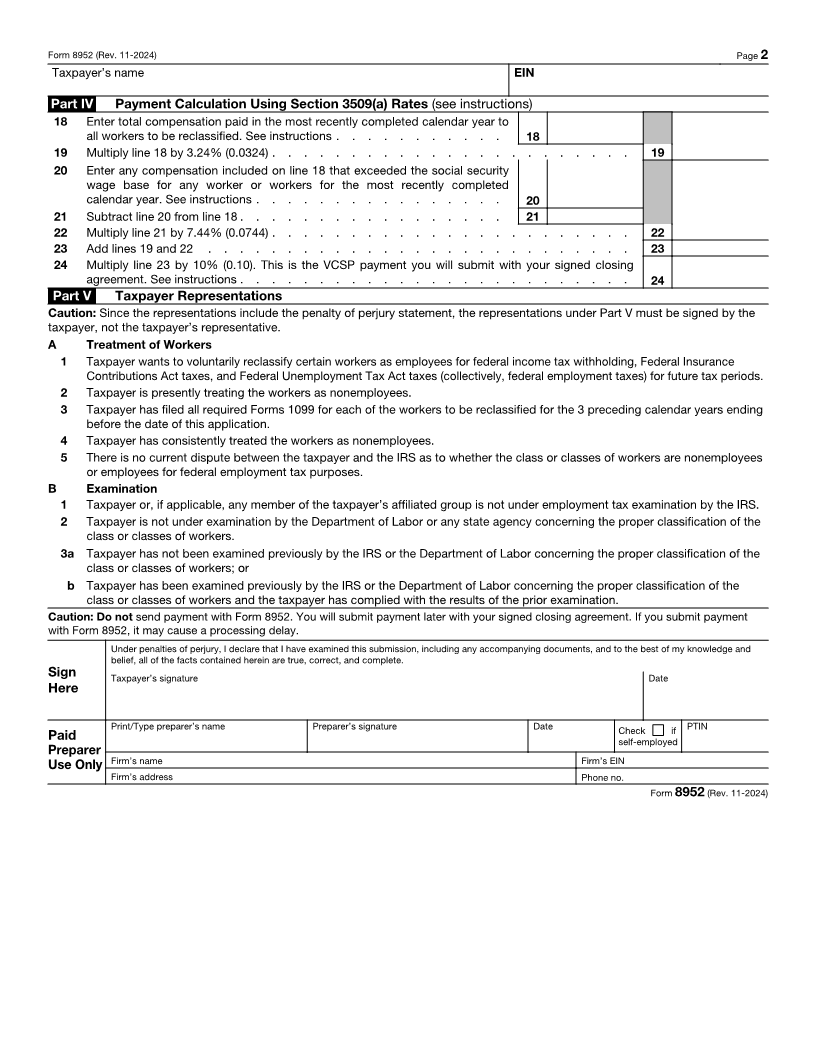

Enlarge image

Application for Voluntary

Form 8952 Classification Settlement Program (VCSP) OMB No. 1545-0029

(Rev. November 2024)

Department of the Treasury Do not send payment with Form 8952.

Internal Revenue Service Go to www.irs.gov/Form8952 for instructions and the latest information.

Caution: Taxpayer must make certain representations in order to be eligible to participate in the VCSP. These representations can be

found in Part V on page 2.

Part I Taxpayer Information

1 Taxpayer’s name 2 Employer identification number (EIN)

3 Number and street (or P.O. box number if mail is not delivered to a street address) Room/Suite

4 City, town or post office, state, and ZIP code

5 Telephone number 6 Website address (optional)

7 Fax number (optional) 8 Email address (optional)

9 Type of entity. Check the applicable box:

Sole proprietorship Cooperative organization described in section 1381 of the Internal Revenue Code

Joint venture Tax-exempt organization

Partnership State or local government (for worker class or position not covered under a section 218 agreement)

C corporation Other (specify here)

S corporation

10 Are you a member of an affiliated group?

Yes No

If “Yes,” complete the common parent information on lines 11–14.

If “No,” skip to Part II.

11 Name of common parent of the affiliated group 12 EIN of common parent

13 Number and street (or P.O. box number if mail is not delivered to a street address) of common parent

14 City, town or post office, state, and ZIP code of common parent

Part II Contact Person

Attach a properly completed Form 2848, Power of Attorney and Declaration of Representative, if applicable. Also see Special

instructions for Form 2848 in the instructions.

• Name and title of contact person

• Contact person’s number and street (or P.O. box number if mail is not delivered to a street address)

• Contact person’s city, town or post office, state, and ZIP code

• Contact person’s telephone number

• Contact person’s fax number (optional)

• Contact person’s email address (optional)

Part III General Information About Workers To Be Reclassified

15 Enter the total number of workers from all 16 Enter a description of the class or classes of workers to be reclassified.

classes to be reclassified. A class of workers If more space is needed, attach separate sheets. See instructions.

includes all workers who perform the same

or similar services.

17 Enter the beginning date of the employment

tax period (calendar year or quarter) for which

you want to begin treating the class or classes

of workers as employees. This date should be

at least 120 days after the date you file Form

8952. See instructions.

/ /

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37772H Form 8952 (Rev. 11-2024)