Enlarge image

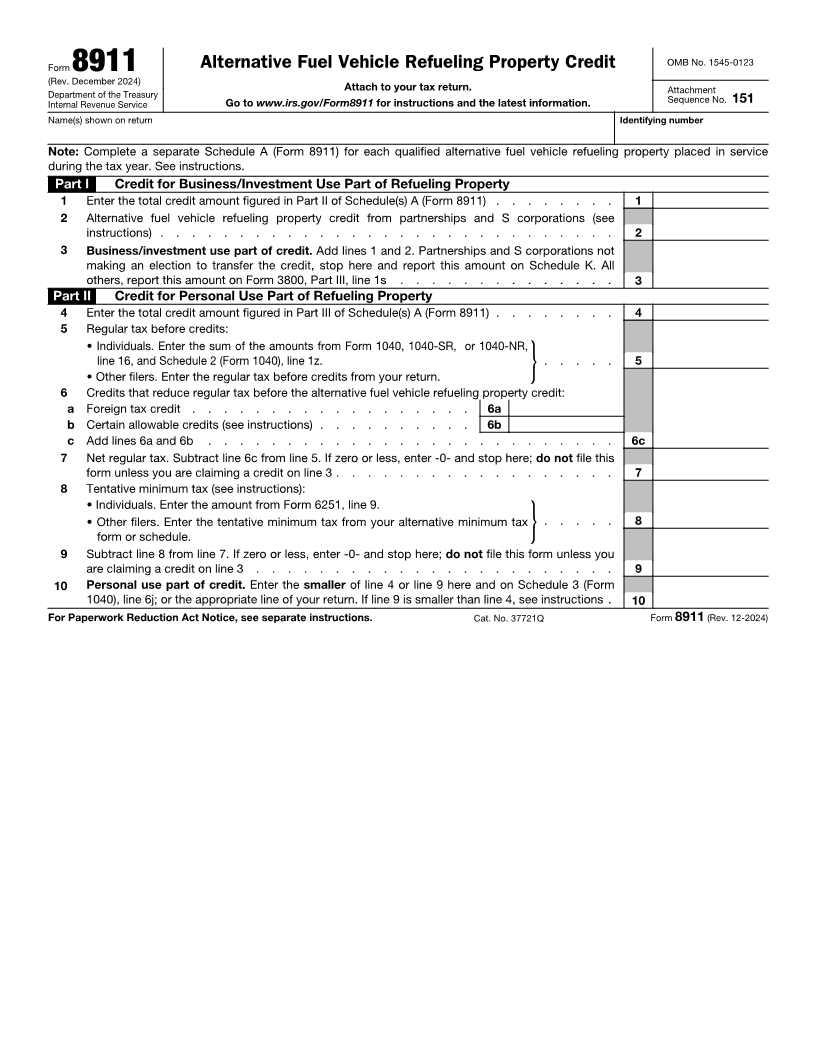

Form 8911 Alternative Fuel Vehicle Refueling Property Credit OMB No. 1545-0123 (Rev. December 2024) Attach to your tax return. Attachment Department of the Treasury Sequence No. 151 Internal Revenue Service Go to www.irs.gov/Form8911 for instructions and the latest information. Name(s) shown on return Identifying number Note: Complete a separate Schedule A (Form 8911) for each qualified alternative fuel vehicle refueling property placed in service during the tax year. See instructions. Part I Credit for Business/Investment Use Part of Refueling Property 1 Enter the total credit amount figured in Part II of Schedule(s) A (Form 8911) . . . . . . . . 1 2 Alternative fuel vehicle refueling property credit from partnerships and S corporations (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Business/investment use part of credit. Add lines 1 and 2. Partnerships and S corporations not making an election to transfer the credit, stop here and report this amount on Schedule K. All others, report this amount on Form 3800, Part III, line 1s . . . . . . . . . . . . . . 3 Part II Credit for Personal Use Part of Refueling Property 4 Enter the total credit amount figured in Part III of Schedule(s) A (Form 8911) . . . . . . . . 4 5 Regular tax before credits: • Individuals. Enter the sum of the amounts from Form 1040, 1040-SR, or 1040-NR, line 16, and Schedule 2 (Form 1040), line 1z. . . . . . 5 • Other filers. Enter the regular tax before credits from your return. } 6 Credits that reduce regular tax before the alternative fuel vehicle refueling property credit: a Foreign tax credit . . . . . . . . . . . . . . . . . . 6a b Certain allowable credits (see instructions) . . . . . . . . . . 6b c Add lines 6a and 6b . . . . . . . . . . . . . . . . . . . . . . . . . . 6c 7 Net regular tax. Subtract line 6c from line 5. If zero or less, enter -0- and stop here; do not file this form unless you are claiming a credit on line 3 . . . . . . . . . . . . . . . . . . 7 8 Tentative minimum tax (see instructions): • Individuals. Enter the amount from Form 6251, line 9. • Other filers. Enter the tentative minimum tax from your alternative minimum tax . . . . . 8 form or schedule. } 9 Subtract line 8 from line 7. If zero or less, enter -0- and stop here; do not file this form unless you are claiming a credit on line 3 . . . . . . . . . . . . . . . . . . . . . . . 9 10 Personal use part of credit. Enter the smaller of line 4 or line 9 here and on Schedule 3 (Form 1040), line 6j; or the appropriate line of your return. If line 9 is smaller than line 4, see instructions . 10 For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37721Q Form 8911 (Rev. 12-2024)