Enlarge image

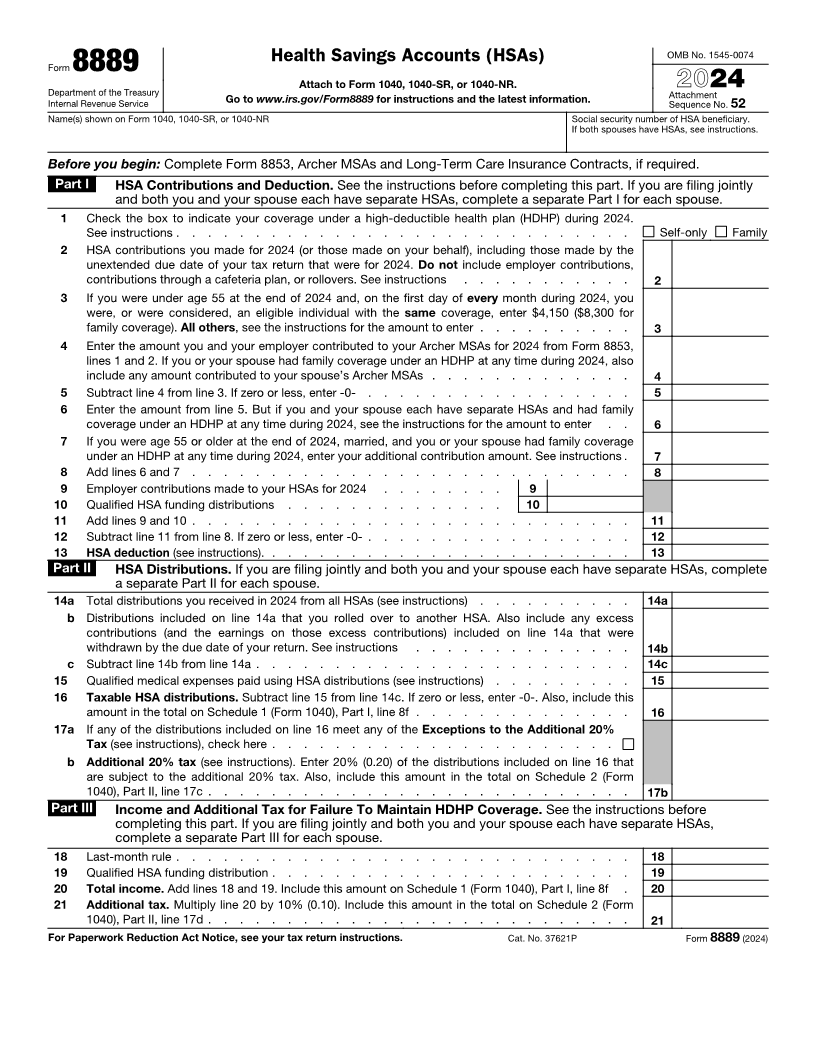

Health Savings Accounts (HSAs) OMB No. 1545-0074

Form 8889

Attach to Form 1040, 1040-SR, or 1040-NR.

Department of the Treasury 2024

Internal Revenue Service Go to www.irs.gov/Form8889 for instructions and the latest information. Attachment

Sequence No. 52

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Social security number of HSA beneficiary.

If both spouses have HSAs, see instructions.

Before you begin: Complete Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, if required.

Part I HSA Contributions and Deduction. See the instructions before completing this part. If you are filing jointly

and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse.

1 Check the box to indicate your coverage under a high-deductible health plan (HDHP) during 2024.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Self-only Family

2 HSA contributions you made for 2024 (or those made on your behalf), including those made by the

unextended due date of your tax return that were for 2024. Do not include employer contributions,

contributions through a cafeteria plan, or rollovers. See instructions . . . . . . . . . . . 2

3 If you were under age 55 at the end of 2024 and, on the first day of every month during 2024, you

were, or were considered, an eligible individual with the same coverage, enter $4,150 ($8,300 for

family coverage). All others, see the instructions for the amount to enter . . . . . . . . . . 3

4 Enter the amount you and your employer contributed to your Archer MSAs for 2024 from Form 8853,

lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2024, also

include any amount contributed to your spouse’s Archer MSAs . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 5

6 Enter the amount from line 5. But if you and your spouse each have separate HSAs and had family

coverage under an HDHP at any time during 2024, see the instructions for the amount to enter . . 6

7 If you were age 55 or older at the end of 2024, married, and you or your spouse had family coverage

under an HDHP at any time during 2024, enter your additional contribution amount. See instructions . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Employer contributions made to your HSAs for 2024 . . . . . . . . 9

10 Qualified HSA funding distributions . . . . . . . . . . . . . . 10

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 8. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 12

13 HSA deduction (see instructions). . . . . . . . . . . . . . . . . . . . . . . . 13

Part II HSA Distributions. If you are filing jointly and both you and your spouse each have separate HSAs, complete

a separate Part II for each spouse.

14 a Total distributions you received in 2024 from all HSAs (see instructions) . . . . . . . . . . 14a

b Distributions included on line 14a that you rolled over to another HSA. Also include any excess

contributions (and the earnings on those excess contributions) included on line 14a that were

withdrawn by the due date of your return. See instructions . . . . . . . . . . . . . . 14b

c Subtract line 14b from line 14a . . . . . . . . . . . . . . . . . . . . . . . . 14c

15 Qualified medical expenses paid using HSA distributions (see instructions) . . . . . . . . . 15

16 Taxable HSA distributions. Subtract line 15 from line 14c. If zero or less, enter -0-. Also, include this

amount in the total on Schedule 1 (Form 1040), Part I, line 8f . . . . . . . . . . . . . . 16

17 a If any of the distributions included on line 16 meet any of the Exceptions to the Additional 20%

Tax (see instructions), check here . . . . . . . . . . . . . . . . . . . . . .

b Additional 20% tax (see instructions). Enter 20% (0.20) of the distributions included on line 16 that

are subject to the additional 20% tax. Also, include this amount in the total on Schedule 2 (Form

1040), Part II, line 17c . . . . . . . . . . . . . . . . . . . . . . . . . . . 17b

Part III Income and Additional Tax for Failure To Maintain HDHP Coverage. See the instructions before

completing this part. If you are filing jointly and both you and your spouse each have separate HSAs,

complete a separate Part III for each spouse.

18 Last-month rule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Qualified HSA funding distribution . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total income. Add lines 18 and 19. Include this amount on Schedule 1 (Form 1040), Part I, line 8f . 20

21 Additional tax. Multiply line 20 by 10% (0.10). Include this amount in the total on Schedule 2 (Form

1040), Part II, line 17d . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37621P Form 8889 (2024)