- 3 -

Enlarge image

|

Form 8888 (Rev. 10-2024) Page 3

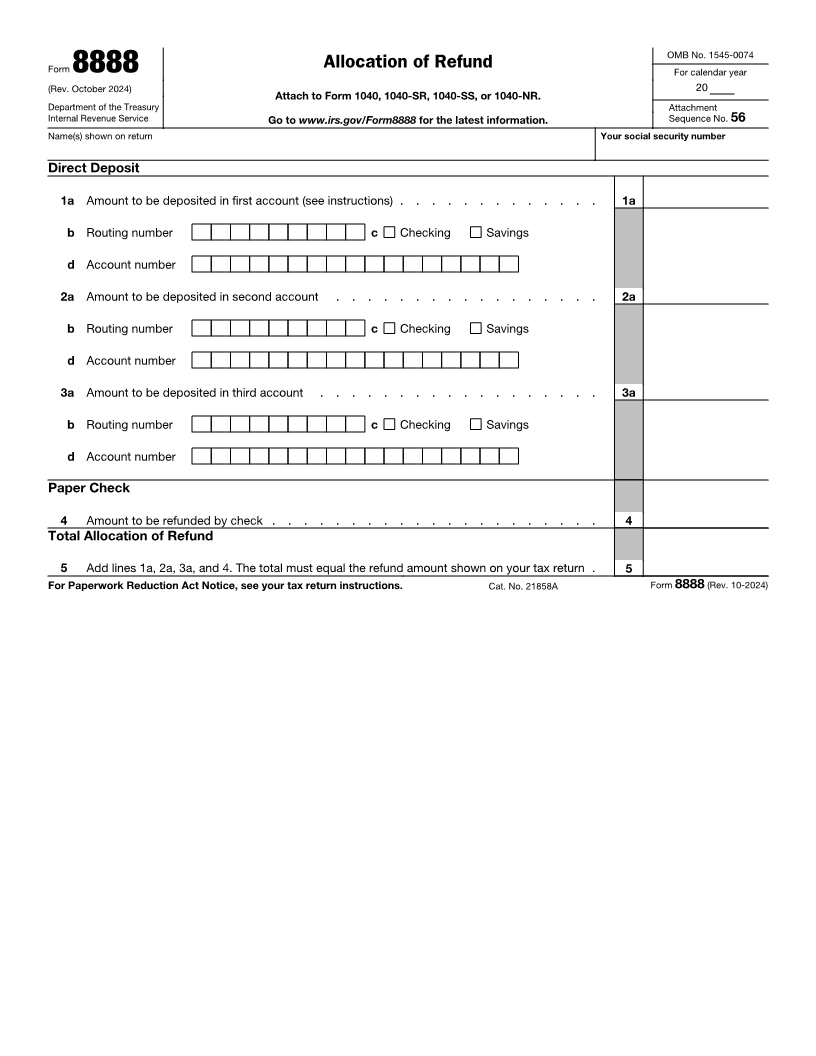

Lines 1c, 2c, and 3c • Three direct deposits of tax refunds Refund Offset

Check the appropriate box for the type of already have been made to the same The following rules apply if your refund is

account. Don’t check more than one box account or prepaid debit card. offset (used) to pay past-due federal tax or

for each line. If your deposit is to an • You haven’t given a valid account certain other debts.

account such as an IRA, HSA, brokerage number or routing transit number. Past-due federal tax. If you owe past-due

account, or other similar account, ask your • Any numbers or letters on lines 1a federal tax and your refund is offset by the

financial institution whether you should through 3d are crossed out or whited out. IRS to pay the tax, the past-due amount

check the “Checking” or “Savings” box. will be deducted first from any deposit to

You must check the correct box to ensure The IRS isn’t responsible for a an account on line 3, next from the deposit

your deposit is accepted. lost refund if you enter the to the account on line 2, and finally from

▲! wrong account information.

Lines 1d, 2d, and 3d CAUTION Check with your financial the deposit to the account on line 1.

Other offsets. If you owe other past-due

The account number can be up to 17 institution to get the correct routing and amounts (such as state income tax, child

characters (both numbers and letters). account numbers and to make sure your support, spousal support, or certain federal

Include hyphens but omit spaces and direct deposit will be accepted. nontax debts, such as student loans) that

special symbols. Enter the number from left

to right and leave any unused boxes blank. Changes in Refund Due to Math are subject to offset by the Treasury

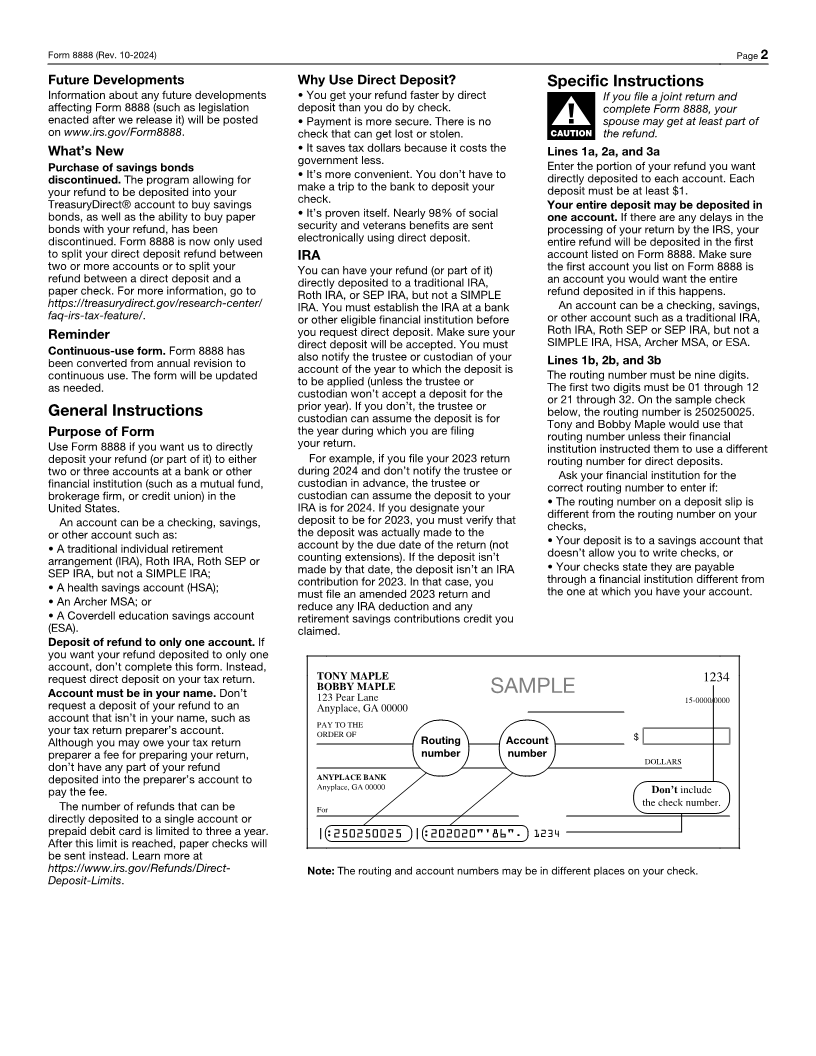

On the sample check in these instructions, Errors or Refund Offsets Department’s Bureau of the Fiscal Service,

the past-due amounts will be deducted first

the account number is 20202086. Don’t The rules below explain how your direct from the deposit to the account with the

include the check number. deposits may be adjusted. lowest routing number. Any remaining

Line 4 Math Errors amount due will be deducted from the

If any portion of your refund remains after The following rules apply if your refund is deposit to the account with the next lowest

completing lines 1a, 2a, and 3a, you can increased or decreased due to a math routing number and then from the deposit

request this portion be sent to you in the error. to the account with the highest routing

form of a check. Enter the amount on line 4 Refund increased. If you made an error on number.

that you would like to be sent by check. your return and the amount of your refund If the deposit to one or more of

Line 5 is increased, the additional amount will be your accounts is changed due

The total on line 5 must equal the total deposited to the last account listed. If you ▲! to a math error or refund offset,

amount of the refund shown on your tax asked that your refund be split among CAUTION and that account is subject to

return. It must also equal the total of the three accounts, any increase will be contribution limits, such as an IRA, HSA,

amounts on lines 1a, 2a, 3a, and 4. If the deposited to the account on line 3. If you Archer MSA, or Coverdell ESA, or the

total on line 5 is different, a check will be asked that your refund be split among two deposit was deducted as a contribution to

sent instead. accounts, any increase will be deposited to a tax-favored account on your tax return,

the account on line 2. you may need to correct your contribution

Direct Deposit Request Rejected Example. Your return shows a refund of or file an amended return.

If your financial institution rejects one or $300 and you ask that the refund be split Example. You deduct $1,000 on your

two but not all of your direct deposit among three accounts with $100 to each 2024 tax return for an IRA contribution. The

requests, you may get part of your refund account. Due to an error on the return, your contribution is to be made from a direct

as a paper check and part as a direct refund is increased to $350. The additional deposit of your 2024 refund. Due to an

deposit. $50 will be added to the deposit to the offset by the Bureau of the Fiscal Service,

Example. You complete lines 1 and 2 account on line 3. the direct deposit isn’t made to your IRA.

correctly but forget to enter an account Refund decreased. If you made an error You need to correct your contribution by

number on line 3d. You will get a paper on your return and the amount of your contributing $1,000 to the IRA from another

check for any amount shown on line 3a. refund is decreased, the decrease will be source by the due date of your return

The parts of your refund shown on lines 1a taken first from any deposit to an account (determined without regard to any

and 2a will be directly deposited to the on line 3, next from the deposit to the extension) or file an amended return

accounts you indicated. account on line 2, and finally from the without the IRA deduction.

Reasons your direct deposit request will deposit to the account on line 1. Don’t file a Form 8888 on which

be rejected. If any of the following apply, Example. Your return shows a refund of you have crossed out or whited

your direct deposit request will be rejected, $300, and you ask that the refund be split ▲! out any numbers or letters. If

and a check will be sent instead. among three accounts with $100 to each CAUTION you do, the IRS will reject your

• You are asking to have a joint refund account. Due to an error on your return, allocation of refund, and send you a check

deposited to an individual account, and your refund is decreased by $150. You instead.

your financial institution(s) won’t allow this. won’t receive the $100 you asked us to

The IRS isn’t responsible if a financial deposit to the account on line 3, and the

institution rejects a direct deposit. deposit to the account on line 2 will be

• The name on your account doesn’t match reduced by $50.

the name on the refund, and your financial Note: If you appeal the math error

institution(s) won’t allow a refund to be adjustment and your appeal is upheld, the

deposited unless the name on the refund resulting refund will be deposited to the

matches the name on the account. account on line 1.

|