Enlarge image

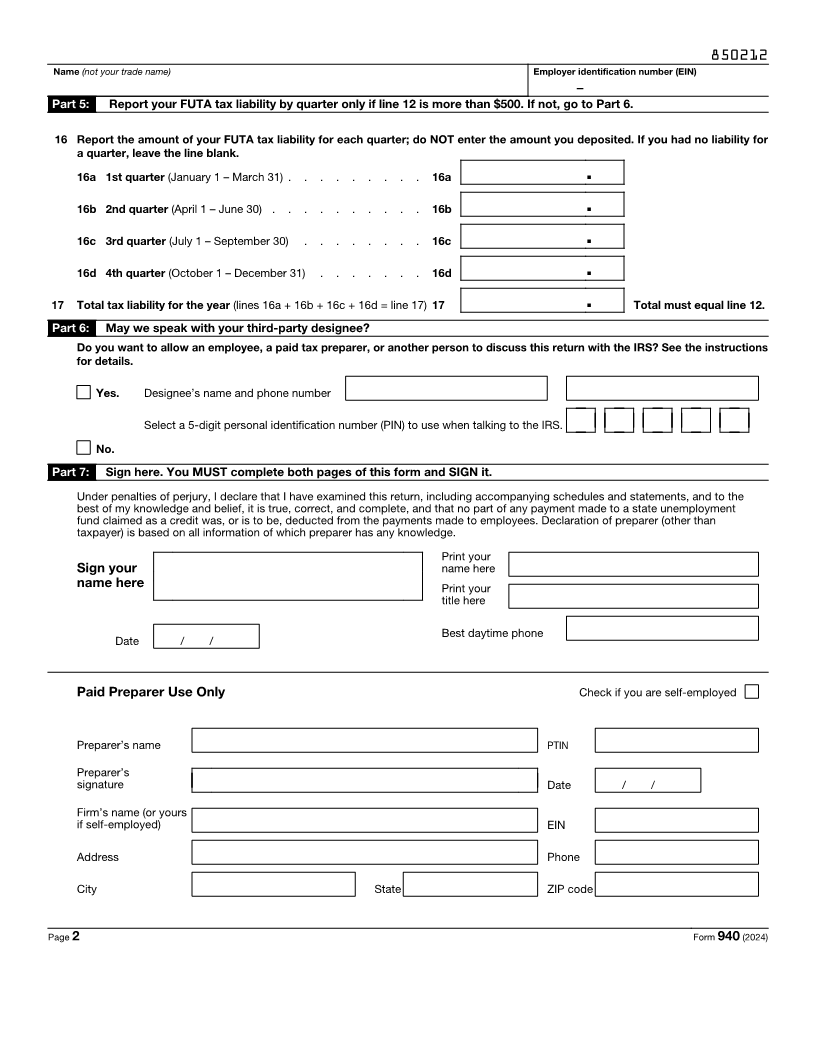

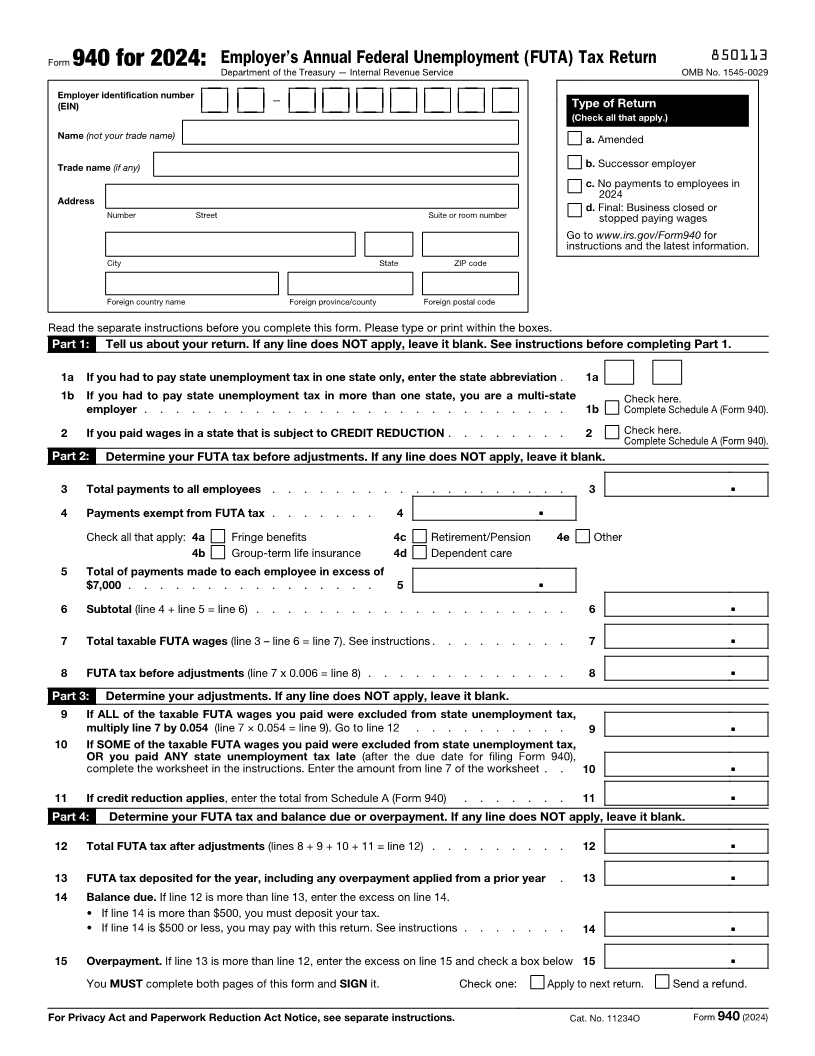

Form 940 for 2024: Employer’s Annual Federal Unemployment (FUTA) Tax Return 850113 Department of the Treasury — Internal Revenue Service OMB No. 1545-0029 Employer identification number — Type of Return (EIN) (Check all that apply.) Name (not your trade name) a. Amended Trade name (if any) b. Successor employer c. No payments to employees in Address 2024 Number Street Suite or room number d. Final: Business closed or stopped paying wages Go to www.irs.gov/Form940 for instructions and the latest information. City State ZIP code Foreign country name Foreign province/county Foreign postal code Read the separate instructions before you complete this form. Please type or print within the boxes. Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1. 1a If you had to pay state unemployment tax in one state only, enter the state abbreviation . 1a 1 b If you had to pay state unemployment tax in more than one state, you are a multi-state Check here. employer . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b Complete Schedule A (Form 940). 2 If you paid wages in a state that is subject to CREDIT REDUCTION . . . . . . . . 2 Check here. Complete Schedule A (Form 940). Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees . . . . . . . . . . . . . . . . . . . 3 . 4 Payments exempt from FUTA tax . . . . . . . 4 . Check all that apply: 4a Fringe benefits 4c Retirement/Pension 4e Other 4b Group-term life insurance 4d Dependent care 5 Total of payments made to each employee in excess of $7,000 . . . . . . . . . . . . . . . . 5 . 6 Subtotal (line 4 + line 5 = line 6) . . . . . . . . . . . . . . . . . . . . 6 . 7 Total taxable FUTA wages (line 3 – line 6 = line 7). See instructions . . . . . . . . . 7 . 8 FUTA tax before adjustments (line 7 x 0.006 = line 8) . . . . . . . . . . . . . 8 . Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 7 × 0.054 = line 9). Go to line 12 . . . . . . . . . . 9 . 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet . . 10 . 11 If credit reduction applies, enter the total from Schedule A (Form 940) . . . . . . . 11 . Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) . . . . . . . . . 12 . 13 FUTA tax deposited for the year, including any overpayment applied from a prior year . 13 . 14 Balance due. If line 12 is more than line 13, enter the excess on line 14. • If line 14 is more than $500, you must deposit your tax. • If line 14 is $500 or less, you may pay with this return. See instructions . . . . . . . 14 . 15 Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below 15 . You MUST complete both pages of this form and SIGN it. Check one: Apply to next return. Send a refund. For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11234O Form 940 (2024)