Enlarge image

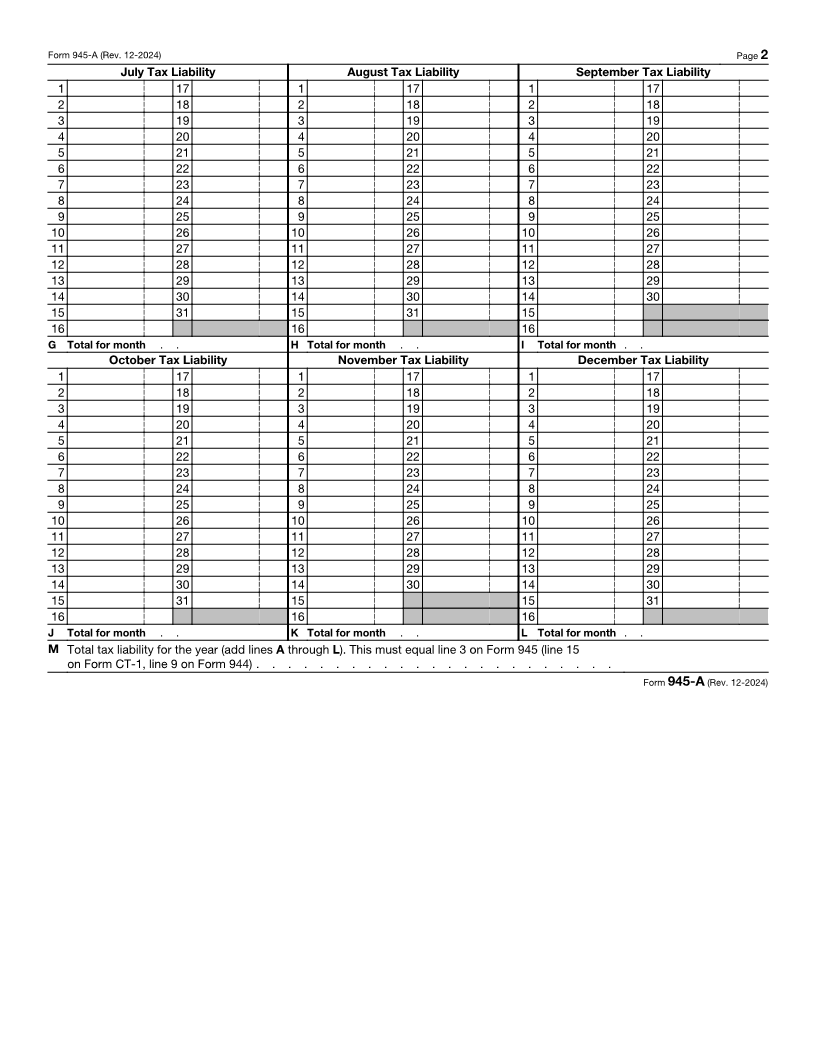

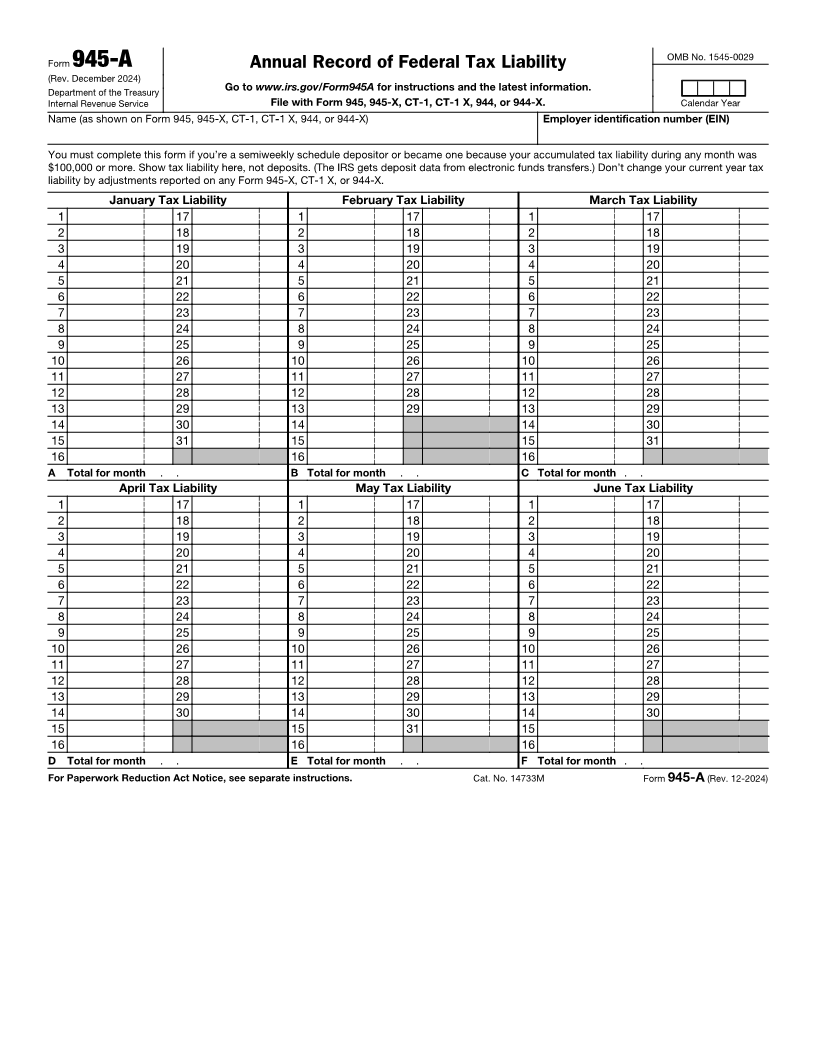

OMB No. 1545-0029 Form 945-A Annual Record of Federal Tax Liability (Rev. December 2024) Department of the Treasury Go to www.irs.gov/Form945A for instructions and the latest information. Internal Revenue Service File with Form 945, 945-X, CT-1, CT-1 X, 944, or 944-X. Calendar Year Name (as shown on Form 945, 945-X, CT-1, CT-1 X, 944, or 944-X) Employer identification number (EIN) You must complete this form if you’re a semiweekly schedule depositor or became one because your accumulated tax liability during any month was $100,000 or more. Show tax liability here, not deposits. (The IRS gets deposit data from electronic funds transfers.) Don’t change your current year tax liability by adjustments reported on any Form 945-X, CT-1 X, or 944-X. January Tax Liability February Tax Liability March Tax Liability 1 17 1 17 1 17 2 18 2 18 2 18 3 19 3 19 3 19 4 20 4 20 4 20 5 21 5 21 5 21 6 22 6 22 6 22 7 23 7 23 7 23 8 24 8 24 8 24 9 25 9 25 9 25 10 26 10 26 10 26 11 27 11 27 11 27 12 28 12 28 12 28 13 29 13 29 13 29 14 30 14 14 30 15 31 15 15 31 16 16 16 A Total for month . . B Total for month . . C Total for month . . April Tax Liability May Tax Liability June Tax Liability 1 17 1 17 1 17 2 18 2 18 2 18 3 19 3 19 3 19 4 20 4 20 4 20 5 21 5 21 5 21 6 22 6 22 6 22 7 23 7 23 7 23 8 24 8 24 8 24 9 25 9 25 9 25 10 26 10 26 10 26 11 27 11 27 11 27 12 28 12 28 12 28 13 29 13 29 13 29 14 30 14 30 14 30 15 15 31 15 16 16 16 D Total for month . . E Total for month . . F Total for month . . For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 14733M Form 945-A (Rev. 12-2024)