Enlarge image

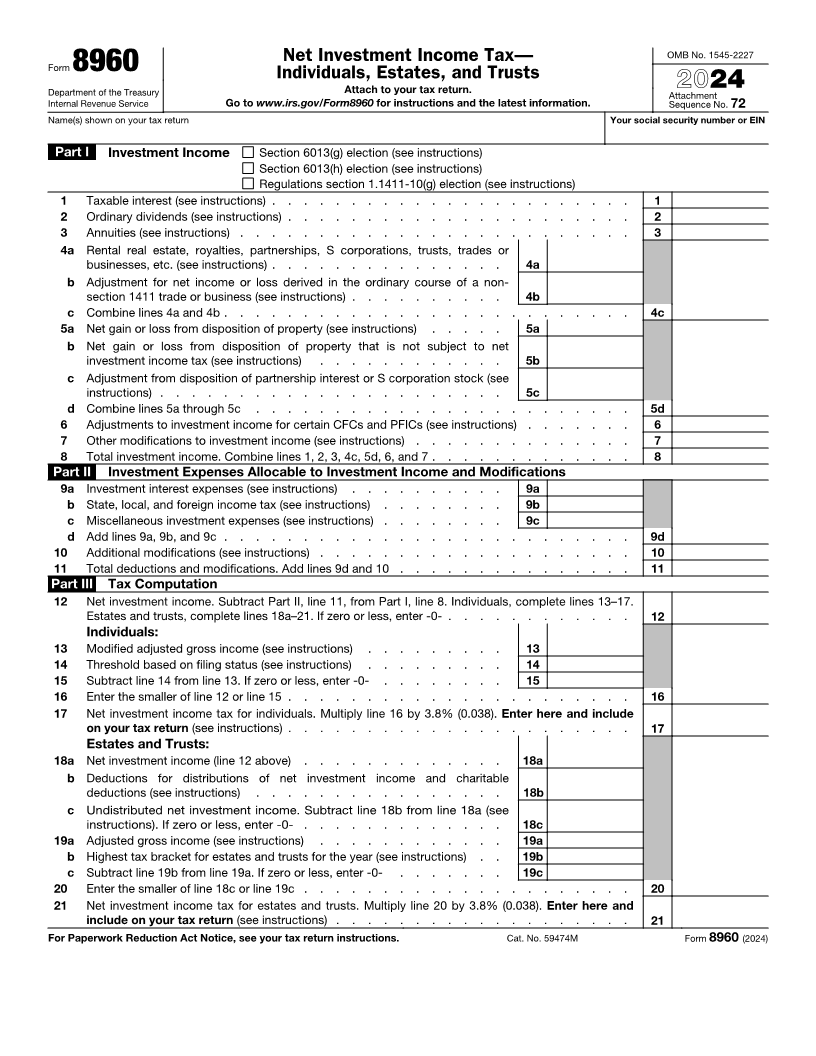

Net Investment Income Tax— OMB No. 1545-2227

Form 8960 Individuals, Estates, and Trusts

Department of the Treasury Attach to your tax return. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8960 for instructions and the latest information. Sequence No. 72

Name(s) shown on your tax return Your social security number or EIN

Part I Investment Income Section 6013(g) election (see instructions)

Section 6013(h) election (see instructions)

Regulations section 1.1411-10(g) election (see instructions)

1 Taxable interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 1

2 Ordinary dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . 2

3 Annuities (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 a Rental real estate, royalties, partnerships, S corporations, trusts, trades or

businesses, etc. (see instructions) . . . . . . . . . . . . . . . 4a

b Adjustment for net income or loss derived in the ordinary course of a non-

section 1411 trade or business (see instructions) . . . . . . . . . . 4b

c Combine lines 4a and 4b . . . . . . . . . . . . . . . . . . . . . . . . . . 4c

5a Net gain or loss from disposition of property (see instructions) . . . . . 5a

b Net gain or loss from disposition of property that is not subject to net

investment income tax (see instructions) . . . . . . . . . . . . 5b

c Adjustment from disposition of partnership interest or S corporation stock (see

instructions) . . . . . . . . . . . . . . . . . . . . . . 5c

d Combine lines 5a through 5c . . . . . . . . . . . . . . . . . . . . . . . . 5d

6 Adjustments to investment income for certain CFCs and PFICs (see instructions) . . . . . . . 6

7 Other modifications to investment income (see instructions) . . . . . . . . . . . . . . 7

8 Total investment income. Combine lines 1, 2, 3, 4c, 5d, 6, and 7 . . . . . . . . . . . . . 8

Part II Investment Expenses Allocable to Investment Income and Modifications

9a Investment interest expenses (see instructions) . . . . . . . . . . 9a

b State, local, and foreign income tax (see instructions) . . . . . . . . 9b

c Miscellaneous investment expenses (see instructions) . . . . . . . . 9c

d Add lines 9a, 9b, and 9c . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

10 Additional modifications (see instructions) . . . . . . . . . . . . . . . . . . . . 10

11 Total deductions and modifications. Add lines 9d and 10 . . . . . . . . . . . . . . . 11

Part III Tax Computation

12 Net investment income. Subtract Part II, line 11, from Part I, line 8. Individuals, complete lines 13–17.

Estates and trusts, complete lines 18a–21. If zero or less, enter -0- . . . . . . . . . . . . 12

Individuals:

13 Modified adjusted gross income (see instructions) . . . . . . . . . 13

14 Threshold based on filing status (see instructions) . . . . . . . . . 14

15 Subtract line 14 from line 13. If zero or less, enter -0- . . . . . . . . 15

16 Enter the smaller of line 12 or line 15 . . . . . . . . . . . . . . . . . . . . . . 16

17 Net investment income tax for individuals. Multiply line 16 by 3.8% (0.038). Enter here and include

on your tax return (see instructions) . . . . . . . . . . . . . . . . . . . . . . 17

Estates and Trusts:

18a Net investment income (line 12 above) . . . . . . . . . . . . . 18a

b Deductions for distributions of net investment income and charitable

deductions (see instructions) . . . . . . . . . . . . . . . . 18b

c Undistributed net investment income. Subtract line 18b from line 18a (see

instructions). If zero or less, enter -0- . . . . . . . . . . . . . 18c

19a Adjusted gross income (see instructions) . . . . . . . . . . . . 19a

b Highest tax bracket for estates and trusts for the year (see instructions) . . 19b

c Subtract line 19b from line 19a. If zero or less, enter -0- . . . . . . . 19c

20 Enter the smaller of line 18c or line 19c . . . . . . . . . . . . . . . . . . . . . 20

21 Net investment income tax for estates and trusts. Multiply line 20 by 3.8% (0.038). Enter here and

include on your tax return (see instructions) . . . . . . . . . . . . . . . . . . . 21

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 59474M Form 8960 (2024)