Enlarge image

OMB No. 1545-2294

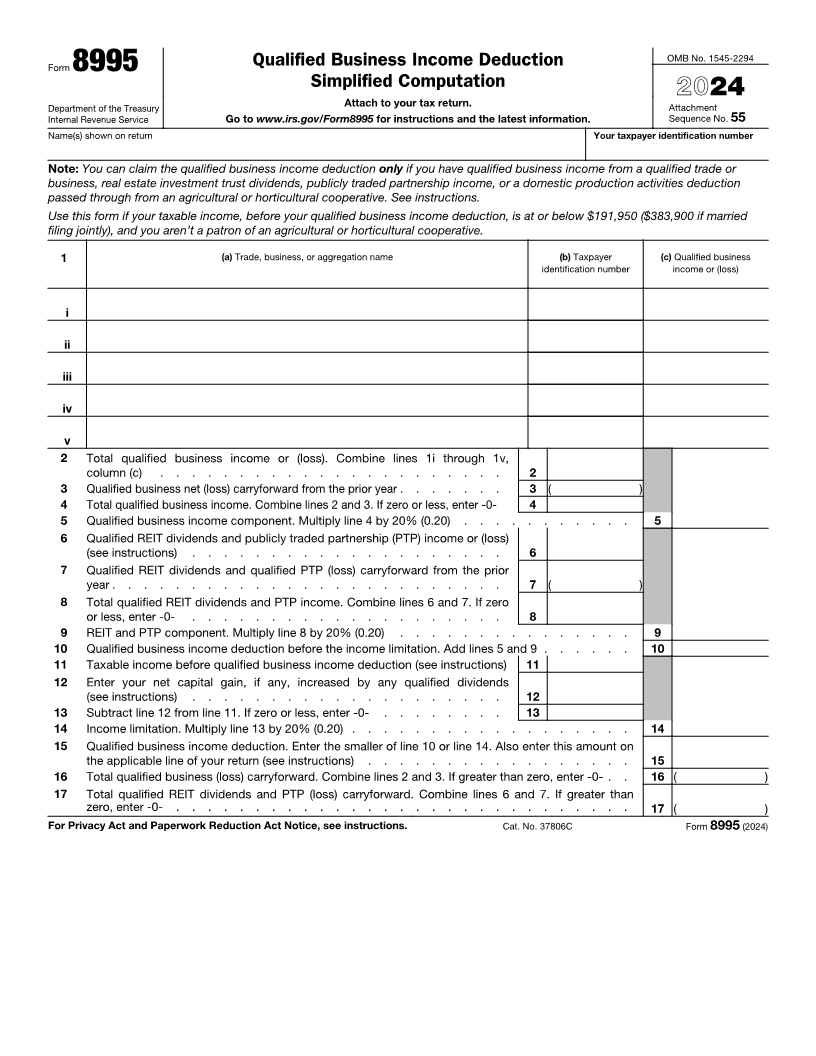

Qualified Business Income Deduction

Form 8995

Simplified Computation

Department of the Treasury Attach to your tax return. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8995 for instructions and the latest information. Sequence No. 55

Name(s) shown on return Your taxpayer identification number

Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or

business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction

passed through from an agricultural or horticultural cooperative. See instructions.

Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married

filing jointly), and you aren’t a patron of an agricultural or horticultural cooperative.

1 (a) Trade, business, or aggregation name (b) Taxpayer (c) Qualified business

identification number income or (loss)

i

ii

iii

iv

v

2 Total qualified business income or (loss). Combine lines 1i through 1v,

column (c) . . . . . . . . . . . . . . . . . . . . . . 2

3 Qualified business net (loss) carryforward from the prior year. . . . . . . 3 ( )

4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter -0- 4

5 Qualified business income component. Multiply line 4 by 20% (0.20) . . . . . . . . . . . 5

6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss)

(see instructions) . . . . . . . . . . . . . . . . . . . . 6

7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior

year . . . . . . . . . . . . . . . . . . . . . . . . . 7 ( )

8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero

or less, enter -0- . . . . . . . . . . . . . . . . . . . . 8

9 REIT and PTP component. Multiply line 8 by 20% (0.20) . . . . . . . . . . . . . . . 9

10 Qualified business income deduction before the income limitation. Add lines 5 and 9 . . . . . . 10

11 Taxable income before qualified business income deduction (see instructions) 11

12 Enter your net capital gain, if any, increased by any qualified dividends

(see instructions) . . . . . . . . . . . . . . . . . . . . 12

13 Subtract line 12 from line 11. If zero or less, enter -0- . . . . . . . . 13

14 Income limitation. Multiply line 13 by 20% (0.20) . . . . . . . . . . . . . . . . . . 14

15 Qualified business income deduction. Enter the smaller of line 10 or line 14. Also enter this amount on

the applicable line of your return (see instructions) . . . . . . . . . . . . . . . . . 15

16 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- . . 16 ( )

17 Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 6 and 7. If greater than

zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 ( )

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 37806C Form 8995 (2024)