Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

instrx

AH XSL/XML Fileid: … -form-8941/2024/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 31 15:54 - 20-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

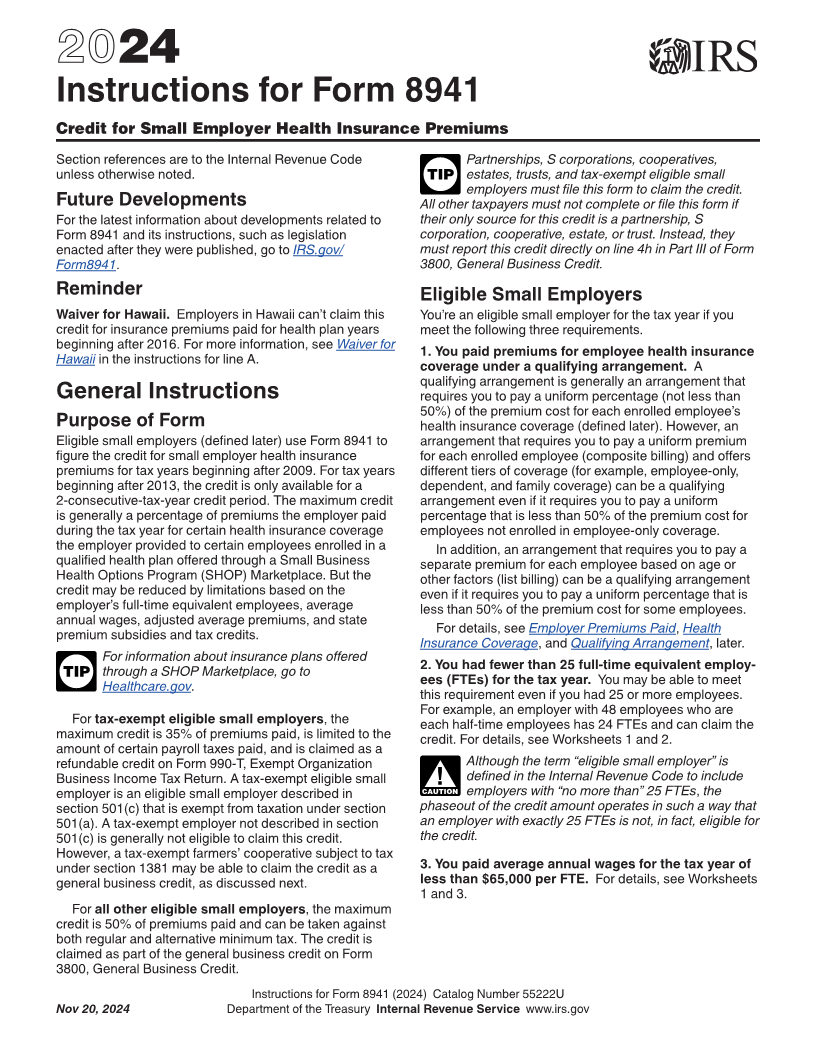

2024

Instructions for Form 8941

Credit for Small Employer Health Insurance Premiums

Section references are to the Internal Revenue Code Partnerships, S corporations, cooperatives,

unless otherwise noted. TIP estates, trusts, and tax-exempt eligible small

employers must file this form to claim the credit.

Future Developments All other taxpayers must not complete or file this form if

For the latest information about developments related to their only source for this credit is a partnership, S

Form 8941 and its instructions, such as legislation corporation, cooperative, estate, or trust. Instead, they

enacted after they were published, go to IRS.gov/ must report this credit directly on line 4h in Part III of Form

Form8941. 3800, General Business Credit.

Reminder Eligible Small Employers

Waiver for Hawaii. Employers in Hawaii can’t claim this You’re an eligible small employer for the tax year if you

credit for insurance premiums paid for health plan years meet the following three requirements.

beginning after 2016. For more information, see Waiver for

1. You paid premiums for employee health insurance

Hawaii in the instructions for line A.

coverage under a qualifying arrangement. A

qualifying arrangement is generally an arrangement that

General Instructions requires you to pay a uniform percentage (not less than

50%) of the premium cost for each enrolled employee’s

Purpose of Form health insurance coverage (defined later). However, an

Eligible small employers (defined later) use Form 8941 to arrangement that requires you to pay a uniform premium

figure the credit for small employer health insurance for each enrolled employee (composite billing) and offers

premiums for tax years beginning after 2009. For tax years different tiers of coverage (for example, employee-only,

beginning after 2013, the credit is only available for a dependent, and family coverage) can be a qualifying

2-consecutive-tax-year credit period. The maximum credit arrangement even if it requires you to pay a uniform

is generally a percentage of premiums the employer paid percentage that is less than 50% of the premium cost for

during the tax year for certain health insurance coverage employees not enrolled in employee-only coverage.

the employer provided to certain employees enrolled in a In addition, an arrangement that requires you to pay a

qualified health plan offered through a Small Business separate premium for each employee based on age or

Health Options Program (SHOP) Marketplace. But the other factors (list billing) can be a qualifying arrangement

credit may be reduced by limitations based on the even if it requires you to pay a uniform percentage that is

employer’s full-time equivalent employees, average less than 50% of the premium cost for some employees.

annual wages, adjusted average premiums, and state

For details, see Employer Premiums Paid Health ,

premium subsidies and tax credits.

Insurance Coverage, and Qualifying Arrangement, later.

For information about insurance plans offered

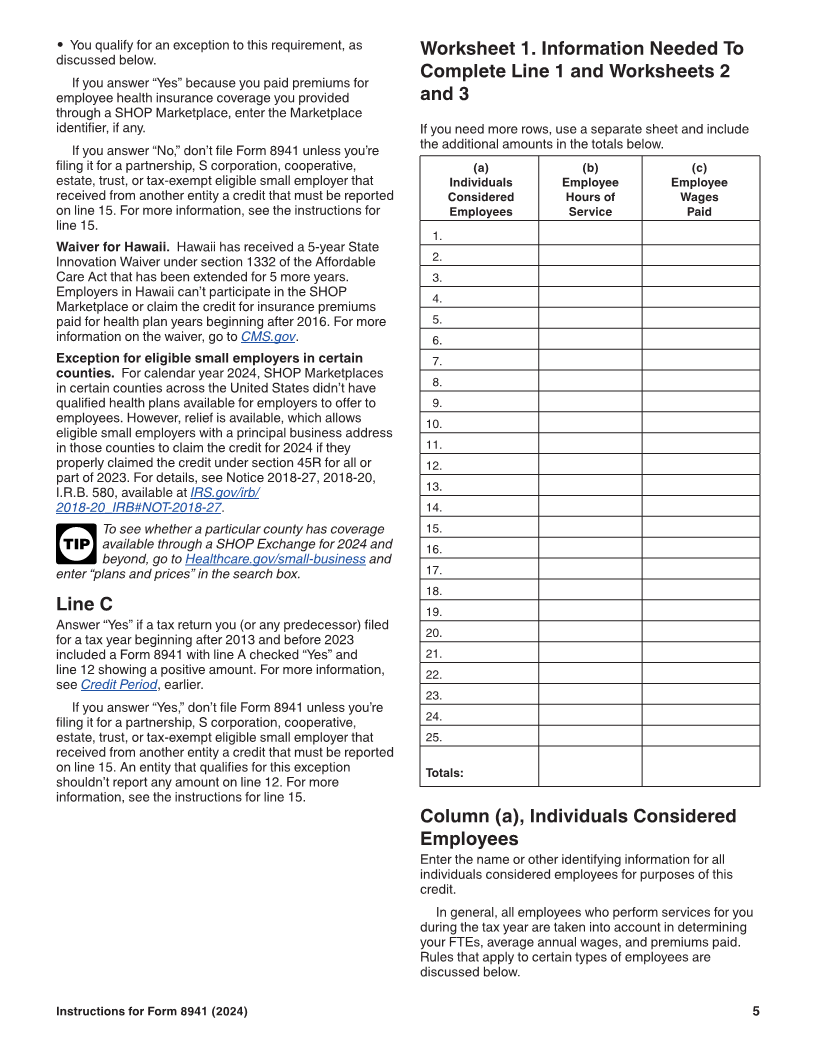

2. You had fewer than 25 full-time equivalent employ-

TIP through a SHOP Marketplace, go to

Healthcare.gov. ees (FTEs) for the tax year. You may be able to meet

this requirement even if you had 25 or more employees.

For example, an employer with 48 employees who are

For tax-exempt eligible small employers, the each half-time employees has 24 FTEs and can claim the

maximum credit is 35% of premiums paid, is limited to the credit. For details, see Worksheets 1 and 2.

amount of certain payroll taxes paid, and is claimed as a

refundable credit on Form 990-T, Exempt Organization Although the term “eligible small employer” is

Business Income Tax Return. A tax-exempt eligible small ! defined in the Internal Revenue Code to include

employer is an eligible small employer described in CAUTION employers with “no more than” 25 FTEs the ,

section 501(c) that is exempt from taxation under section phaseout of the credit amount operates in such a way that

501(a). A tax-exempt employer not described in section an employer with exactly 25 FTEs is not, in fact, eligible for

501(c) is generally not eligible to claim this credit. the credit.

However, a tax-exempt farmers’ cooperative subject to tax

under section 1381 may be able to claim the credit as a 3. You paid average annual wages for the tax year of

general business credit, as discussed next. less than $65,000 per FTE. For details, see Worksheets

1 and 3.

For all other eligible small employers, the maximum

credit is 50% of premiums paid and can be taken against

both regular and alternative minimum tax. The credit is

claimed as part of the general business credit on Form

3800, General Business Credit.

Instructions for Form 8941 (2024) Catalog Number 55222U

Nov 20, 2024 Department of the Treasury Internal Revenue Service www.irs.gov